- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

You will need to enter two different Self-Employment activities.

As both activities are separate from each other.

You will report your business on its own Schedule C.

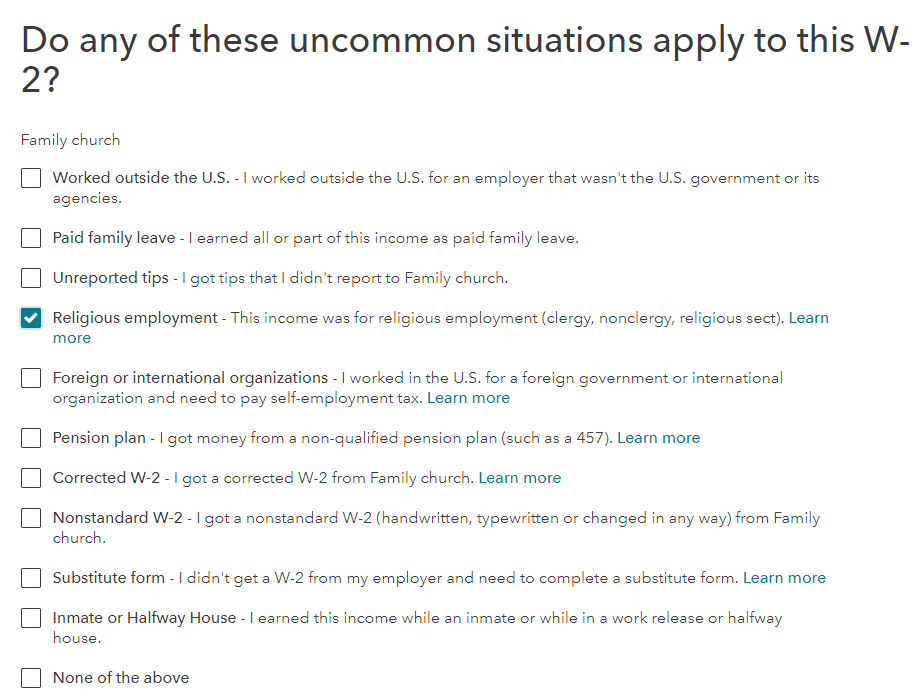

You can then add another Schedule C to report the housing allowance for your spouse. Your spouse should have received a W-2 Form. Make sure to select that they are a member of the clergy. TurboTax will walk you through the steps and will ask for your housing allowance once you mark this box.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 28, 2020

6:05 PM