- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How Use Turbotax to report Sale of part of farm owned by LLC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How Use Turbotax to report Sale of part of farm owned by LLC

I am selling part of my farm owned by LLC. I want to know how to enter that into my Turbotax. Have looked Farming Expenses and Income where I usually report income and expenses for this LLC. Where do I go to account for/report the sale of part of the property owned by this LLC?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How Use Turbotax to report Sale of part of farm owned by LLC

To report the sale, you will need to navigate to the Farm section in the federal interview screens, and more specifically, the assets area.

To do this, log back into TurboTax and go to the Income section.

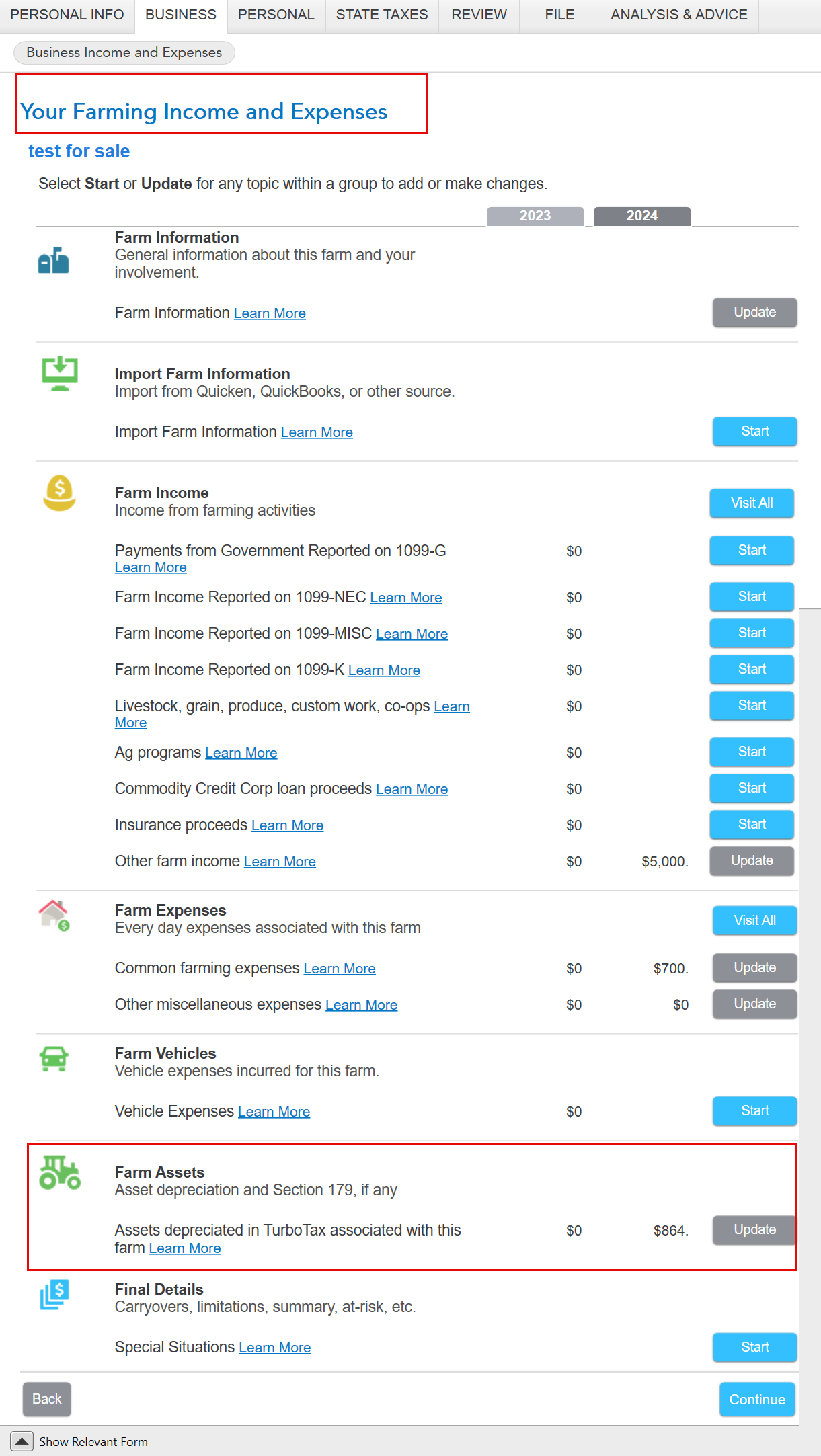

Scroll down to Farm Income and Expenses, and then select update/edit to the right of Farm Income and Expenses.

Proceed through the screens until you see Farm Summary. Select edit to the right of the applicable activity.

Scroll down to the Farm Assets and select update.

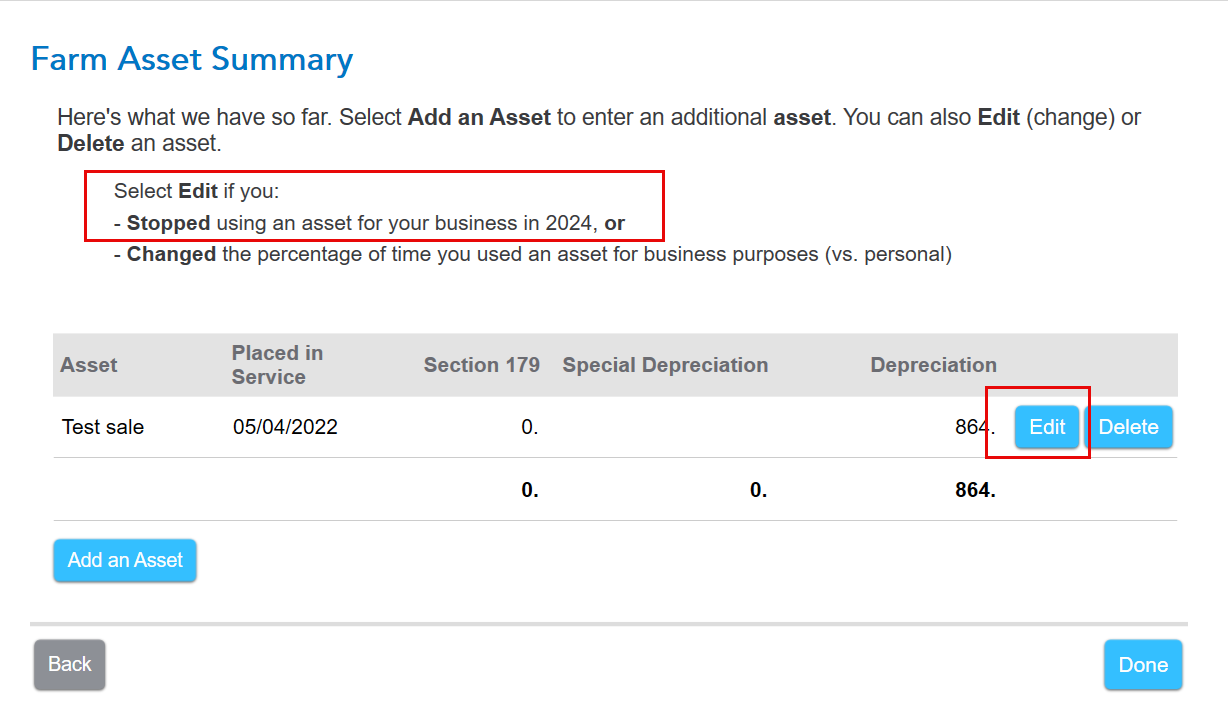

Proceed through the screens until you see the page titled Farm Asset Summary. Select Edit to the right of the applicable asset.

Continue through the screens until you see "Tell us more about this farm asset."

Select the box to indicate the item was sold and enter the disposal date. Proceed through the screens and answer the questions as prompted.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodiy2k21

Returning Member

jmgretired

New Member

dpa500

Level 2

Questioner23

Level 1

colinsdds

New Member