- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How to list startup costs for a business

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

hi @BrittanyS

I'm been at that screen so many times but I can't find what you have... are you missing a few more steps? See my screenshot below.. and i'm using turbotax business download version.

- Click Yes for "Did you buy, or do you already own, any depreciable assets related to this business?"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

I have it right here

Interesting that Rental Real Estate Expenses appear here. Did you enter any information for any rental real estate? In an earlier screenshot that you presented, you were in the Business Information tab/ Rental Real Estate Property Summary.

If you entered information there, then you might want to click on Rental Real Estate/Rental Real Estate Assets like this

And see where that takes you. I am not sure what kind of business you have.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

Hi @AbrahamT ,

See below on my business info ;

Did you enter any information for any rental real estate? Yes, and I do not want to add the start up of the LLC cost to the real estate property since it's not pertaining to the individual property but rather the LLC itself. My previous CPA listed it as an amortized expense for the llc and not the individua real estate. If I want to isolate that expense seem like only way is to create another dummy real estate assets and then add that expense there but the issues is that it'll consider this as another real estate property.

there is a section under federal taxes -> deduction called start up cost but it wont' let me enter anything because 2022 is not my first tax year. The LLC was created a few years ago.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

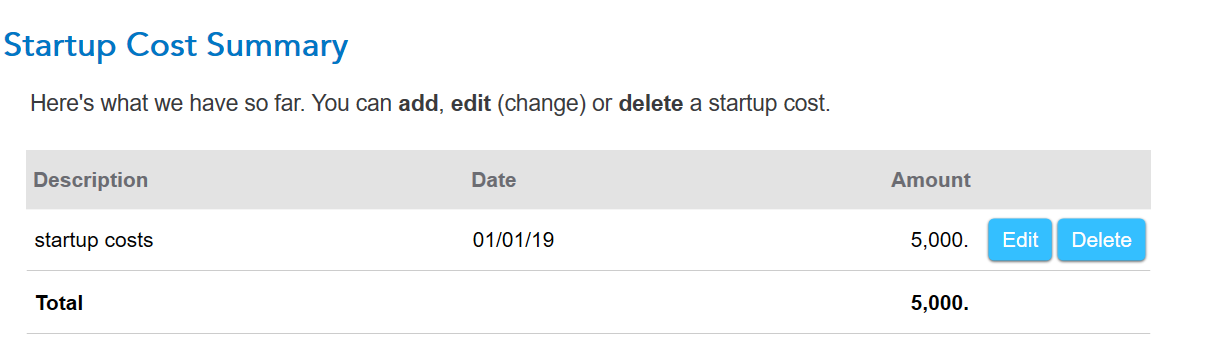

I was able to enter it in just fine

See here

And then

You see, I was able to pick up startup costs from 2019.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

@AbrahamT right.. but I've never used turbotax business until this year. In your case if i'm understanding correctly you entered the startup cost in 2019 tax year and this year (2022) you were able to update it?

I've did another test and create a dummy LLC tax and seems like if you do not use turbotax to enter your start up cost when you first create the company, you can't add it if you use turbotax afterwards.

Is there a way for us to file a bug request?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

I did this on a brand new 2022 return and I was still able to include the earlier startup costs from 2019.

See here

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

@AbrahamT K this is definitely a bug. I create a new tax return and stated the llc formed in 2019 and then I was able to go directly to deduction and see the startup cost entry. I was able to enter the cost and back date it back to the date I formed the LLC. Then I removed the start up cost entry and save it and then I get that msg again ( the topic does not apply to you since you indicated that 2022 is not your first tax year).

Once you remove it, you can't add it back w/o having to create a brand new tax return. 😠

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

I have entered just fine. Just to reiterate . You started the business in 2019 as opposed to 2022 and you want to include the startup costs as of 2019, right? . Before, I was under the impression that you started the business in 2022 and I originally gave you the illustration as such; business started in 2022 and startup costs in 2019. So now, I presented the scenario with the business being started in 2019 as well. Anyway you slice it, I'm still able to include the startup costs. I'm not sure why you want to remove the startup cost entry, though. See these illustrations.

I simply went into Federal Taxes/ Deductions and then Startup costs. It's in.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jstan78

New Member

joe-kyrox

New Member

SterlingSoul

New Member

kfrodcrafts

New Member

cmallari

New Member