- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How to list startup costs for a business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

Start-Up Expenses are reported in aggregate - one amount equal to the total of all expenses incurred. For active business activities, these costs are entered either under Assets/Depreciation or under Business Expenses depending...

As long as your start-up expenses are less than $5000, you can add them as Business Expenses. Continue past the expense categories (or choose Other Miscellaneous Expenses) to the page titled "Enter Business Expenses Not Yet Reported" and enter the description & amount (see screenshots below - click to enlarge).Per IRS Pub 535 Business Start-Up and Organizational Costs: "Business start-up and organizational costs are generally capital expenditures. However, you can elect to deduct up to $5,000 of business start-up and $5,000 of organizational costs paid or incurred after October 22, 2004. The $5,000 deduction is reduced by the amount your total start-up or organizational costs exceed $50,000. Any remaining costs must be amortized."

If you have more than $5000 in start-up costs, the remainder is entered under Assets/Depreciation as a capital asset for amortization (TurboTax provides this category for you).

If you have Rental Property (passive business) start up costs must be capitalized, subject to depreciation. Enter these costs under Rental Assets/Depreciation as "improvements." See this discussion for more: Start-Up Expenses for Rental Activity

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

Start-Up Expenses are reported in aggregate - one amount equal to the total of all expenses incurred. For active business activities, these costs are entered either under Assets/Depreciation or under Business Expenses depending...

As long as your start-up expenses are less than $5000, you can add them as Business Expenses. Continue past the expense categories (or choose Other Miscellaneous Expenses) to the page titled "Enter Business Expenses Not Yet Reported" and enter the description & amount (see screenshots below - click to enlarge).Per IRS Pub 535 Business Start-Up and Organizational Costs: "Business start-up and organizational costs are generally capital expenditures. However, you can elect to deduct up to $5,000 of business start-up and $5,000 of organizational costs paid or incurred after October 22, 2004. The $5,000 deduction is reduced by the amount your total start-up or organizational costs exceed $50,000. Any remaining costs must be amortized."

If you have more than $5000 in start-up costs, the remainder is entered under Assets/Depreciation as a capital asset for amortization (TurboTax provides this category for you).

If you have Rental Property (passive business) start up costs must be capitalized, subject to depreciation. Enter these costs under Rental Assets/Depreciation as "improvements." See this discussion for more: Start-Up Expenses for Rental Activity

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

Hi,

I've entered my business startup cost and fall into the over $5000 category. Is this money going to be used to offset income only? It doesn't seem to reduce my tax liability, right?

Thanks,

Todd

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

Assuming that your start-up costs are less than $50,000,

- You may deduct the first $5,000 in start-up expenses against current income.

- The portion over $5,000 would be amortized over 15 years, so a portion of this amount would also offset current income.

Expenses paid or incurred after October 22, 2004:

- You can deduct up to $5,000 in startup and $5,000 organizational costs as current expenses if the costs are under $50,000, respectively.

- You can choose to amortize startup and organizational costs greater than $5,000, respectively, (but less than $50,000, respectively) over a period of 15 years.

- If your startup or your organizational costs are more than $50,000, respectively, the excess amount reduces the amount you can deduct.

See TurboTax Best Answer.

[Edited 02/28/2021 8:31 AM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

This is great. my only question is. where do I find the "assets/depreciation as a capital asset for amortization" in turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

Start up costs have a 15 year (180 month) recovery period using amortization (an equal amount for each month). The amortization is under the Assets expense for your business and you must select to 'Add an asset' once you reach the Business Asset Summary page.

- Select Intangibles, Other property on the Describe This Asset page.

- Select Amortizable intangibles on the Tell Us a Little More page

- Type Start up Costs as the description, then the cost remaining to be amortized and the date you opened for business

- Code selection is 195 Business Start Up Costs

- Enter 15 years for the Useful Life (in Years)

@zamacona1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

Hey Diane,

thank you so much for such a prompt response, super helpful and detailed!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

I've done this as you mentioned. So next year that I do my taxes, will turbo tax already have this amortization automatically accounted for? or is there anything else that I would need to do in the future in order to account for this?

Thank you so much for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

Next year, you should be able to receive an amortization schedule transfer over into next year's return. Just to be cautious however, I would keep a copy of this year's schedule in your return just in case the transfer did not take place.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

Okay got it. So it should be stored and automatically transfer next time within my turbo tax account and I’ll keep a copy of my return this year in case there’s any issues.

thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

I realize this original question is quite old, but for any future readers ... training to start a new professional is not deductible, and therefore would not be part of startup costs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

Hi, @DianeW777 / @DaveF1006

Where do you enter this if you're filing with turbo tax business (partnership llc)? I tried entering under business start up cost summary page but it keep stating that since this is not the first year i'm filing tax it wont' let me enter it there. The only way I can enter this is by add this expense under my rental properties or create entirely new asset. Doesn't seem right to nest this under a rental property and if I create a new asset, it ask me for address and treats this as a rental property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

I'm assuming you are referring to the remainder of the amortization after you previously claimed the startup on your previous return. To enter the amortization you will follow these steps in TurboTax Business:

- Under the Assets expense for your business and you must select to 'Add an asset' once you reach the Business Asset Summary page.

- Select Intangibles, Other property on the Describe This Asset page.

- Select Amortizable intangibles on the Tell Us a Little More page

- Type Start up Costs as the description, then the cost remaining from previous return to be amortized and the date you opened for business

- Code selection is 195 Business Start Up Costs

- Enter 15 years (if this is not the first year you will list the remaining years showing on your previous return) for the Useful Life (in Years)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

hi@BrittanyS thanks for the prompt reply.

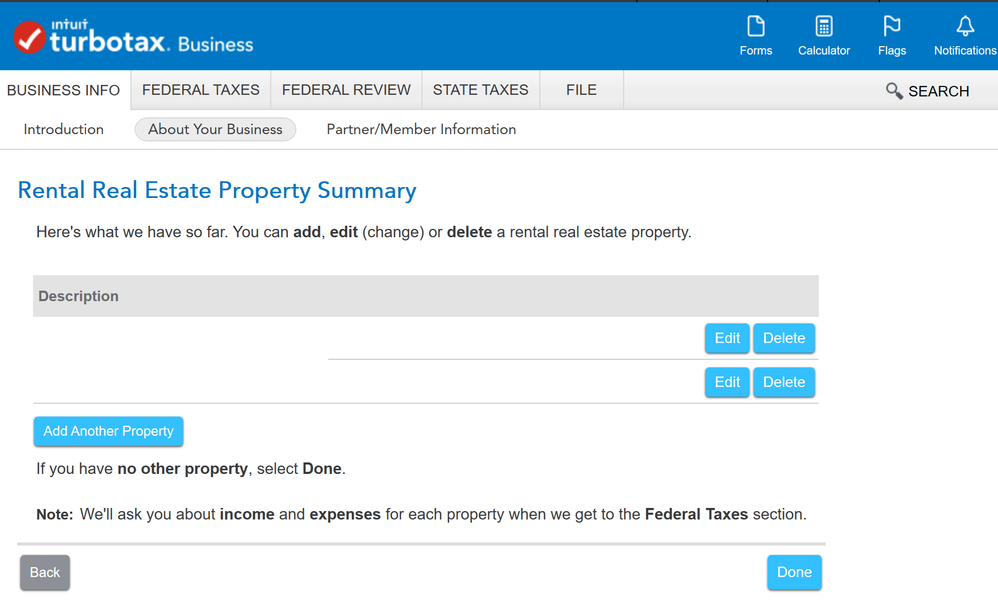

For the life of me I can't find Business Asset Summary page? Is it under business info -> about your business -> rental real estate property summary? When I enter a new assets here it needs and address and it shows up as a rental property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to list startup costs for a business

You can get to the asset entry page by following these steps in TurboTax Business Desktop:

- Click Federal Taxes

- Click Deductions

- Click Yes for "Did you buy, or do you already own, any depreciable assets related to this business?"

- Click Add An Asset

- Enter the information for each asset using your prior year return

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

amyonghwee

Level 4

jstan78

New Member

joe-kyrox

New Member

SterlingSoul

New Member

kfrodcrafts

New Member