- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How to carryover Non passive loss from Schedule K-1 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

I have Non passive loss and Passive income from Schedule K-1s.

I also have rental real estate income.

Since Non passive loss is greater than sum of Passive income and rental real estate income, Schedule E Line 41 Total income or (loss) is negative.

Q1: How do I carryover Non passive loss from K-1 (amount in Line 41) from TY2018 to TY 2019 and beyond ? Is there a limit each year?

Q2: Where do I enter above amount in Turbo Tax for TY2019 ?

Q3: Does Turbo Tax keep track of unused Non passive loss from K-1 that can be used in future year?

Thank you !

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

TurboTax computes all of that for you. Any suspended losses are carried over to the next year. You can see those fields in Forms Mode. Open the K-1 and scroll down to Section A. Column (b) receives the transfer from your prior year return and the current year's suspended amounts are in column (d). Column (d) is what transfers to your next year's return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

@phedwards2 wrote:.....how/where do I see the $150k carryforward in TT due to the basis limitation?

You have to complete the basis limitation worksheet.

See https://www.irs.gov/pub/irs-pdf/i1065sk1.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

TurboTax computes all of that for you. Any suspended losses are carried over to the next year. You can see those fields in Forms Mode. Open the K-1 and scroll down to Section A. Column (b) receives the transfer from your prior year return and the current year's suspended amounts are in column (d). Column (d) is what transfers to your next year's return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

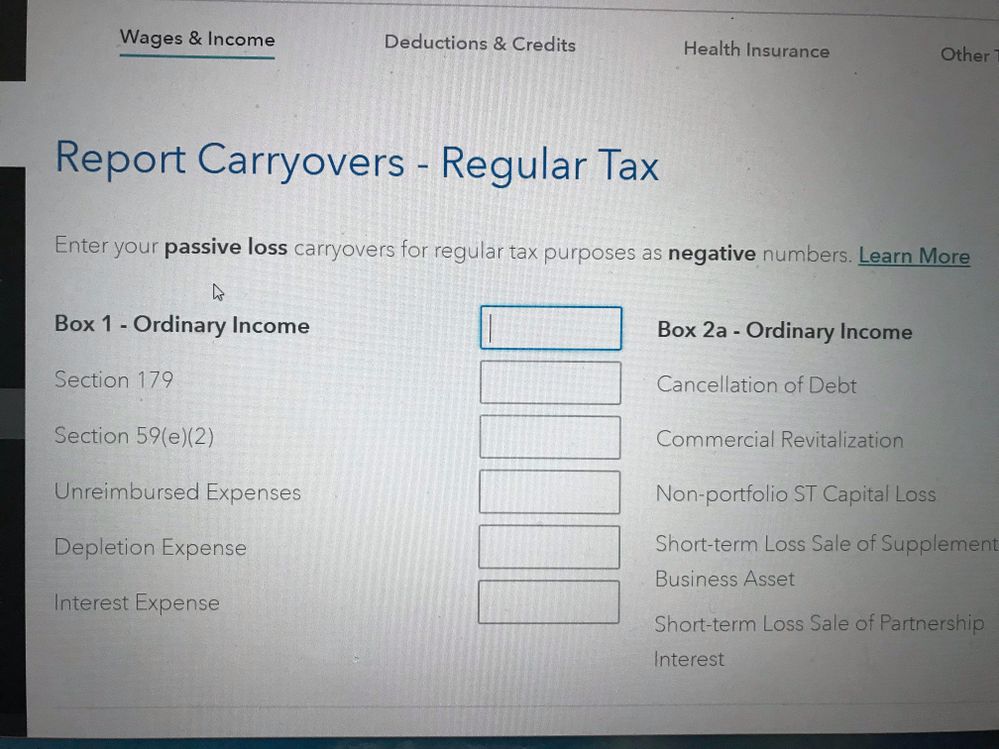

Follow up question - how do I enter passive loss carryover from last year's Form 8582 (filed by a tax accountant not Turbot tax) into Turbotax? I went through the entering K1 info. process but not sure on which form(s) I shall gather info. for below to enter passive loss? thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

Doing my 2021 Tax Return (still). I don't have "Forms Mode". Is there anyway to see K-1 Non-passive losses carried over to next year in TurboTax Online?

It doesn't show up anywhere in the Tax Return PDF (including all the TT Worksheets)

Thanks in advance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

Why were the non-passive losses suspended (and carried over), rather than being used?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

Yes I invested $100k in the partnership and had $250k nonpassive losses, so I could only deduct $100k this year (limited by my invested amount). So I would like to carryforward the remaining $150k to next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

@phedwards2 wrote:

Yes I invested $100k in the partnership and had $250k nonpassive losses, so I could only deduct $100k this year (limited by my invested amount). So I would like to carryforward the remaining $150k to next year.

You have an at-risk issue.

TurboTax should have generated a Form 6198 and also an At-Risk Limitation Allocation Worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

Isn't is a Basis limitation (not At-Risk)? If so, there shouldn't be a Form 6198.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

@AmeliesUncle wrote:

Isn't is a Basis limitation (not At-Risk)? If so, there shouldn't be a Form 6198.

Yes, it most certainly is a basis limitation. Between a post on another board and this post (that was tacked on to an ancient thread), I got thoroughly disoriented.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

Sorry for the confusion - should I start a new thread?

(if I can continue in this thread, how/where do I see the $150k carryforward in TT due to the basis limitation?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

@phedwards2 wrote:.....how/where do I see the $150k carryforward in TT due to the basis limitation?

You have to complete the basis limitation worksheet.

See https://www.irs.gov/pub/irs-pdf/i1065sk1.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

@phedwards2 wrote:Sorry for the confusion - should I start a new thread?

(if I can continue in this thread, how/where do I see the $150k carryforward in TT due to the basis limitation?

Thanks

Nowhere. The program does not limit due to Basis, so you need to manually do everything.

For the year of the Basis limitation, you manually only enter the allowable loss (don't enter the full numbers on the K-1). Then you manually make a note OUTSIDE of the program that you need to carry over the loss that was suspended due to Basis. Then whenever Basis is restored, you enter the now-allowable losses as a second K-1, and label it as "PYA".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

there should be a question asking if some investment in the partnership is not at risk which should be checked yes. then you need to compltet form 6198 which will limit the loss to the at-risk amount

a link to its instructions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

@Mike9241 wrote:there should be a question asking if some investment in the partnership is not at risk which should be checked yes. then you need to compltet form 6198 which will limit the loss to the at-risk amount

Basis is NOT the same as At Risk, and Form 6198 should not be filed if it is limited due to Basis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to carryover Non passive loss from Schedule K-1 ?

Thankyou guys - I think I'm getting it now. I need to calculate my Basis Limitation and my At Risk Limitation. I can deduct the lower of the two. Both calcs are offline based on K-1 info and there is no TT or Excel sheet to do that calc, but there is an IRS PDF Worksheet I can type into. If the At Risk Limitation is lower than my Basis Limitation, then I also need to fill in Form 6198 (also offline).

So I think I'm ok for now (unless you tell me I'm wrong!) - appreciate your help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dinesh_grad

New Member

HNKDZ

Returning Member

yingmin

Level 1

DallasHoosFan

New Member

rhartmul

Level 2