- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How do I file the 1099 G my S Corporation received?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file the 1099 G my S Corporation received?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file the 1099 G my S Corporation received?

No answers yet, so I guess I'll add more information. My S Corporation received 3 1099-G forms from various state of Minnesota government agencies. One is unemployment compensation and the other two have amounts in the taxable grants box (box 6). I can't find a topic in Turbo Tax business where I can enter this information.

S Corp taxes due soon. Any guidance is appreciated.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file the 1099 G my S Corporation received?

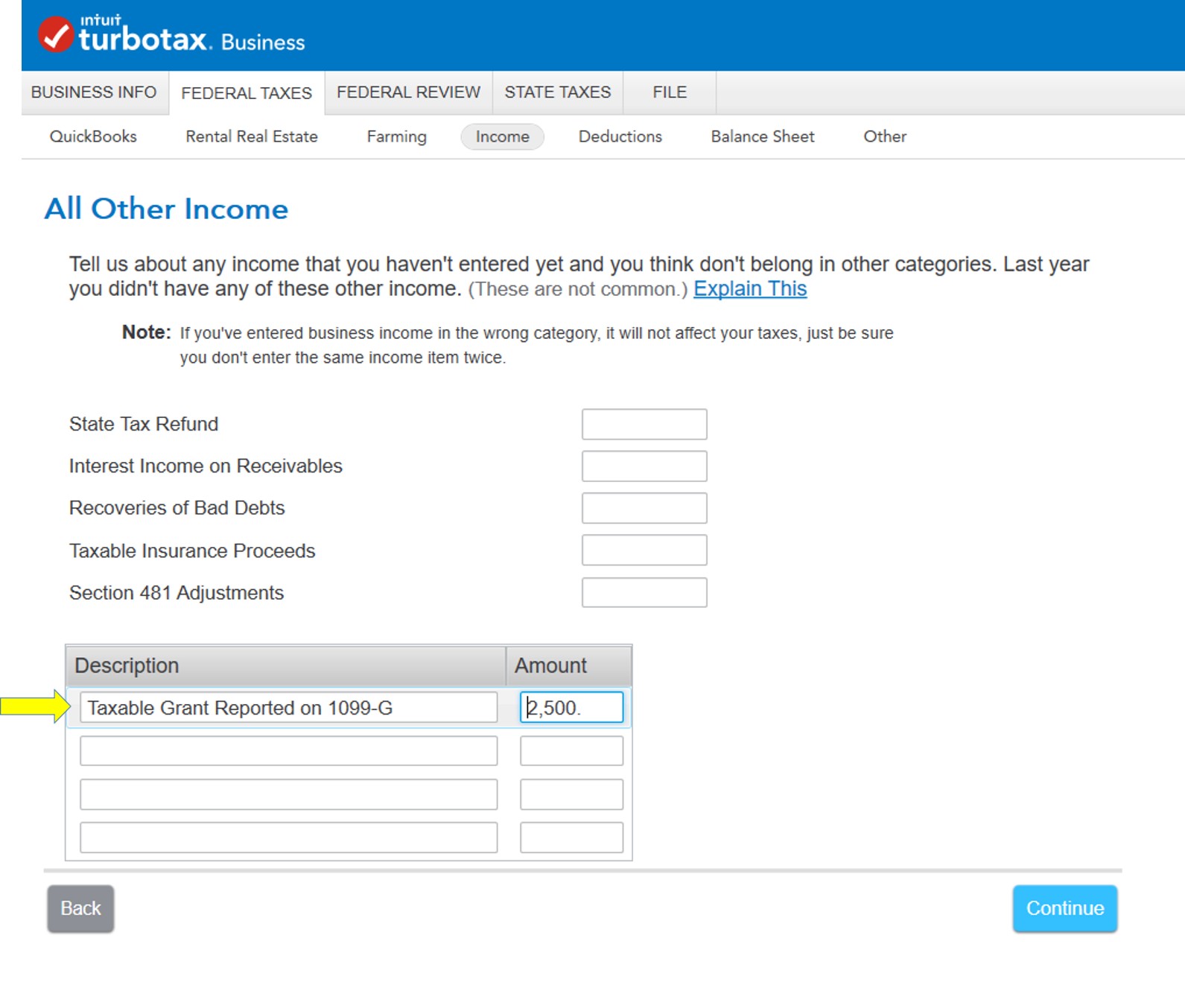

The taxable grants can be entered as other taxable income

Verify the recipient taxpayer identification number on the unemployment compensation Form 1099-G.

It isn't appropriate for an S-Corporation to receive unemployment compensation.

It may be prudent to contact the state unemployment agency to verify this form's accuracy.

If there is only one member for this S-Corporation, you can enter the unemployment compensation the same way as you entered the taxable grant.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file the 1099 G my S Corporation received?

Thank you, this answered my questions. The recipient's TIN ends my confusion (I think). The TINs on the taxable grants are for the S Corporation. The TIN for the unemployment is a personal social security number. If you could confirm, I am entering the unemployment compensation on my 1040 as income. The taxable grant money I will add as other income in accordance with the Turbo Tax screenshot you provided.

Also, the S Corporation is a photography business and only has one employee. Should I instead enter all three 1099Gs as other business income?

Does this sound right?

Thanks,

Mark

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file the 1099 G my S Corporation received?

Report Form 1099-G according the the TIN reported.

One should be reported on the personal return in Income & Expenses under Unemployment.

The other two should be reported on the 1120-S return as described above. It would have otherwise been reported in its own category in Other Common Income as Other 1099-G Income.

For more information about this form, see: What Is a 1099-G Tax Form? - TurboTax Tax Tips & Videos

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

samman2922

New Member

jh777

Level 3

cordovasoftball

New Member

Aowens6972

New Member

ilenearg

Level 2