- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

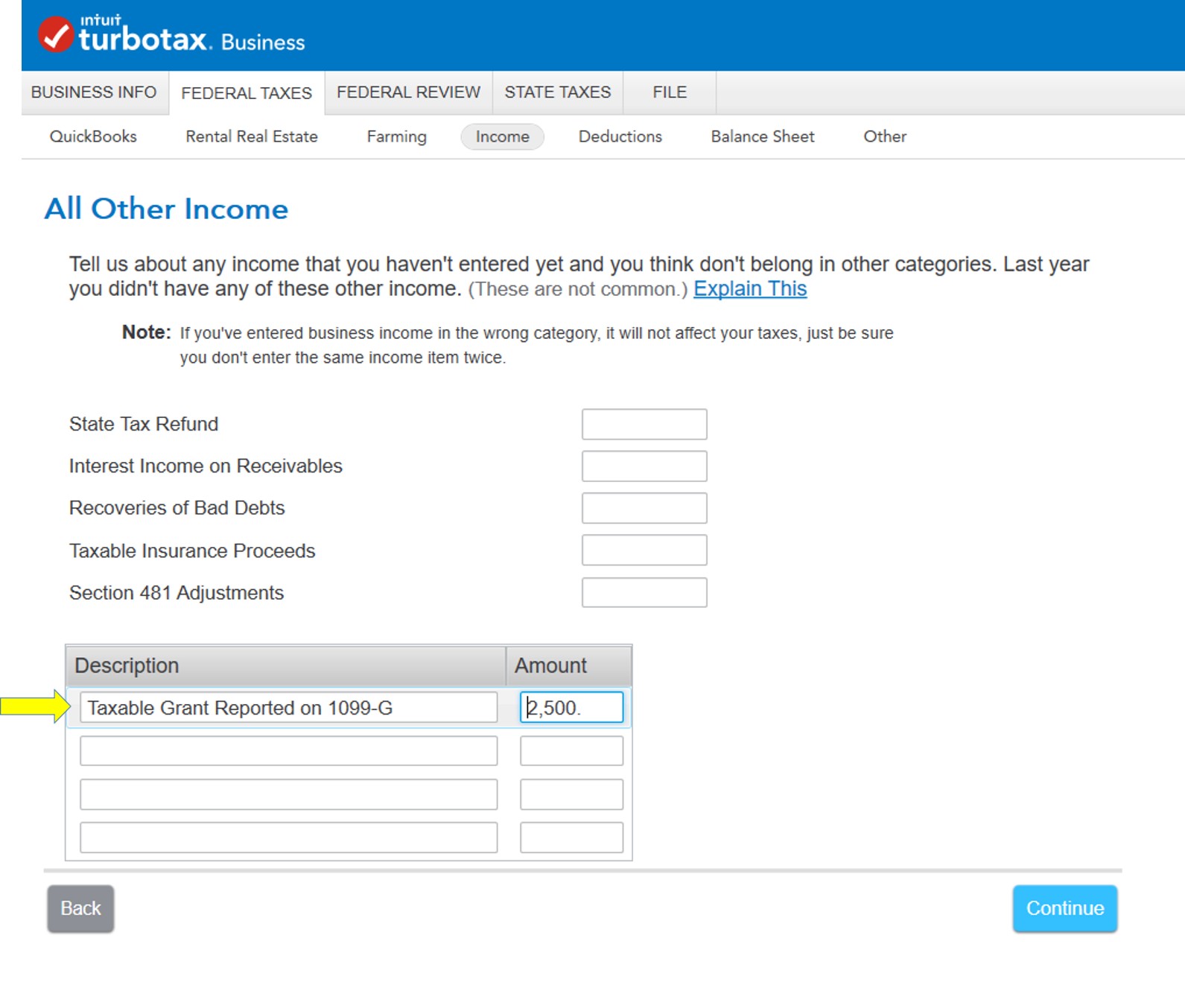

The taxable grants can be entered as other taxable income

Verify the recipient taxpayer identification number on the unemployment compensation Form 1099-G.

It isn't appropriate for an S-Corporation to receive unemployment compensation.

It may be prudent to contact the state unemployment agency to verify this form's accuracy.

If there is only one member for this S-Corporation, you can enter the unemployment compensation the same way as you entered the taxable grant.

March 7, 2021

10:41 AM