- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Hello, I did not receive my 2021 $600 stimulus check. I am an independant, however, I mistakenly checked the box that claims me as a dependant when I filed for my 2021 tax return. The IRS portal is do

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I did not receive my 2021 $600 stimulus check. I am an independant, however, I mistakenly checked the box that claims me as a dependant when I filed for my 2021 tax return. The IRS portal is do

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I did not receive my 2021 $600 stimulus check. I am an independant, however, I mistakenly checked the box that claims me as a dependant when I filed for my 2021 tax return. The IRS portal is do

You must be referring to the 2019 federal tax return you filed in 2020.

A 2020 federal tax return cannot be filed at this time using TurboTax.

Using the TurboTax online editions for tax year 2020, in the My Info section of the program make sure that you did NOT select you can be claimed as a dependent.

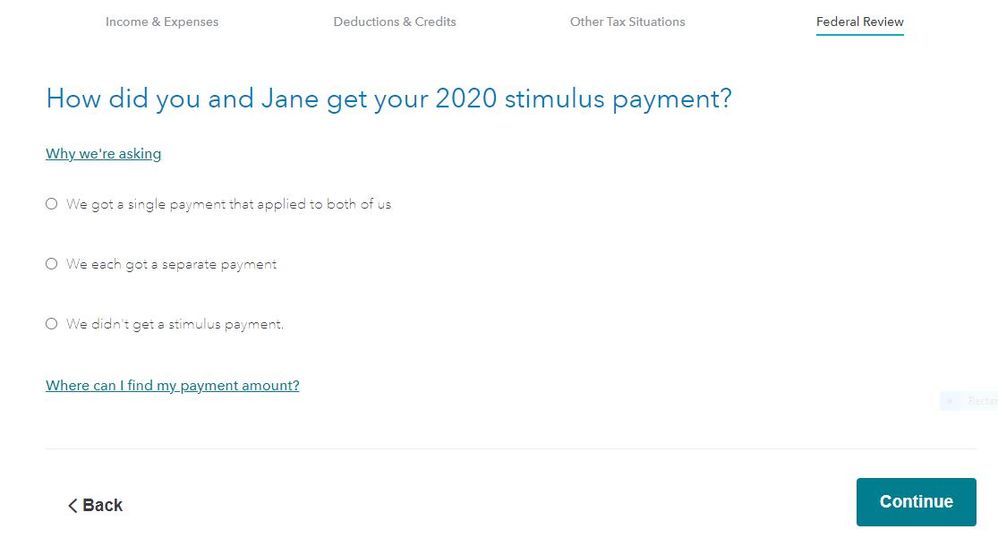

After entering all of your Wages & Income, Deductions & Credits and completing the Other Tax Situations section of the program you will be asked about the stimulus payment you received or did not receive in 2020.

If you are eligible to receive the stimulus payment it will be entered on your federal tax return, Form 1040 on Line 30 and will be included as part of your federal tax refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I did not receive my 2021 $600 stimulus check. I am an independant, however, I mistakenly checked the box that claims me as a dependant when I filed for my 2021 tax return. The IRS portal is do

Hey, thanks for the reply. What do I do if I unintentionally selected that I CAN be claimed as a dependent on my last years tax return? My apologies if this is already answered.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I did not receive my 2021 $600 stimulus check. I am an independant, however, I mistakenly checked the box that claims me as a dependant when I filed for my 2021 tax return. The IRS portal is do

The payments are advance estimates, the actual credit is calculated on your 2020 tax return. When you file you 2020 return, the rebate will be calculated based on your eligibility on your 2020 return. If you are not a dependent in 2020, you should be eligible, even if you were marked as a dependent (correctly or not) on your 2019 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello, I did not receive my 2021 $600 stimulus check. I am an independant, however, I mistakenly checked the box that claims me as a dependant when I filed for my 2021 tax return. The IRS portal is do

Perfect. Thank you so much!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

erinsiebenaler1

New Member

kbwhaley99

New Member

D4U

New Member

Nana881

Returning Member

heidi1222

Level 1