- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Form 7203 Line 8a

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203 Line 8a

The instructions for Form 7203 in the IRS website asks to enter on Line 8a of Form 7203 amounts from Schedule K-1, Box 16, Code C. I entered the information in my tax return related to this but I can't enter it in Form 7203 and it does not come in automatically. Any idea? Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203 Line 8a

A few comments:

- This is a brand new form, so I am sure there will be issues in completing this form for the next year or so.

- Appears you have read the instructions, at least for line 8a. Are you required to complete this form?

- There could be situations where it is not required; albeit only a few. If this is the case, at least you can move forward this year.

- Having said that, this form provides the taxpayer a consistent format to maintain their tax basis. Whether this form is completed within TT when required, or outside of TT if not required, I still believe it is best to complete it.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203 Line 8a

Thank you Rick. Yes I am required to file the form. The problem is that Turbo Tax does not allowed to enter an amount in line 8a in accordance with the instructions for Form 7203. I also found that Line 3k in the form should include amounts from K1 from Line 16 Codes A and B, not only A as Turbo Tax has in their form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203 Line 8a

Did you ever get this resolved? I'm running into the same issue this year. I cannot enter an amount on line 8A

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203 Line 8a

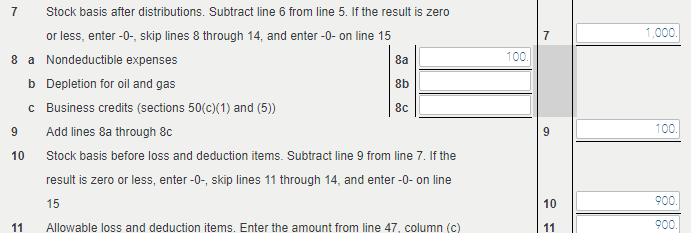

Rather than enter an amount directly on line 8a of IRS form 7203, try entering the amount above at line B Nondeductible expenses.

Make sure that you Refresh Calculations at the bottom of the screen.

You may also be experiencing issues if there is $0 stock basis on line 7.

In that case, the Nondeductible expenses may be reported on line 28

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203 Line 8a

Thank you, that's exactly what I ended up doing. Figured the end result is the same, so seemed like the best option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203 Line 8a

Regarding "...try entering the amount above at line B Nondeductible expenses."

I don't see a Line B Nondeductible expenses.

Would you indicate where it is located?

Also, line 7 on Form 7203 is not blank or zero.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203 Line 8a

JamesG1 was referring to Form 7203 as it appears in TurboTax. Line B Nondeductible expenses appears in the Stock and Debt Basis Limitations Smart Worksheet at the top of the form.

Part I Line 7 is the sum of Stock Basis less Distributions, which is not normally zero if any stock basis has been entered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203 Line 8a

Thank you. I see it now.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

uimcea1

New Member

jiamaio

Level 1

krr28

Level 1

user17718867174

New Member

hex8528

New Member