- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Error on K1 review "Passive Operating Loss ...sum of losses in individual years should not be greater than the total loss" Any ideas on to resolve this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error on K1 review "Passive Operating Loss ...sum of losses in individual years should not be greater than the total loss" Any ideas on to resolve this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error on K1 review "Passive Operating Loss ...sum of losses in individual years should not be greater than the total loss" Any ideas on to resolve this?

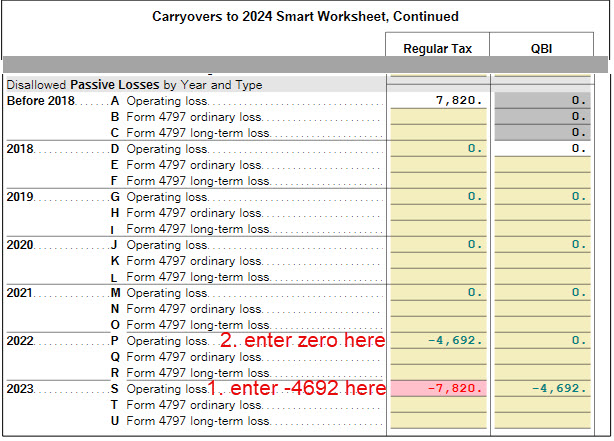

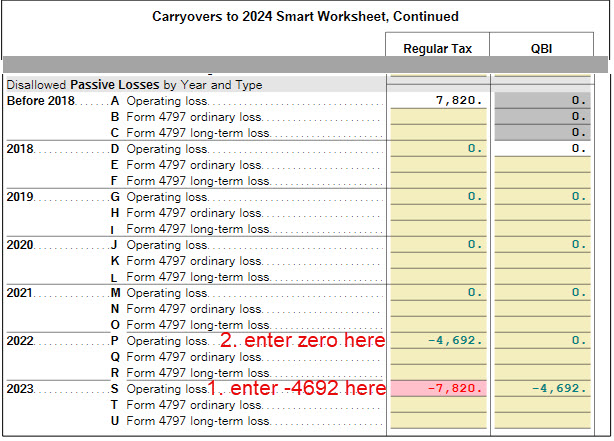

When you run Smart Check, TurboTax will present a section of Schedule E Worksheet Carryovers to 2024 Smart Worksheet, Disallowed Passive Losses by Year and Type. For some properties, the carryovers are out of sequence. For instance, 2022 is on the 2021 line. Or the 2023 number is on the 2022 line.

NOTE: Please use the Chrome browser to access this table when running Smart Check in TurboTax Online.

To fix this, enter the correct number starting with the most recent year. Then move up the schedule until all years are correct. This may be easier if you can access your 2023 return and print the Schedule E worksheet.

We are not aware of an estimated date for this experience to be revised before the tax filing deadline. The ultimate fix is to 1) clear and start over in TurboTax Online or 2) transfer your 2023 return into a new 2024 return using TurboTax for Desktop.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error on K1 review "Passive Operating Loss ...sum of losses in individual years should not be greater than the total loss" Any ideas on to resolve this?

When you run Smart Check, TurboTax will present a section of Schedule E Worksheet Carryovers to 2024 Smart Worksheet, Disallowed Passive Losses by Year and Type. For some properties, the carryovers are out of sequence. For instance, 2022 is on the 2021 line. Or the 2023 number is on the 2022 line.

NOTE: Please use the Chrome browser to access this table when running Smart Check in TurboTax Online.

To fix this, enter the correct number starting with the most recent year. Then move up the schedule until all years are correct. This may be easier if you can access your 2023 return and print the Schedule E worksheet.

We are not aware of an estimated date for this experience to be revised before the tax filing deadline. The ultimate fix is to 1) clear and start over in TurboTax Online or 2) transfer your 2023 return into a new 2024 return using TurboTax for Desktop.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kkrana

Level 1

doubleO7

Level 4

jtrains3

New Member

mjperez0500

New Member

HNKDZ

Returning Member