- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Enter Ordinary Gains and Losses, Form 4797 Part II

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Enter Ordinary Gains and Losses, Form 4797 Part II

Some of the assets sold with my business were owned under one year (and expensed) or otherwise need to be reported as Ordinary Gains and Losses. However, when I fill out the information for sale of business assets, and report the date acquired and date sold as within the same year, they show up under Part III. Turbotax then tells me in the check that there is an error, because they need to be reported on page 1 since they have been owned less than 1 year!

How do I report them in Turbotax so they end up on Form 4797 Part II?

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Enter Ordinary Gains and Losses, Form 4797 Part II

I believe the issue you are seeing is the result of checking the incorrect box for the transaction. You should check the Section 179 recapture box as shown in the screenshot below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Enter Ordinary Gains and Losses, Form 4797 Part II

Unfortunately that didn't quite capture the issue. The next screen asked about change in use, which is not the case, and reviewing the help section on recapture clarified that this is not the situation I'm trying to address.

Thank you though.

| If your business use of property on which you claimed the section 179 deduction fell to 50% or less for the first time in 2018, enter the following information about this property. See section 179 recapture for help in determining the amounts to enter here. |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Enter Ordinary Gains and Losses, Form 4797 Part II

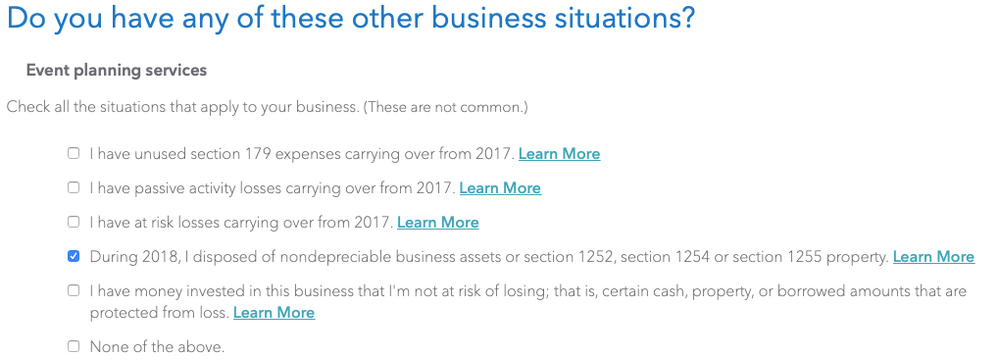

Enter an asset in Sale of Business Property section (even if you have to fabricate a transaction), and you will eventually get to a screen like the screenshot below. Note that you can always go back and delete the asset you entered in order to get to the appropriate screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Enter Ordinary Gains and Losses, Form 4797 Part II

Thanks for the feedback. I have the Self-employed edition and for me anyway, the answer ended up being to search for Schedule C and click Go To... (I believe I could've also gotten there through business income/expenses). Then select uncommon expenses, and then:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Enter Ordinary Gains and Losses, Form 4797 Part II

I have an ordinary gain from an investment in a limited partnership which has to be entered on form 4797. How do I do that in the turbo tax software?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Enter Ordinary Gains and Losses, Form 4797 Part II

It depends. If it is entered as an ordinary gain on a K1, the information will populate in the return and generate a 4797, if required.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Enter Ordinary Gains and Losses, Form 4797 Part II

hope it's ok to piggy back on this same question

I did not receive any K1 but I did receive and import the 1099-B statements I had and they all imported into Form 8949 as capital gains/losses.

I made the MTM selection for 2020 when I filed my 2019 return so for my 2020 return I want to report these as "ordinary" gains/losses, however I cannot seem to edit Form 4797 Part II, any advice here?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Enter Ordinary Gains and Losses, Form 4797 Part II

I made a MTM election as well and am trying to reach 4797 Part II. I trade Forex only. Instructions for Form 4797 state the data should be input into Part II only.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Enter Ordinary Gains and Losses, Form 4797 Part II

@TSLO2008 The TurboTax application does not support the import of Form 1099-B with values in boxes 8, 9, 10, and 11. If values are reported in boxes 8, 9, 10, and 11 on Form 1099-B, or similar statement, manual entry is required.

To begin manual entry of your Forex trades, go to the Wages & Income section. Scroll down to the section Investment Income and select Contracts and Straddles. Continue through the program and you will get to a page wherein you will be asked whether you wish to enter your transactions separately. Select yes, and enter the relevant information for each transaction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Enter Ordinary Gains and Losses, Form 4797 Part II

I was able to get it to work by opening the Form 4797 from the Forms view, rather than Step by Step. From there, you can enter the summary on the Smart Worksheet that pops up. In the final column labeled "PT", choose "II" (two). From there as you scroll through the form you can see it populates Part II Ordinary Gain/Loss from the summary you entered on the smart worksheet. For your summary, you can enter Short Term reported on a line, ST not report, etc. and same for Long Term. For e-filing, I'm not sure if we need to include the 1099-B as a "statement" though.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Enter Ordinary Gains and Losses, Form 4797 Part II

When you do a summary, the program will tell you to mail the 8453 and any attachments needed, like the 1099-B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dinesh_grad

New Member

Dslatt87

New Member

jmeza52

New Member

user17544516265

Returning Member

Cindy10

Level 1