In TurboTax Online, enter IRS form K-1 (1120-S) information at the screen Enter Box 17 info,

- Select code V Section 199A information. Do not enter a value to the right.

- Click Continue.

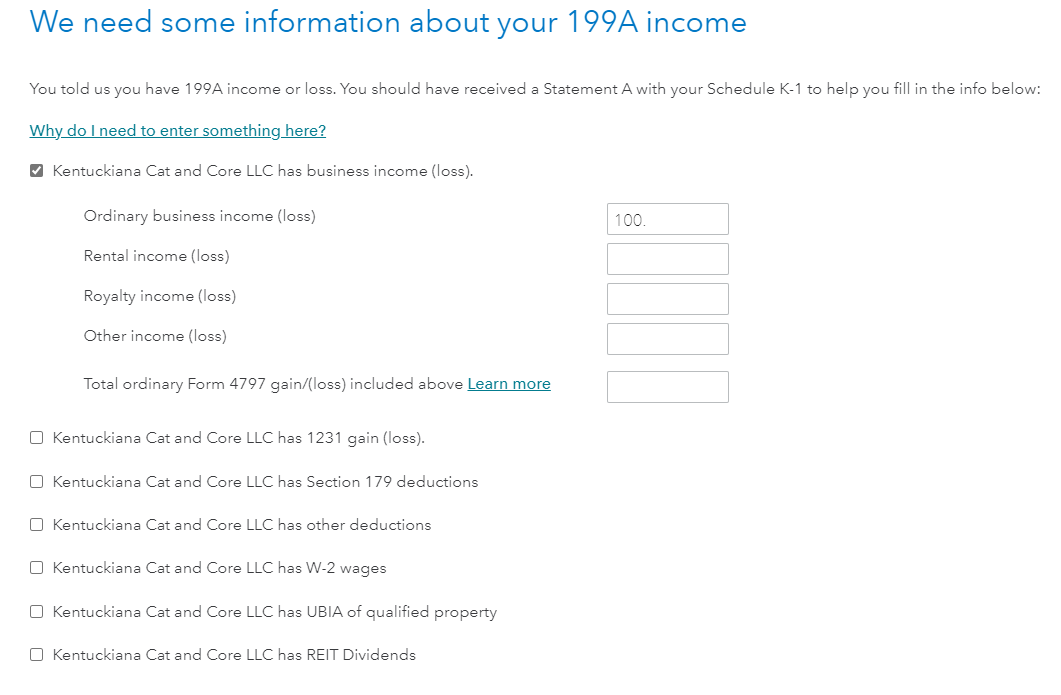

- At the screen We need some information about your 199A income, you will likely enter the following information:

- Ordinary business income (loss) from this business, and/or

- Rental income (loss).

Enter these values for the Qualified Business Income Deduction to be calculated.

Some preparers of the K-1 form will include the Section 199A information on a separate statement called a Statement A.

It is possible that additional information may need to be entered. Click the box to the left to open up entry boxes.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"