- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Business Expense Deductions - unsure how to categorize (no place for tools?, what about documents that I bought? or, very expensive software?)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Expense Deductions - unsure how to categorize (no place for tools?, what about documents that I bought? or, very expensive software?)

So, I have a variety of types of expenses associated with my small business. But, I am unsure where to list these in TurboTax.

I have recorded monthly profit and expense reports spreadsheets. However, I did not categorize the expenses.

The reason why I ask is I am currently using TurboTax to enter business expenses. I see a category for "Supplies" - but the examples indicate things such as pens and pencils and perhaps printers. There is also "Office Expenses" - would I list my tools, cables, engineering documents and very expensive software that I purchased in this category?

In my notes I have these categories (thus far)

- Office Supply - pens, pencils, paper

- Advertising - flyers I create and mail

- Lab Tools - screwdrivers, pliers, soldering irons

- Lab Equipment - bench-top laboratory equipment - and related cables

- Engineering Documents - some document are hundreds of dollars to buy

- Engineering Software - about $10,000 this year (two sub categories - yearly software maintanece and license purchase of new software)

Any help with guiding me where to place these deductions would be most appreciated.

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Expense Deductions - unsure how to categorize (no place for tools?, what about documents that I bought? or, very expensive software?)

If you are new to being self employed, are not incorporated or in a partnership and are acting as your own bookkeeper and tax preparer you need to get educated ....

If you have net self employment income of $400 or more you have to file a schedule C in your personal 1040 return for self employment business income. You may get a 1099-Misc for some of your income but you need to report all your income. So you need to keep your own good records. Here is some reading material……

IRS information on Self Employment….

http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Self-Employed-Individuals-Tax-Center

Publication 334, Tax Guide for Small Business

http://www.irs.gov/pub/irs-pdf/p334.pdf

Publication 535 Business Expenses

http://www.irs.gov/pub/irs-pdf/p535.pdf

Home Office Expenses … Business Use of the Home

https://www.irs.gov/businesses/small-businesses-self-employed/home-office-deduction

https://www.irs.gov/pub/irs-pdf/p587.pdf

There are 17 unique categories for entering business expenses in the TurboTax Home and Business program for a Schedule C. If you have a particular expense that does not fit in the other 16 categories listed use Other Miscellaneous Expenses at the bottom of the list.

- Click on Business

- Click on Business Income and Expenses

- Click on I'll choose what I work on

- On Profit or Loss from Business, click on the start or update button

On the next screen, click on Edit for your business listed.

On the next screen scroll down to Business Expenses

On Other Common Business Expenses, click on the start or update button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Expense Deductions - unsure how to categorize (no place for tools?, what about documents that I bought? or, very expensive software?)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Expense Deductions - unsure how to categorize (no place for tools?, what about documents that I bought? or, very expensive software?)

I've purchased software for my business just under $6000 in 2019.

Also, all my software for my business costs about $3000 per year - I have to pay this to stay up to date.

So, it sounds like both of these are an asset.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Expense Deductions - unsure how to categorize (no place for tools?, what about documents that I bought? or, very expensive software?)

Is there someone I could just call and ask these questions? I feel that I have a more unusual cause with my business - being that I purchase both lab equipment and highly specialized software. Not only is the software VERY expensive - but the software also has non-trivial yearly renewal costs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Expense Deductions - unsure how to categorize (no place for tools?, what about documents that I bought? or, very expensive software?)

I hope someone can answer this for me.

Where to I put the $1900 renewal cost for my software? Office Expenses? Or, a 179 asset?

And, it sounds like I'd put the $6000 software that I purchased this year in the 179 asset area of Turbotax (I hope I can find it!)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Expense Deductions - unsure how to categorize (no place for tools?, what about documents that I bought? or, very expensive software?)

Well, I guess it is time to call an accountant. I need VERY FAST answers. I need to respond to Medi-Cal with my "wage" - the catch 22 is that I need to do my taxes to know what my "wage" is. Otherwise I'll unfairly report my wage as being too high.

I purchased TurboTax this morning and got through most of the deductions

HOWEVER

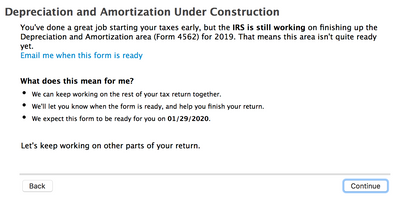

I still need to put about $8000 spent on software into the 179 form (asset area of TurboTax) - BUT - I can't due that for about a month - TurboTax says they expect forms on 1/29/2020 - which is not in a few days (when I need to inform Medi-Cal of my so called wage). Oy vey!

Since I'm only making an estimate - how would I calculate this on my own?

Yeah, I know - pay an accountant. Ouch.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bobking13

New Member

amy

New Member

rebeccaspann2011

Level 1

Bebl21

Level 1

brendageo

New Member