- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Well, I guess it is time to call an accountant. I need VERY FAST answers. I need to respond to Medi-Cal with my "wage" - the catch 22 is that I need to do my taxes to know what my "wage" is. Otherwise I'll unfairly report my wage as being too high.

I purchased TurboTax this morning and got through most of the deductions

HOWEVER

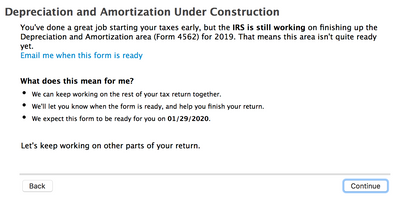

I still need to put about $8000 spent on software into the 179 form (asset area of TurboTax) - BUT - I can't due that for about a month - TurboTax says they expect forms on 1/29/2020 - which is not in a few days (when I need to inform Medi-Cal of my so called wage). Oy vey!

Since I'm only making an estimate - how would I calculate this on my own?

Yeah, I know - pay an accountant. Ouch.

November 25, 2019

1:19 PM