- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Book Income (Loss) Wont balance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Book Income (Loss) Wont balance

Hello, I am hoping someone can help me figure out what I am missing here. My Income (loss) is out of balance and I know what it is based on the amount. I just don't know how to correct.

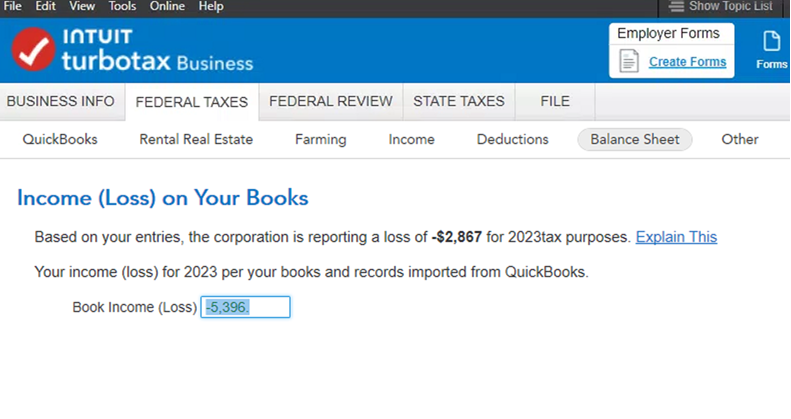

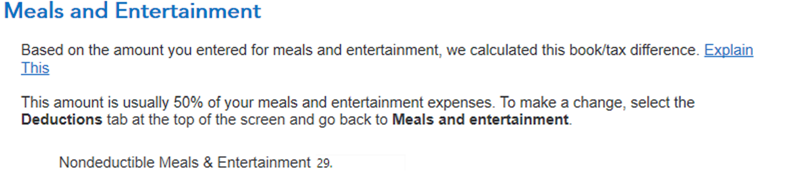

The first part of my issue. The difference from my books seems to be the gain from the sale of my trailer ($2500.00) and $29 non-deductible amount from $58 meals on my books. My p&l is showing -$5,396 , but turbotax is showing -$2,867.

In the income section of TurboTax, I have $2500 in the Dispose of Business Property and also in Other Income the same amount. Should I include both?

Any suggestions would be greatly appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Book Income (Loss) Wont balance

To look at this in detail, we would like to see a diagnostic copy of your return. The information in this file is a sanitized copy meaning there is no personal information, only numbers so that we can troubleshoot in depth, check for calculation issues, and to see how certain items are applied. Here is how to order.

For Turbo Tax online, go to tax tools>tools>share my file with agent. When this is selected, you will receive a token number. Respond back in this thread and tell us what that token number is.

If you use the desktop version, go to the black stripe at the top of the program>online>send tax file to agent. Once you receive the token number, reply back in this thread and let us know what that token number is.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Book Income (Loss) Wont balance

Thank you, Token # is 1204212

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Book Income (Loss) Wont balance

Hello, I think I figured out the problem. I was adding a separate entry of Additional income, when the 4797 form had already account for this amount.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

shanesnh

Level 3

Divideby7

Level 1

tandonusatax

Returning Member

TS61

Level 2

LLCHERMOSA

New Member