- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- 1099 or not? My SP performed services for my SMLLC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 or not? My SP performed services for my SMLLC.

Hi. I own two businesses. One is a sole proprietorship. One is a single-member LLC.

When I work as a SP, my clients send me a 1099-MISC.

When my SMLLC hires an independent contractor (IC), the SMLLC files a 1099-MISC covering their IC service.

This year, I did some work for my SMLLC using equipment wholly owned by my SP. The accounting I did was: SMLLC paid the SP. The SP wrote an invoice, same as for every other client. Then the SMLLC cut a check, same as for every other IC. With respect to tax filing, my inclination was NOT to file a 1099-MISC. The SMLLC is a disregarded entity.

Should I have filed a 1099-MISC or not?

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 or not? My SP performed services for my SMLLC.

First of all, the amount has to be over $600. If not, you would not issue a 1099-Misc.

Second, you have to treat them as two distinct businesses, despite the fact that you own both. If you would sent that 1099-Misc to any other business you would have worked for, then you have to treat your business the same way.

If you acted in the capacity of contract labor for the LLC, then the LLC owes the SP a 1099-Misc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 or not? My SP performed services for my SMLLC.

I agree with everything you said. And thank you for your reply. I will indeed report my work as contract labor, and it is more than $600.

However. What confuses me is how do you balance the status of the SMLLC, that it is a separate business but also a disregarded entity with respect to tax purposes?

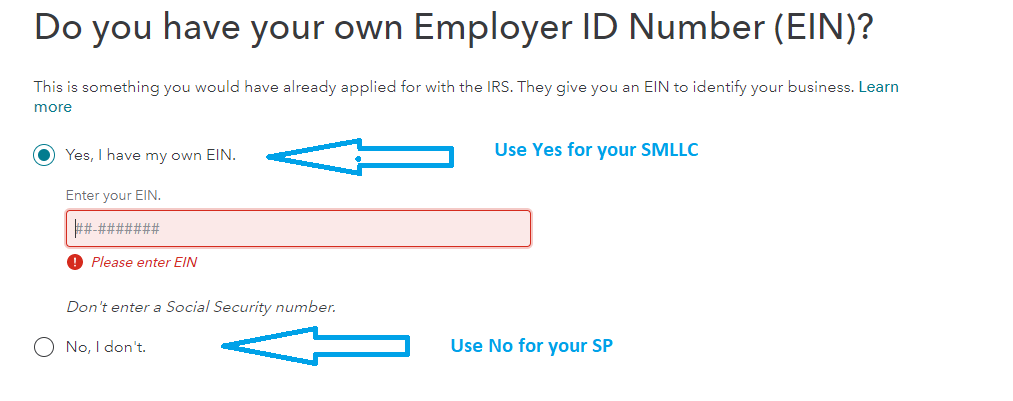

For example, the SMLLC has its own EIN. It's a separate business and legal entity. But for taxable income reporting, I report the SMLLC with form 1040C using my SSN. Not the EIN.

I agree with everything you wrote. But where is my mistake here: Since the SMLLC is a disregarded entity for tax purposes, this is a 1:1 transfer of taxable income to the same taxpayer, and I should therefore NOT file a 1099?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 or not? My SP performed services for my SMLLC.

As stated above, you have 2 distinct businesses, so 2 separate Schedule Cs included with your Form 1040. You use your SSN number for the SP and you can and should use your EIN for the SMLLC. There is a place to enter that in TurboTax when you are setting up your different lines of work (Schedule Cs).

Your LLC should give you a 1099 for work done. The LLC claims an expense on its Schedule C and the income is reported on the SP's Schedule C.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 or not? My SP performed services for my SMLLC.

Thank you again for your time and your help.

@DawnC wrote:Form 1040. You use your SSN number for the SP and you can and should use your EIN for the SMLLC.

Just to clarify. The SMLLC has an EIN. I don't have an EIN. I believe I should not use the LLC's EIN for 1040C.

For federal income tax purposes, a single-member LLC classified as a disregarded entity generally must use the owner's social security number (SSN) or employer identification number (EIN) for all information returns and reporting related to income tax. For example, if a disregarded entity LLC that is owned by an individual is required to provide a Form W-9, the W-9 should provide the owner’s SSN or EIN, not the LLC’s EIN.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 or not? My SP performed services for my SMLLC.

That's also why I thought I should not file a 1099-MISC: The payer and payee would have the same TIN.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kerryaclark

Level 1

jinjer

Level 2

sf_smllc

Level 2