- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

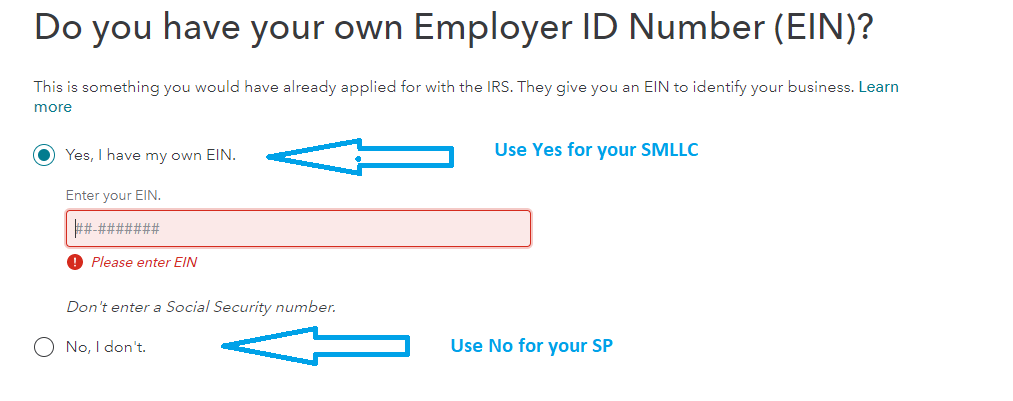

As stated above, you have 2 distinct businesses, so 2 separate Schedule Cs included with your Form 1040. You use your SSN number for the SP and you can and should use your EIN for the SMLLC. There is a place to enter that in TurboTax when you are setting up your different lines of work (Schedule Cs).

Your LLC should give you a 1099 for work done. The LLC claims an expense on its Schedule C and the income is reported on the SP's Schedule C.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 4, 2020

1:58 PM