- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- 1099 NEC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 NEC

I am a realtor. My principal broker pays me the commission from my closed transactions. I am a cash basis, but if she issues me a 1099-NEC it changes what I have to report as actual income received? My last two commission checks were not received until Jan 4, 2021, but she is including them on my 1099 NEC. That increases my tax liability significantly. How can I make this adjustment with out the IRS making correction based on the 1099-NEC. they receive?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 NEC

All answers suggest that in such cases IRS's definition of "constructively received" should be used.... which states (per IRS Publication 538) "Income is constructively received when an amount is credited to your account or made available to you without restriction. You do not need to have possession of it. If you authorize someone to be your agent and receive income for you, you are considered to have received it when your agent receives it. Income is not constructively received if your control of its receipt is subject to substantial restrictions or limitations."

In the case of the end-of-year mailing of payments that didn't arrive in your hand until the following year, despite the date on the check, you didn't constructively receive the money until the following year. So it's taxable income, in most cases, in the year you got the check.

Keep in mind, the person who sent you the 1099 is probably going to provide the 1099 to the IRS. But if you have good records of the date you received the money, you will have no problems.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 NEC

Thank you for taking the time out to clarify and answer my question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 NEC

One more question to RayW answer. How do I report the actual money that I received within the year? Do I lower the amount of the 1099-NEC and enter it in the other income location?

It's odd, because even though it is our portion of the commission, the Principal Broker (at least mine) does not issue me a check until after she deposits it and it shows that the amount was deposited in her account... then she writes the check. So technically, it's not available to me until I actually receive it in the mail. I asked her to correct the 1099-NEC to show the correct amount, but of course she wants it out of her account... and back dated her checks. Frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 NEC

You can certainly reduce the amount of the 1099-NEC, Box 1. You are required to report only what you constructively received as @RayW7 indicated.

If you deposited the money and, if by chance you have the envelope showing the postage date, you will have your bank records to show that you did not receive the money before January 1, 2021.

As far as recording your income, you do not have to enter the Form 1099-NEC directly. It's a convenience but not a requirement. Follow the steps below to enter your business income (it is not 'Other' income).

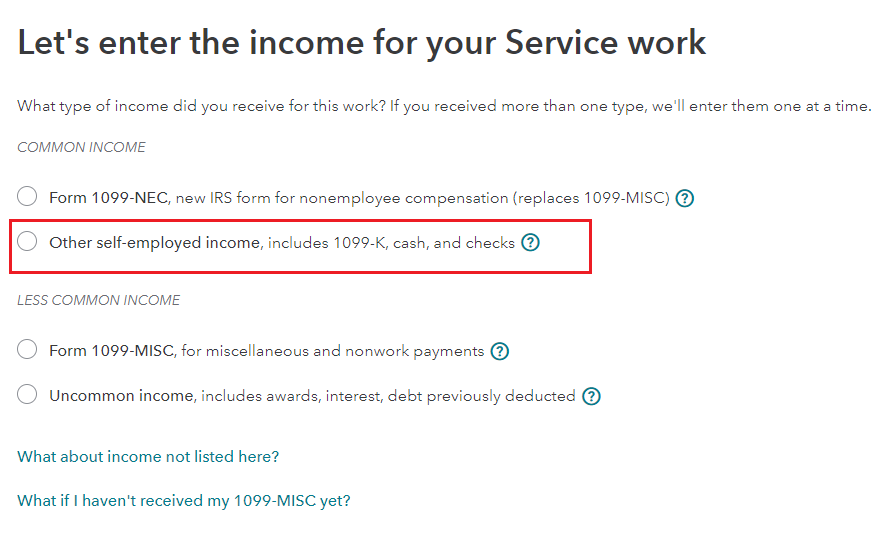

You can also choose to enter this as a cash payment of business income by selecting Other self-employed income, includes 1099-K, cash, and checks (if you choose this, delete the 1099-NEC). See the image below from online, but it's similar in desktop.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ajm2281

Returning Member

Lukas1994

Level 2

currib

New Member

adotschkal

Level 2

Th3turb0man

Level 1