- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

You can certainly reduce the amount of the 1099-NEC, Box 1. You are required to report only what you constructively received as @RayW7 indicated.

If you deposited the money and, if by chance you have the envelope showing the postage date, you will have your bank records to show that you did not receive the money before January 1, 2021.

As far as recording your income, you do not have to enter the Form 1099-NEC directly. It's a convenience but not a requirement. Follow the steps below to enter your business income (it is not 'Other' income).

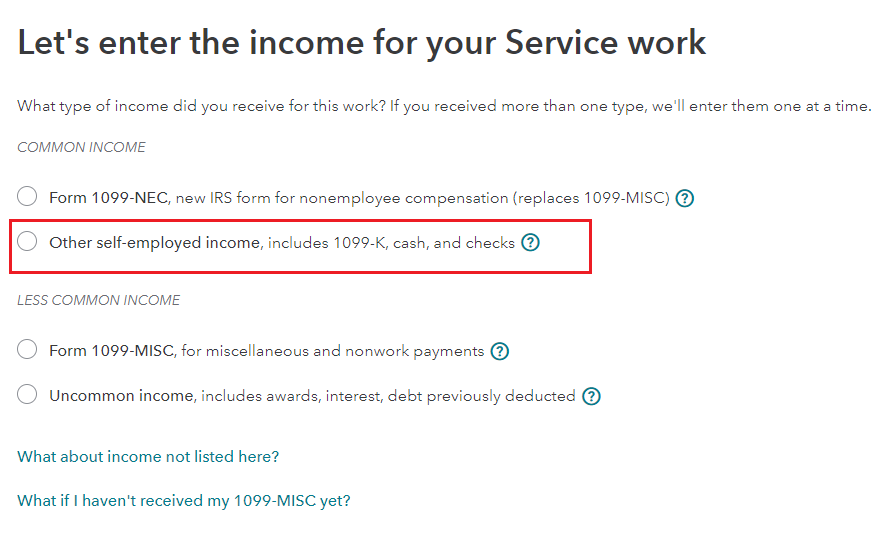

You can also choose to enter this as a cash payment of business income by selecting Other self-employed income, includes 1099-K, cash, and checks (if you choose this, delete the 1099-NEC). See the image below from online, but it's similar in desktop.

**Mark the post that answers your question by clicking on "Mark as Best Answer"