- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Where can I find the Oregon tax liability? Is says line 22 on form OR-40 but there are two line 22's. How do I know which one?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the Oregon tax liability? Is says line 22 on form OR-40 but there are two line 22's. How do I know which one?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the Oregon tax liability? Is says line 22 on form OR-40 but there are two line 22's. How do I know which one?

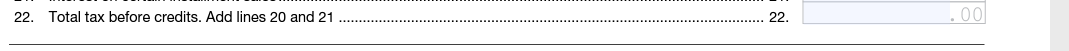

There is only one Line 22 on your 2020 OR-40 and it is for "Total tax before credits".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the Oregon tax liability? Is says line 22 on form OR-40 but there are two line 22's. How do I know which one?

Thank you for your response, but there are 2 places on my OR-40 2020 taxes. One is what you showed and the other says: 22. Figure the tax on the amount on line 5. If the amount on line 5 is less than $100,000, use the Tax 10Table to figure the tax. If the amount on line 5 is $100,000 or more, use the Tax Computation Worksheet

The amount on this line is less than the amount on the line you pointed out. You are sure that is the Tax Liability they are wanting?

D

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the Oregon tax liability? Is says line 22 on form OR-40 but there are two line 22's. How do I know which one?

Can you clarify what screen in the Oregon return that is requesting this amount so I can confirm?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the Oregon tax liability? Is says line 22 on form OR-40 but there are two line 22's. How do I know which one?

It's for the OR state part of taxes

At the top of the page it says:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the Oregon tax liability? Is says line 22 on form OR-40 but there are two line 22's. How do I know which one?

Then it would be the Line 22 I showed you in the previous post. It is asking for your total tax liability for 2020.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the Oregon tax liability? Is says line 22 on form OR-40 but there are two line 22's. How do I know which one?

Thank you Sooooo Much! I have been trying to find the answer to this for quite a while.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the Oregon tax liability? Is says line 22 on form OR-40 but there are two line 22's. How do I know which one?

I have another question...It asked me about Retirement Savings contribution credit...It says I can get a credit, but it will cost more to do the page than the actual credit is. How do I get it to not give that credit? I can't find a way to get out of it and Turbotax is saying I have to pay to upgrade in order to file my taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the Oregon tax liability? Is says line 22 on form OR-40 but there are two line 22's. How do I know which one?

If you do not want to claim the credit, revisit that section and indicate you were a Full-time student during 2021.

To remove the credit :

- Login to your account.

- Select Federal from the left menu.

- Go to Deductions and Credits

- Scroll down to Retirement savings contribution credit in the Retirement and Investments section

- Continue to the screen Retirement savings contribution credit and answer Yes to the question "Were you a full time student during any five month in 2021?"

You won't qualify for the credit if you check that you were a full time student.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the Oregon tax liability? Is says line 22 on form OR-40 but there are two line 22's. How do I know which one?

Won't I get in trouble for being dishonest on my taxes as I wasn't a student last year.

Is there no other way?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the Oregon tax liability? Is says line 22 on form OR-40 but there are two line 22's. How do I know which one?

No, you won’t be in any trouble, but it’s good that you’re conscientious about your tax responsibilities.

All you’re doing is telling the program you don’t want the credit. Your entry isn’t transmitted to the IRS. You’re not lying to the government.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the Oregon tax liability? Is says line 22 on form OR-40 but there are two line 22's. How do I know which one?

Thank you so much! Taxes are finished. I really felt like online was more difficult than previous years even though I didn't have any changes.

Have a great day!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kac42

Level 1

user17549413515

New Member

user17548719818

Level 1

rolfarber

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

LD71

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill