- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- What do i do when they say my bank isnt supported how do i get the info to put on my taxes from my bank and y isnt simple supported by turbotax????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do i do when they say my bank isnt supported how do i get the info to put on my taxes from my bank and y isnt simple supported by turbotax????

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do i do when they say my bank isnt supported how do i get the info to put on my taxes from my bank and y isnt simple supported by turbotax????

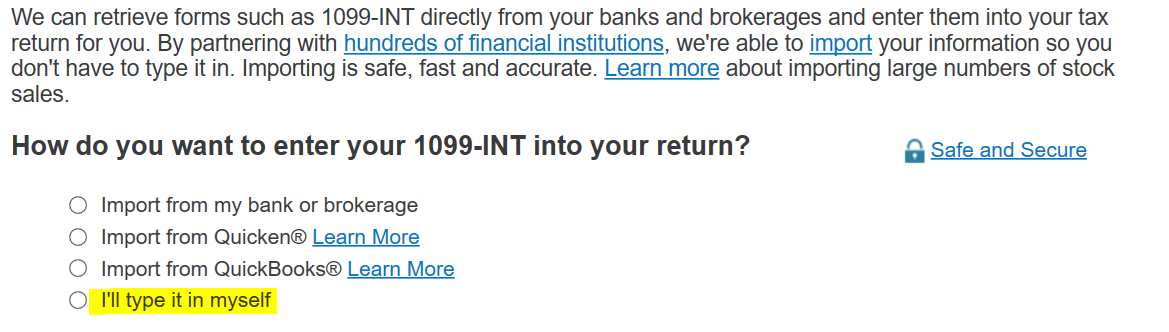

The bank decides whether they will partner with TurboTax for importing tax information. If the bank is not a TurboTax import partner, you have to enter the information manually from the 1099-series tax form(s) that the bank sent you in the mail. If you don't have the tax forms, ask the bank to send you a duplicate copy. If you have online access to your account, you may be able to get your tax forms on the bank's web site or mobile app.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do i do when they say my bank isnt supported how do i get the info to put on my taxes from my bank and y isnt simple supported by turbotax????

You have to manually enter the tax documents that can't be imported. TurboTax partners with some financial institutions, but not all. Are you referring to Form 1099-INT?

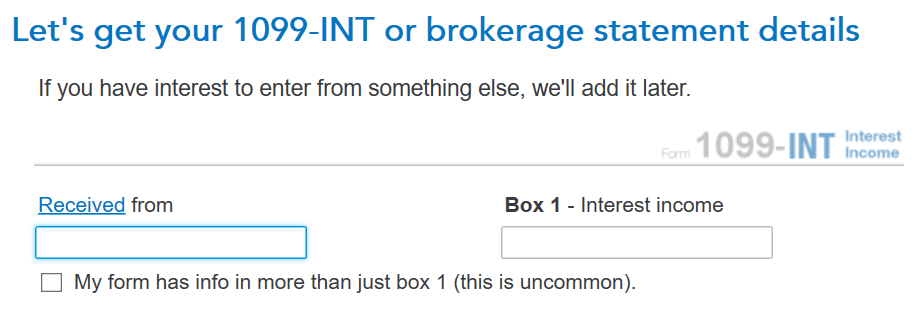

If you only have amounts in Box 1, it is easier to manually enter the amount than to do the import. The entry screen for bank interest is 2 boxes, see below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

smorgan8619

New Member

renluo1

New Member

taxquestion010101

New Member

Sgspaddy

Returning Member

Atif-benyosef-alsiddiqi

New Member

Want a Full Service expert to do your taxes?