- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- We are instructed to enter “exact amount” of advance Child Tax Credit, but turbo tax rounds the number. Is it OK to provide a rounded number for advance Child Tax Credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

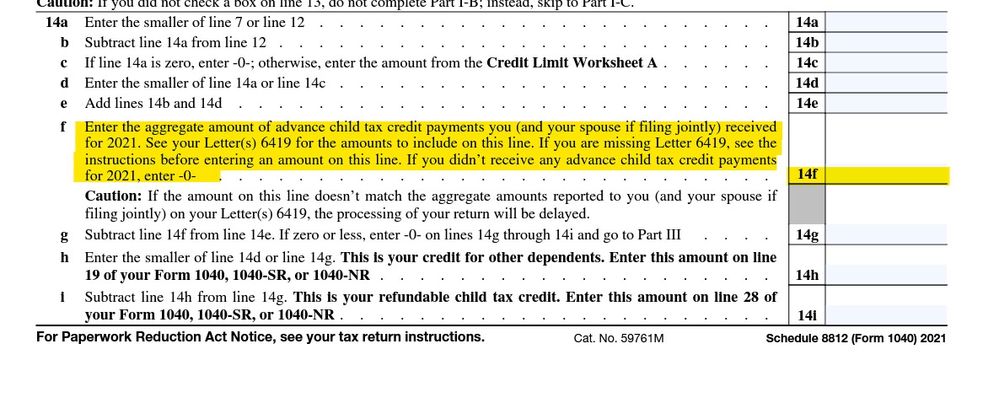

We are instructed to enter “exact amount” of advance Child Tax Credit, but turbo tax rounds the number. Is it OK to provide a rounded number for advance Child Tax Credit?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We are instructed to enter “exact amount” of advance Child Tax Credit, but turbo tax rounds the number. Is it OK to provide a rounded number for advance Child Tax Credit?

Ok ... married couples who have 50 Cents at the end of their number just need to be smarter than the program ... so either add the 2 payments together and enter it all under one person and put a zero under the other OR round one up and one down.

601 + 0 = 601

300.50 + 300.50 = 601 301 + 300 = 601

Remember the IRS only gets the total on the form 8812 ... how the correct total gets there is immaterial :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We are instructed to enter “exact amount” of advance Child Tax Credit, but turbo tax rounds the number. Is it OK to provide a rounded number for advance Child Tax Credit?

Ok ... married couples who have 50 Cents at the end of their number just need to be smarter than the program ... so either add the 2 payments together and enter it all under one person and put a zero under the other OR round one up and one down.

601 + 0 = 601

300.50 + 300.50 = 601 301 + 300 = 601

Remember the IRS only gets the total on the form 8812 ... how the correct total gets there is immaterial :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We are instructed to enter “exact amount” of advance Child Tax Credit, but turbo tax rounds the number. Is it OK to provide a rounded number for advance Child Tax Credit?

Critter-3 is correct. It’s fine to use a rounded number.

According to Rounding off dollars under Computations in the IRS’ Your Federal Income Tax For Individuals,

You can round off cents to whole dollars on your return and schedules. If you do round to whole dollars, you must round all amounts. To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar. For example, $1.39 becomes $1 and $2.50 becomes $3.

If you have to add two or more amounts to figure the amount to enter on a line, include cents when adding the amounts and round off only the total.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MWMark

New Member

mtl7770

Level 2

jazzki73

Level 1

cwyn

Level 2

anonymous2

Level 3