- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Turbotax is rounding up the advance Child Tax Credit, but is asking for the exact amount to avoid delays?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is rounding up the advance Child Tax Credit, but is asking for the exact amount to avoid delays?

I thought it was maybe just rounding it up in the recap, but when I go back in the form it has also changed to $1,038.

Will that cause any issues?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is rounding up the advance Child Tax Credit, but is asking for the exact amount to avoid delays?

No, the IRS requires all entries be rounded numbers. If there are two of you, adjust one to $1,037 and the other to $1,038 to equal the correct amount. If it is just you, the IRS will also round up and it will match.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is rounding up the advance Child Tax Credit, but is asking for the exact amount to avoid delays?

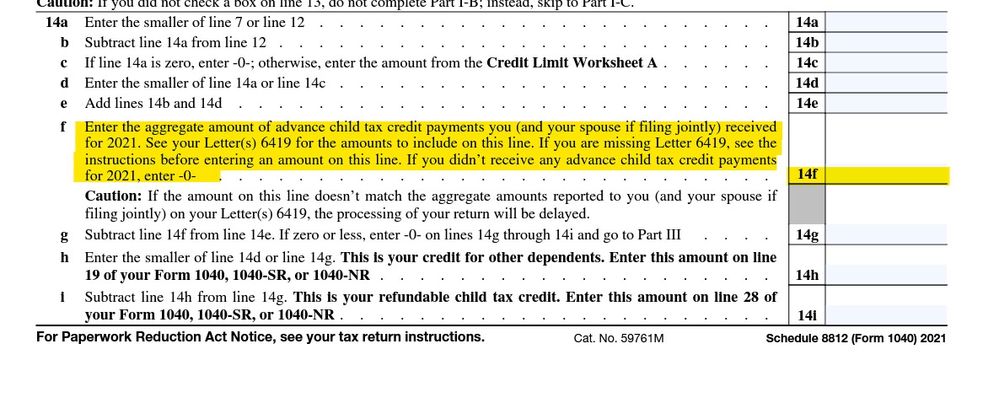

Ok ... you must be married and you each got a letter with 50 Cents on it so since the form 8812 line 14f ONLY gets the combined total of what was on the separate letters so let's be smarter then the auto rounding system shall we ??? You can either add the 2 amounts together and enter it all under ONE parent and put a zero on the other OR if the amount is say 300.50 on both letters then enter 300 on one parent and 301 on the other. 300.50 + 300.50 = 601 and 300 + 301 = 601

LOOK at the form line instructions :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax is rounding up the advance Child Tax Credit, but is asking for the exact amount to avoid delays?

It is definitely an issue if one needs to manually adjust one spouse's number in order to defeat the software's inappropriate rounding prior to the final calculation. It's amazing that the one line this year which warns "Caution! Can delay your return!" has such a bug.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ashleytoth55

New Member

kruegerjenna85

New Member

TT-Fan

Level 2

TheHolyHolden

New Member

ikner7913

New Member