- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

As my previous post state, Efile for amended returns is only available for the current year. You must paper file amendments for prior year returns.

Can I e-file my federal Form 1040-X amended return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

Yes @CatinaT1, we did see your previous post. However, it does not address the current concerns being expressed, namely:

- This is an extremely frustrating problem that for some of us means finding a printer to print out very long returns to then pay to mail return receipt requested.

- All information previously posted (i.e. when we paid for the software) indicated that it was possible to e-file an amended return with the desktop version. As such, customers feel mislead, and some are searching for other software options for their future returns.

- This seems to be a simple bug that could easily be fixed by Intuit/TT. The IRS does not prevent electronic filing of amended returns after the close of the original calendar year.

- If it is a bug, can this be communicated to Intuit/TT so they can escalate the fix to this seemingly simple bug? And can we hear from Intuit/TT as to the expected time frame of a fix?

- No one from Intuit/TT has indicated whether it is a bug or an intentional "feature," and whether, if a bug, it is a simple or complex bug to fix. If it is an intentional feature, it seems arbitrary and/or callous on the part of Intuit/TT. Again, no official explanation has been put forth either way.

So while we appreciate your reiterating your previous post stating, essentially, "It can't be e-filed after 12/31, so just print it and mail it," can you address the aforementioned concerns and questions?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

This is not a bug, it is simply something that is unsupported by TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

Thank you @CatinaT1 for your response.

Putting aside the thoughts many might be having of "I paid for a program that said it could do this," or "Well that seems arbitrary and, frankly, a little lazy on the part of Intuit/TT," you have at least answered the question of whether this was a bug that might be fixed. Now a small segment of TT customers (those reading this thread) can now comparison shop for alternate software knowing that TT does not support e-filing amendments after the end of the original calendar year, and has not stated that they ever will.

If there is any way you can communicate the frustrations expressed in this thread to someone in a position to listen and with the ability to have Intuit/TT consider changing it's policy on this matter, we would greatly appreciate it.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

When you say it will support this year.

Does it mean this year 2023 desktop SW will support filing amendment after December 31, 2024? Or it's going to be the same story as 2022 where it will end the support after December 31st?

I bought this year's SW about a month ago, still hasn't filed my taxes. So, I would like to understand, as I still have an option at least for this year to find a different solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

CatinaT said......As my previous post state, Efile for amended returns is only available for the current year. You must paper file amendments for prior year returns.

Current year means you can amend the current year (like 2023) until efiling is closed for the year, usually in mid Oct. Then 2023 will become the prior year. So no you won't be able to efile a 2023 return after October. Unless they change what years they allow to efile.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

Hello,

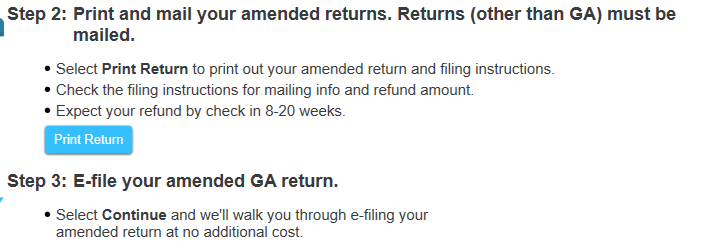

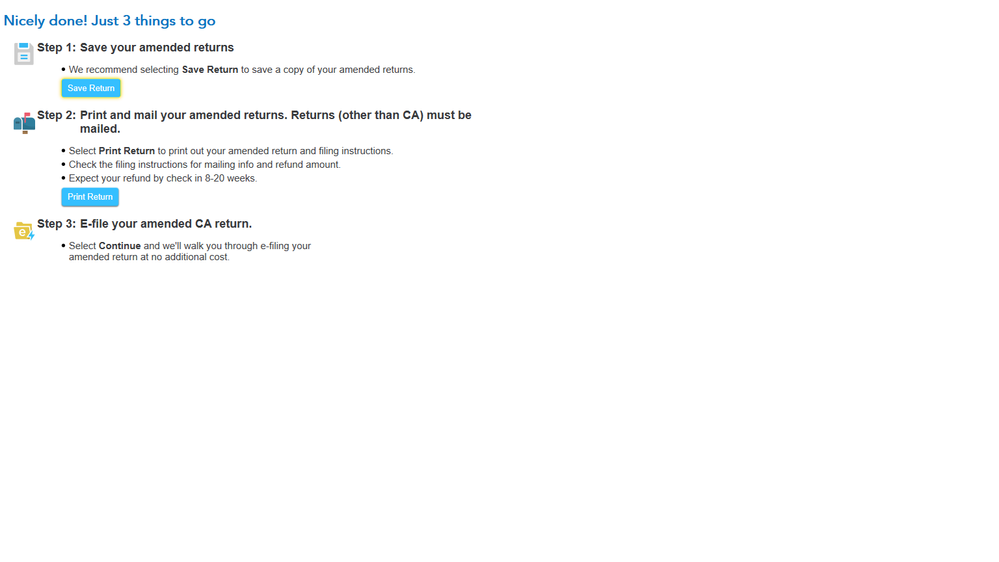

I get it, you guys are adamant about not being able to e-file a previous year amended return, but the desktop version is stating something different for Ga.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

Says the same for me in CA. It says I can e-file but it doesn't let you....did everyone in this thread end up mailing theirs in since TT is incompetent?

After pressing Continue on this screen, I get stuck on another screen to finalize the e-filing for amendment. It won't let me press Continue to move on

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

The annual e-filing program for do-it-yourself software users ended last fall.

The open season for e-filing 2023 returns began January 29, 2024, and will end again the fall.

You can still prepare prior year returns in TurboTax, but they would need to be printed and mailed.

If you need to prepare and file a tax return from a previous year, login to TurboTax to download and install TurboTax software. The program will walk you through the steps to prepare, print and mail your 2021 or 2022 taxes.

To prepare a state return within TurboTax you will first need to prepare a federal return as your federal tax information will flow into the needed state forms.

If you already have the Desktop version for the previous years (Deluxe & above) they include one free state program. Your free state is available after you update the software (Online menu, Check for Updates), then click on the State Taxes tab and you should see your state.

See here to purchase prior year tax products if needed.

See this help article for more information and links.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

@MonikaK1 does your response mean the following section on the irs.gov website is incorrect?

"Can I file my amended return electronically? (updated January 5, 2024) Yes. If you need to amend your Form 1040, 1040-SR, 1040-NR, or 1040-SS/PR for the current or two prior tax periods, you can amend these forms electronically using available tax software products."

I am trying to amend one tax credit on my 2022 return, and I share the frustrations others have stated on this thread (e.g., printing more than 100 pages, sending via unsecure snail mail, etc.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

an amended return should not be 100 or even 10 pages if amending a tax credit. Closing e-filing of amended returns is a Turbotax decision.

the 1040-x

the tax form for the credit

and if needed the form the tax credit flows to

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

I have the same issue. My wife and I filed as Married Filing Separately and a few weeks ago, we got a letter from Intuit stating that due to an error with the 2022 Taxable Dependent Care Benefits calculation for MFS in the TT Desktop 2022 software, she needed to file an amended return. The instructions we were given were to load up the file we used to do her taxes in TT 2022 (thankfully we still had in installed), save a new file, then follow the amended return instructions. In those instructions it was mentioned that we should be able to file electronically. I followed said instructions and then hit the signature date problem to efile. The letter we got was received in July 2024 about our 2022 taxes about the error in TT.

For the person saying TT 2022 Desktop does not support e-filing amended returns, TT's own instructions online to fix this specific problem say nothing about needing to mail the federal amended return due to lack of support for efiling in the 2022 Desktop Software. The instructions are to e-file the taxes on line 21 under the Turbotax Desktop instructions. The page was updated three months ago as of this post in July 2024, so it's not an old page.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

@thizzle7xu See this TurboTax support FAQ for e-filing an amended tax return - https://ttlc.intuit.com/turbotax-support/en-us/help-article/tax-return/e-file-1040x-amend-return/L9t...

If you're amending your return for 2022 or earlier, you need to print and mail your amended return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

3 months is old. Sorry you can only efile a prior year amended return using the Online version. For Desktop you have to print and mail.

On Feb 20, 2024 an employee posted this……..

According to our tech support team, this is not a product defect. TurboTax Desktop for prior years does not support E-file for amendments like TurboTax Online does. Apparently, the signature date is the trigger for rejecting an e-file attempt. See this thread…..

https://ttlc.intuit.com/community/after-you-file/discussion/tt-desktop-won-t-let-me-e-file-2022-amen...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT desktop won't let me e-file 2022 amended return saying "E-filing isClosed for the Season" here in Feb 2024

Three months is not old when you are posting about software that was relevant in early 2023 and the e filing ability (or inability) should be known by now as not a feature of the 2022 tax software. Intuit is just informing customers in the past month about this bug in their 2022 software product. They sent us the letter just a few weeks ago with these instructions. So don't post a support message saying the software does something that apparently the forum people here know that it is not capable of.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.