- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Total Retirement income taxable error noted from letter from IRS - HELP!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Total Retirement income taxable error noted from letter from IRS - HELP!!!

I just received a letter from the IRS claiming that the total retirement income taxable reported on the 2021 return was less than what the IRS calculated it should be (off by many dollars!). I checked the basis of their calculation of my total retirement income from their letter and it is correct. I checked the inputs to TurboTax and they are correct. What I cannot figure out is how they got an incorrect total out of the electronic filing for 2021 from Turbotax. The only thing they say is they extracted specifically is my total income from line 15 of 1040 (which of course has more than just my retirement income). Where is a calculation of total retirement income in TurboTax they claim is incorrect? I can't find it. Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Total Retirement income taxable error noted from letter from IRS - HELP!!!

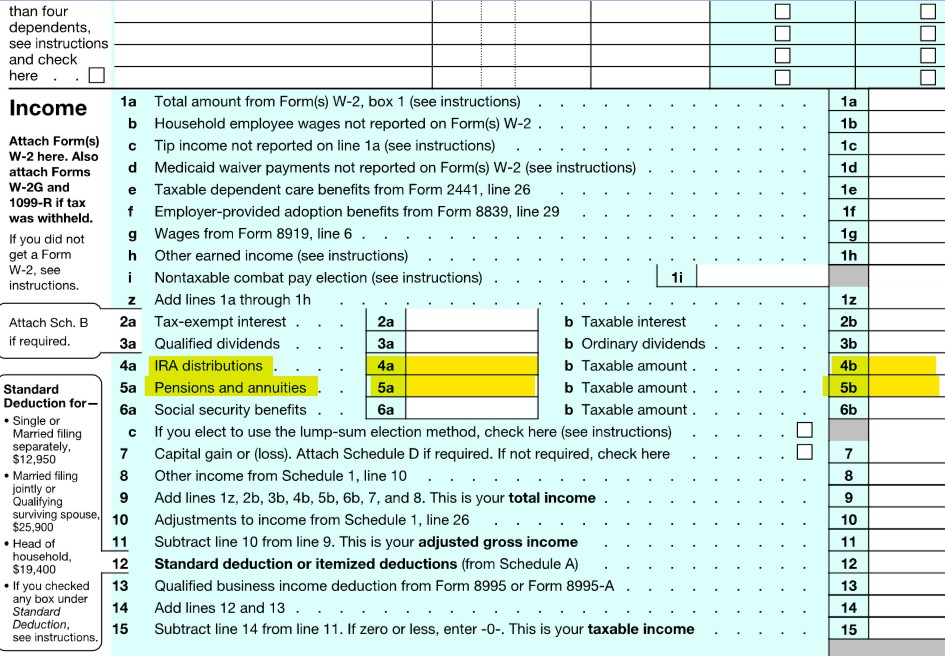

Taking a look at Form 8606 in conjunction with your Form 1099-R reporting the IRA distributions should help you understand the taxable portion (Form 1040 line 4b) of the IRA distributions.

Also, see the following TurboTax help article for more information:

Are IRA or pension distributions taxable?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Total Retirement income taxable error noted from letter from IRS - HELP!!!

Hi All,

What a great forum this is!

Thanks for the information on the 8606; which, in turn, referred me to the 8915 form. It turns out that that form was not properly completed and I also made an error on the Disaster Relief question in the interview topic in Turbo-Tax. My Bad!!

Thanks to all for helping me hunt down the discrepancy. Unfortunately, now I owe back taxes and huge late penalties. Lesson learned!! Goodbye!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Total Retirement income taxable error noted from letter from IRS - HELP!!!

Was this really a letter from the IRS or a state Department of Revenue? If so, which state? "Total Retirement income" is not a phrase that jumps to mind vis-à-vis the IRS.

Line 15 on the 1040 is taxable income, not total income (which is line 9).

I suspect that when you say "total retirement income", you really mean is total income which is only from retirement sources, which is somewhat confusing.

The letter should show what fields they used to arrive at taxable income for line 15. So why lesser field is different from your actual return? Line 15 is pretty clearly the result of addition and subtraction of the line above.

In any case, If you ever get a letter form the IRS or a state revenue department, please visit our TurboTax Audit Support Center. They will explain the letter to you and suggest how to respond to it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Total Retirement income taxable error noted from letter from IRS - HELP!!!

Thanks for your reply . The line item on the CP2000 form says "Retirement income taxable" ..." shown on return". They give no line item in the 1040 for the reference for this value they claim is in the tax return and this is where they think there is a discrepancy. That is why I asked if, in Turbotax, is there is somewhere on the 1040 (or other forms?) in TurboTax or other associated forms that are electronically sent to the IRS, so I can determine how such an error occurred (i.e., is it a fault in Turbotax or at the IRS?). I submitted all the correct retirement source amounts in the forms I filled out in TurboTax which I just checked. So, why the IRS is getting a different total is not clear to me at all without a reference to a line item they picked up or the addition of line items they picked up. Thanks 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Total Retirement income taxable error noted from letter from IRS - HELP!!!

retirement income taxable is either Line 4b or Line 5b or both.

compare to retirement distribution: Line 4a and/or Line 5a.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Total Retirement income taxable error noted from letter from IRS - HELP!!!

Retirement income is on Lines 4 and 5 on Form 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Total Retirement income taxable error noted from letter from IRS - HELP!!!

Again, Thanks to everyone who has responded so far! I see now where there is a discrepancy between what the IRS picked up off the 1040 and what they say should be the taxable retirement income. Apparently, they only picked up the addition of what is in lines 4a and 5a on the 1040 form. They did not use the addition of the "taxable amount" in lines 4b and 5b. Why would they do that? I am having difficulty hunting down how the 4a got converted to the 4b, in case the IRS has further questions about the taxable basis, so I can defend myself against their assertions of what is and is not taxable in the IRA distribution.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Total Retirement income taxable error noted from letter from IRS - HELP!!!

Taking a look at Form 8606 in conjunction with your Form 1099-R reporting the IRA distributions should help you understand the taxable portion (Form 1040 line 4b) of the IRA distributions.

Also, see the following TurboTax help article for more information:

Are IRA or pension distributions taxable?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Total Retirement income taxable error noted from letter from IRS - HELP!!!

Hi All,

What a great forum this is!

Thanks for the information on the 8606; which, in turn, referred me to the 8915 form. It turns out that that form was not properly completed and I also made an error on the Disaster Relief question in the interview topic in Turbo-Tax. My Bad!!

Thanks to all for helping me hunt down the discrepancy. Unfortunately, now I owe back taxes and huge late penalties. Lesson learned!! Goodbye!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17521061672

New Member

tandonusatax

Returning Member

juham2013

Level 3

Vermillionnnnn

Returning Member

in Education

CRAM5

Level 2