- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- To add another state to your return in TurboTax Online:...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to add a state to my federal return. My federal return has been accepted. So how can I file my state return

I filed my federal return and Illinois return, but forgot to file my Missouri return.

How can I fix this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to add a state to my federal return. My federal return has been accepted. So how can I file my state return

To add another state to your return in TurboTax Online:

- Sign in to TurboTax.

- Under Your tax returns & documents, select Show, and then select 2018.

- Now select Add a state (this reopens your return).

- Select State from the menu on the left (on mobile devices, tap in the upper-left corner to open the menu).

- On the Let's get your state taxes done right screen, select Continue and follow the onscreen instructions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to add a state to my federal return. My federal return has been accepted. So how can I file my state return

Since your return has been accepted you can now go into your TurboTax return and do an amendment to add the additional state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to add a state to my federal return. My federal return has been accepted. So how can I file my state return

Which option in the amendment should I choose. It seems it always requires me to amend one filed return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to add a state to my federal return. My federal return has been accepted. So how can I file my state return

Please be aware that if you are simply ADDING a state return and NOT changing your Federal return, you DO NOT AMEND, you only "Add a State".

The instructions for "ADDING" a state return is listed above.

Sign in to TurboTax.

- Under Your tax returns & documents, select Show, and then select 2018.

- Now select Add a state (this reopens your return).

- Select State from the menu on the left (on mobile devices, tap in the upper-left corner to open the menu).

- On the Let's get your state taxes done right screen, select Continue and follow the onscreen instructions.

If you need to AMEND a return, please start a new question. This question is asking how to add a state return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to add a state to my federal return. My federal return has been accepted. So how can I file my state return

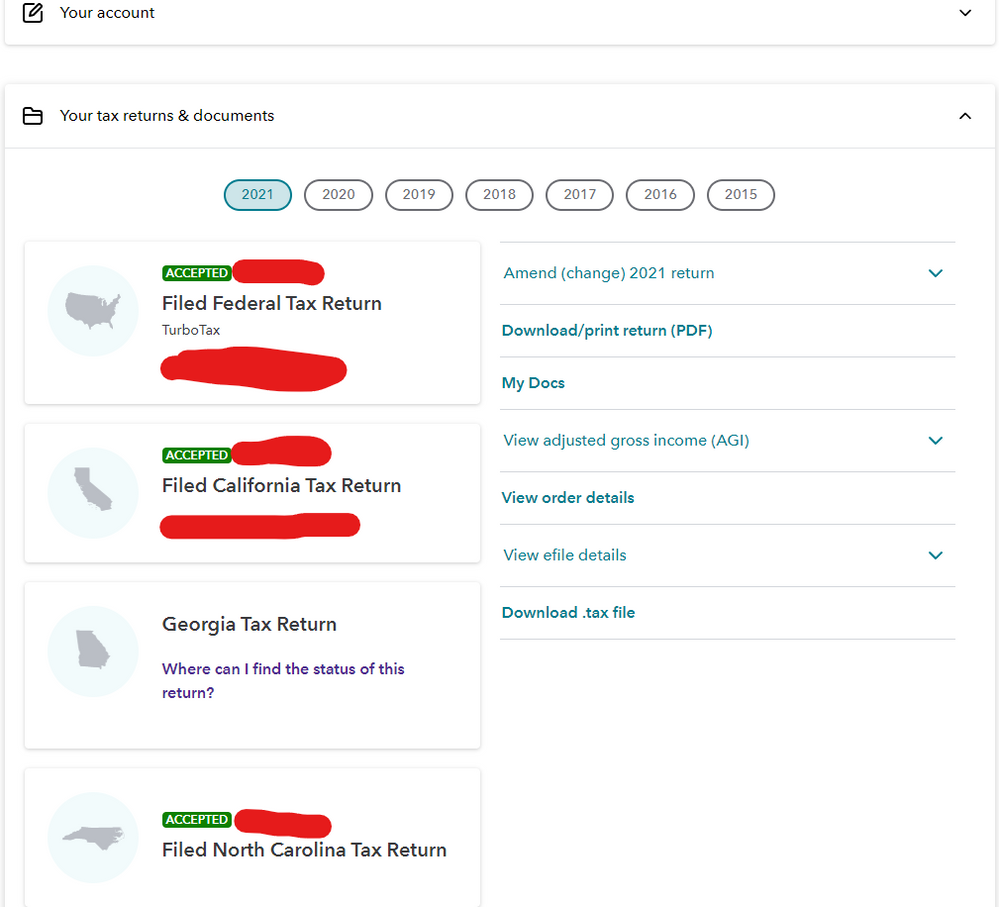

For example, this screenshot of my 2021 tax return. It doesn't have "Add a State" button. Does "Add a State" only work for current year? How do I add a state for previous tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I forgot to add a state to my federal return. My federal return has been accepted. So how can I file my state return

Yes, Add State is only good for the current year. In your case, you will need to:

- Select Amend (change) return, then Amend a filed return.

- Follow the on screen directions to start an amendment, but don't make any changes in your federal return.

- Once you are in the return, select the State tab and add the state that you need.

- When you are done with that state, click on the Forms icon in the upper right corner.

- Find Form 1040-X on the list on the left.

- Highlight it, then click Delete in the lower left corner of the reading pane.

- Click on Step by Step in the upper right corner to return to the interview.

I noticed that you already have several state returns. If you get Error 190, that means you haven't installed all of the states included in your .tax file.

You may need a little more help with your amendment. Click here to get additional help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

xiaoning

New Member

cwr64

New Member

irunalot

Level 2

tlpeckham

New Member

chas-riley

New Member