- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- S-Corp K-1 negative amount not allowed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-Corp K-1 negative amount not allowed

I'm having a hard time this year.....

My personal tax return was rejected because on the K-1 for my husband's S-corp (taxes I also prepare) there is a negative amount for Line 15A (Post-1986 Depreciation Adjustment/Alternative Minimum Tax). I didn't catch this or know that it couldn't be negative. I'm hoping someone can help me with how to fix this. I am already filing a superceded/amended return for the S-corp for a different reason once I can figure this out.

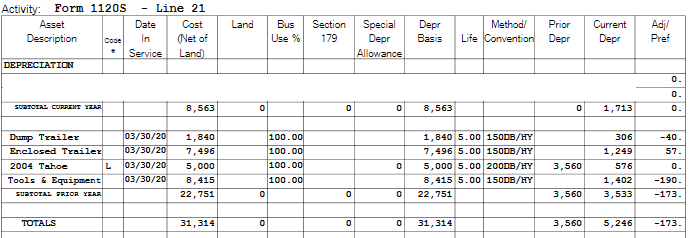

For reference, the amount in box 15A is -173 which is coming from this report:

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-Corp K-1 negative amount not allowed

not sure what you did back in 2020, but apparently you used a different depreciation method for regular tax purposes and AMT purposes. The same method should have been used for both.

the numbers presented in the ADJ/PREF column don't make sense. They shouldn't exist because the method selected and thus the deduction should be the same for regular tax and amt tax. thus no difference. In addition, there is no logic to 2 amounts in the ADJ/PREF being negative and 1 being positive

in addition, if 150DB is selected for regular tax purposes in a year for 5-year assets that method applies to all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-Corp K-1 negative amount not allowed

not sure what you did back in 2020, but apparently you used a different depreciation method for regular tax purposes and AMT purposes. The same method should have been used for both.

the numbers presented in the ADJ/PREF column don't make sense. They shouldn't exist because the method selected and thus the deduction should be the same for regular tax and amt tax. thus no difference. In addition, there is no logic to 2 amounts in the ADJ/PREF being negative and 1 being positive

in addition, if 150DB is selected for regular tax purposes in a year for 5-year assets that method applies to all.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kmatchulat

New Member

cecily-vanhouten

New Member

cecily-vanhouten

New Member

ambtlb13

New Member

mqc5

New Member