- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-Corp K-1 negative amount not allowed

I'm having a hard time this year.....

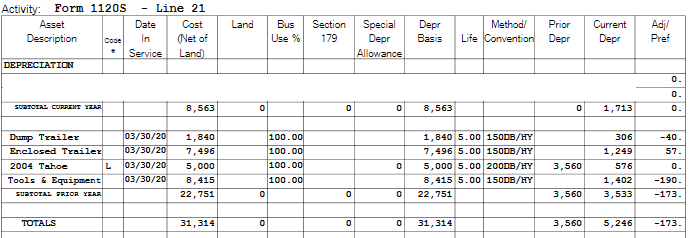

My personal tax return was rejected because on the K-1 for my husband's S-corp (taxes I also prepare) there is a negative amount for Line 15A (Post-1986 Depreciation Adjustment/Alternative Minimum Tax). I didn't catch this or know that it couldn't be negative. I'm hoping someone can help me with how to fix this. I am already filing a superceded/amended return for the S-corp for a different reason once I can figure this out.

For reference, the amount in box 15A is -173 which is coming from this report:

Topics:

March 5, 2024

5:51 PM