- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Reject Code F8960-019-04

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

After filing both federal and state returns. I received an email that said the return was rejected and got this code.

Reject Code F8960-019-04

Description of error:

If Form 8960, 'NetRentalIncomeOrLossAmt' has a non-zero value, then it must be equal to Schedule 1 (Form 1040), 'RentalRealEstateIncomeLossAmt' unless all of the following conditions are true: 1) Filing status of the return is Married filing jointly or Qualifying widow(er) and 2) Form 8960, checkboxes 'Section6013gInd' and 'Section6013hInd' are not checked and 3) Form 8960, 'FilingThresholdAmt' equals 125000.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

This error refers to Form 8960 Net Investment Income Tax Individuals, Estates, and Trusts. The issue is known by the IRS and there is a resolution date of 2/17/2023. Once fixed by the IRS, TurboTax will make their adjustments.

IRS Forms & Instructions revision dates

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

Will I be notified when Turbotax makes the change, or should I just resubmit on the 17th?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

You would need to resubmit after the 17th. Once the IRS finalizes everything, then Turbo Tax can update the form. @gdahlgren

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

I just spoke to Turbo Tax and was told the projected date for this to be fixed is 2/19 (a Sunday?)

Where are these dates coming from?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

The dates are usually based on projections from the programmers. With each update pushed by the IRS the programmers have to code the new forms and then test everything to see that it works before they roll it out to the public. In this instance I would guess that they said "New IRS update - it'll take us 48 hours to get it ready and make sure it works."

And this time of year they definitely work on weekends.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

Seems to me there will be no need to do any additional coding or testing by TT, that TT is using the correct form and following the correct instructions. Just an erroneous rejection by IRS that should be corrected by an update on their end. At least that’s what I’m hoping!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

@RobertB4444 Thank you. My e-filing was rejected yesterday on 02/13/23 with this error and I do not have any rental property. I talked to 3 TT Live experts:

1st expert made me to delete form 8960 manually . It was useless: it immediately reappeared

2nd expert said to wait until 02/19/23 (till IRS fixes the issue) and file again. I saw this date somewhere in the TurboTax screens, but cannot find the screen again.

3rd expert said the same as the 2nd, but he also explained to me why the form 8960 reappeared and why it was correct.

I wonder where 02/19/23 date came: Is it from TT or from IRS? Is it just an IRS rule : wait 6 days before you re-file? I guess since it is IRS issue, it must be published somewhere on IRS site, I do not want to e-file again on that date just to be rejected again for the same reason. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

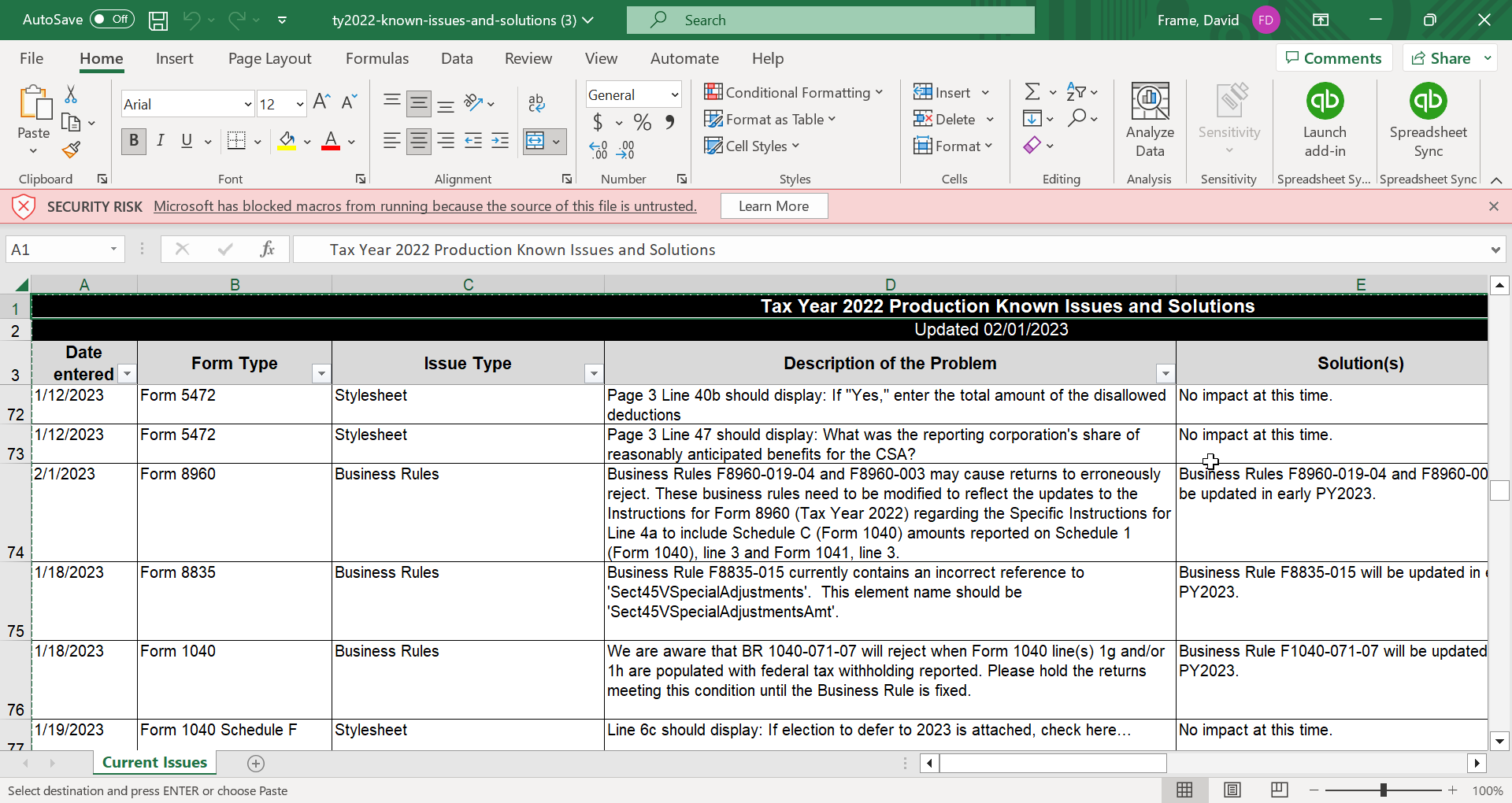

I have found this information in a spreadsheet compiled by the IRS reporting their known issues. According to this, the issue was reported on 02/01/2023 and there is no solution at this moment except for the fact it will be resolved early in Tax Year 2023. How early remains to be seen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

Thank you @DaveF1006 ! It all makes sense to me now. I wanted to mark your answer as "Mark as Best Answer" (as suggested). But I did not find where to click for it . It is just sad that TT invents the dates. Looks like some guinea-pigs customers are needed to see if the "Reject Code F8960-019-04" issue is fixed by IRS on 02/19/23 .

Thank you again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

@EugeneTT wrote:Looks like some guinea-pigs customers are needed to see if the "Reject Code F8960-019-04" issue is fixed by IRS on 02/19/23 .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

I submitted my federal return this morning at 9:05am and I just received an email from TT that the IRS accepted my return at 11:40am. I had my federal return rejected twice previously by the IRS for Form 8960 errors.

Looks like the IRS has fixed this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

My return was accepted on 2/19 after previous rejection. I had the same issues as everyone here. I have a Schedule C basically business contractor profit that was not passive income. That amount was placed by Turbo tax on line 4a of 8960. (even though I have no real estate profits). Then on 4b is the exact same amount but a negative value canceling it out and it shows a "0" on 4c. There is also a negative amount on line 5a "net loss of disposition of property" but I had no property, the amount listed is my total capital gains loss from stocks this year. Line 5 of schedule 1 is blank. Line 17 on 8960 does have a positive amount which is 3.8% of my dividends and interest minus my capital gains losses which is the correct amount. That was auto placed correctly on my 1040. On my 8960 works form it listed the total amount of business income(profit) on the line "adjustment for business or trade income not subject to net investment tax". I did notice that a schedule E was autogenerated at some point, so I just deleted that form. What is interesting is that turbo tax showed no errors, and I filed, and it was rejected. On the rejection explanation it said try again on 2/19. So basically, I did not have to change anything other than deleted schedule E. This time it was just accepted. Everything looks the same as it did when it was rejected. So the IRS must have changed something. But wanted to update people that it did go through today for me. I still think it is unusual the way lines 4a and 4b are worded that a small self business income is listed there. Other advice to delete form 8960 is wrong. if you make over 250,000 married filing jointly and have investment or dividend income you have to do this form. I am not a tax professional at all. Just a TurboTax user. But it went through today for me with pretty much changing nothing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

Thank you for sharing that your return is accepted. My return was rejected yesterday due to the same reason. Learning that IRS would fix the issue on 02/19, I resubmitted my return today around 10 AM. I am waiting to hear what will happen but It sounded like they fixed it so finger cross it will be accepted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reject Code F8960-019-04

Thank you for sharing that your return is accepted. I read in another article that issue would be fixed on 02/19 so after reading your post I resubmitted the return. Waiting to hear whether will it be accepted this time. Finger crossed. Thank you again!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

brandenp5308

New Member

mar2tell

New Member

sjbauer98

New Member

carlieb

New Member

mahonej

New Member