- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Received a Notice from IRS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a Notice from IRS

2021 return. Filed electronically and accepted on April17.

Married, filing separately, we both file with standard deduction $12,550.

Taxable income $34,000. Receive SSI (I'm 64) and have a pension plus, work a part-time job.

Notice said that my standard deduction was reduced because my income did not exceed the standard deduction or I was claimed as a dependent by someone else. Now own more taxes.

Not sure why there are 2 possible reasons.

I believe I was fraudulently claimed as a dependent (latter part of the reason) as my Taxable income is $34,000.

Recommendation on how to best resolve this issue?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a Notice from IRS

If you purchased Audit Defense for your 2021 tax return, call TaxAudit at 877-829-9695, or report your IRS notice on the TaxAudit.com web site. Do not contact the IRS until you have spoken to TaxAudit. They may contact the IRS on your behalf.

If you did not purchase Audit Defense, I suggest that you consult a local tax professional for help understanding your IRS notice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a Notice from IRS

this is extremely strange. Are you sure it's from the iRS? follow the iRS instructions for contesting its findings. include a letter with a statement that you are over 24 years of age on 12/31/2021 and that you are not totally or permanently disabled, therefore you do not qualify to be claimed as a qualifying child. also, your gross income is over $4300 and therefore you don't qualify to be a qualifying relative. you believe the other taxpayer entered the wrong SSN.

I wondering if your spouse messed up and claimed you as a dependent. the IRS won't give you the name of the other party but you certainly can ask your spouse if you can see her return. if it's her then she'll need to file an amended return.

if it was;t your spouse

include form 14039 in your response.

https://www.irs.gov/pub/irs-pdf/f14039.pdf

or you can use

The Audit Defense service is provided by TaxResources, Inc., also called TaxAudit.com, in partnership with TurboTax. If you paid for Audit Defense and you received a notice, call TaxResources, Inc. at 877-829-9695, or report your notice on their website at http://intuit.taxaudit.com/. Do not contact the tax agency until you have spoken to TaxResources. They may contact them on your behalf.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a Notice from IRS

A few thoughts

1) check your spouse’s tax return

2) were you inadvertently listed as a dependent on that return?

3) did your spouse itemize (I know you wrote both were standard deductions) - when filing separate both must file the same way

either could cause the result you are experiencing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a Notice from IRS

Not listed as a dependent on spouses return.

Both are standard deductions, filed the same way.

The Notice is indeed from the IRS. Have not contacted them.

Did not purchase audit defense when filling through TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a Notice from IRS

After reviewing the 1040 again, may have discovered something.

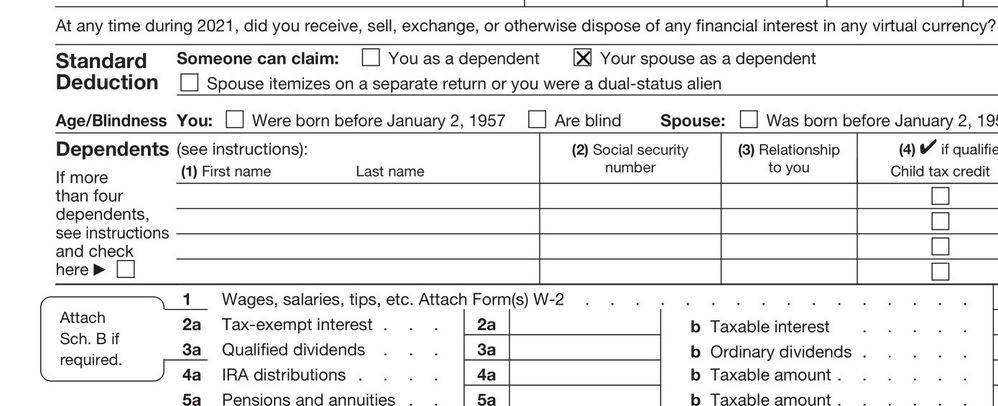

In the attached image, Standard Deduction, Someone can Claim: the box is checked ☑️ Your Spouse as a dependent.

Could this have caused the Notice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a Notice from IRS

@bmerrill - that is the problem..... I assume that is the spouse's return????? needs to be amended.....and then you can amend yours once the spouse's return is processed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a Notice from IRS

The image/checked box is from my return.

Should I amend my return to remove the check box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a Notice from IRS

@bmerrill - yes - as that is what caused the issue.

assume once you amend, it'll take 9-12 months for the IRS to process it due to their signidicant backlogs.... so must put a tickler on your calender for next spring to check and see what happened.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

itsimpossible86

New Member

dthornton34

New Member

jhoke1996

New Member

jason-5418

New Member

Fishwish

Level 2