- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Where’s my federal refund?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

If it shows ''in process'', that means that only the IRS knows what the delay is, unfortunately. They are reviewing something on your return, but that something could be anything. You can either try contacting them or wait for correspondence that will arrive by US mail.

Tax Season Refund Frequently Asked Questions - Link lists possible reasons for the delay.

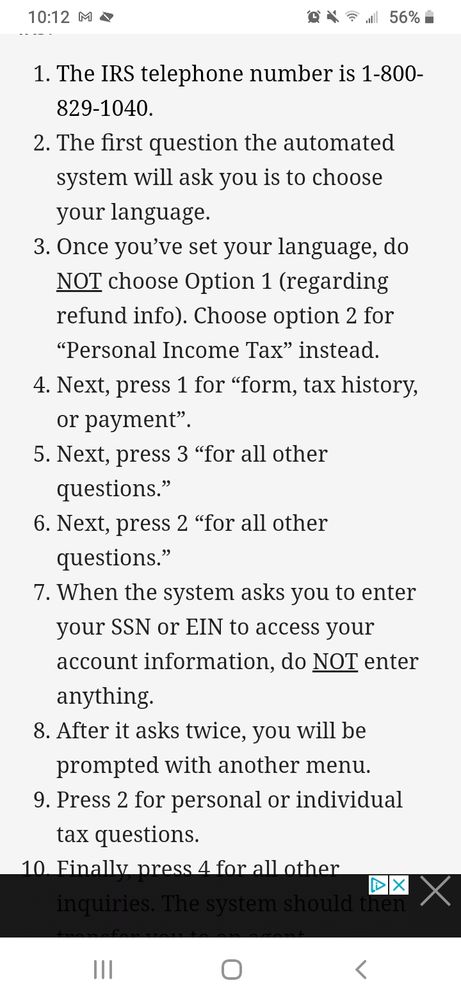

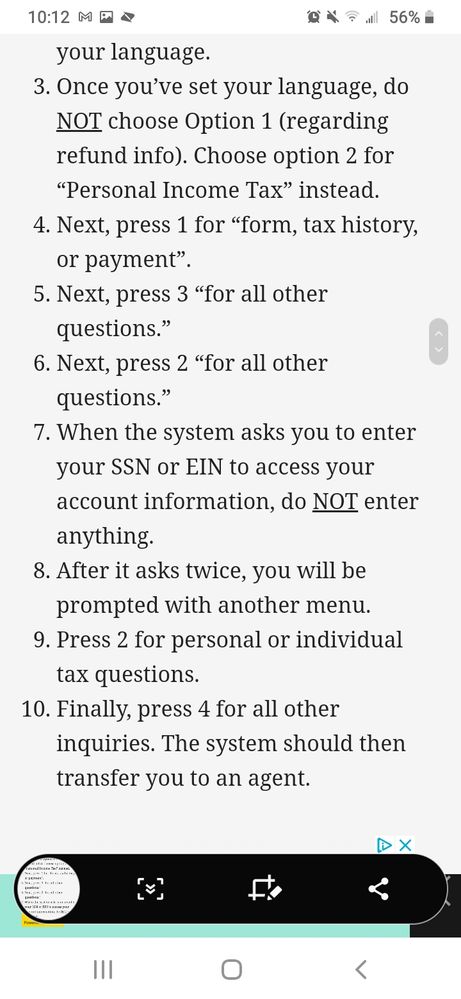

Here is a link to a thread that details how to go through the automated phone prompts to reach a live representative. The steps may save you some frustration. You can also search for a local IRS office in your area. It may be easier to contact a local representative than using the main phone number. You can use the ''make an appointment'' option even if you have no intention of going to the office, but that may get you a live person on the phone that can provide you some info. They have access to the same information and the appointment lines are usually non-automated (you will get a real person). @Player25

-------------------------------------------------------- If you are unable to find help there, Taxpayer Advocate Services may be able to help.

The Taxpayer Advocate Service (TAS) is aware that taxpayers are experiencing more refund delays this year than usual. Typically, the IRS processes electronic returns and pays refunds within 21 days of receipt. However, the high volume of 2020 tax returns being filed daily, backlog of unprocessed 2019 paper tax returns, IRS resource issues, and technology problems are causing delays. This is due, in part, to the IRS’s need to manually verify large numbers of Refund Recovery Credits (RRCs), as well as Earned Income Tax Credit (EITC) and Advance Child Tax Credit (ACTC) 2019 adjusted income lookback claims. Once a return is processed by the IRS and loaded on to the IRS systems, TAS may be able to assist with delayed refunds if you meet our case criteria. Please review our case criteria tool to determine if TAS may be able to assist. @CandiceS

The TurboTax payment fee is for using the software for tax preparation and tax return filing, we do not ''process'' tax returns or issue refunds. The IRS issues refunds, not TurboTax. This means that we can't say for sure why you haven’t received your refund if it's been longer than 21 days since you e-filed. You'll have to speak directly to IRS to find out more about the delay.

What makes refunds late? @Madashell6

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

You can call Turbotax and they can give you a 3week extension for the payment. Also call the IRS as I had posted on some postings and find out what the hold back is. I did and if I wouldn't done it I would be waiting. Filed my taxes on Feb 16th, 2021 and since this Monday after the call to the IRS I got it taken care off! First and last time I used this site! Call first thing at 7AM. Search how to speak to an agent there are instructions how to get around the system it works. Have it posted on some of my answers. Good luck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

I personal called the IRS and yes it does help and speeds up things! Filed 16 Feb 2021, waited long enough on no help from this site!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

The IRS issues refunds, not TurboTax. This means that we can't say for sure why you haven’t received your refund if it's been longer than 21 days since you e-filed. You'll have to speak directly to IRS to find out more about the delay.

Here is a link to a thread that details how to go through the automated phone prompts to reach a live representative. The steps may save you some frustration. You can also search for a local IRS office in your area. It may be easier to contact a local representative than using the main phone number. You can use the ''make an appointment'' option even if you have no intention of going to the office, but that may get you a live person on the phone that can provide you some info. They have access to the same information. @8674113

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

Yes I did all that that u sad to do they didn't transfer me to alive agent it just told mew to call back or next business day

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

but intuit is still gonna yank their money, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

When you choose to pay your TurboTax fees from your Federal refund & there is a delay in the processing of your return/refund, then per the Refund Processing Agreement, TurboTax can deduct the fees from your bank account.

Why was my bank account auto-debited for TurboTax fees?

https://ttlc.intuit.com/community/charges-and-fees/help/why-was-my-bank-account-auto-debited-for-

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

yeah, no doubt.

Imma think I'll quit using turbo

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

I've been waiting for months with TurboTax promising that my return would be adjusted for unemployment automatically. It wasn't. The amount deposited was the amount I should have gotten months ago, and no adjustment has been made for my unemployment. My refund was literally half. I should have amended my return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

If this is related to the Unemployment Exclusion-

...there is no need to file an amended return (Form 1040-X) to figure the amount of unemployment compensation to exclude. The IRS will refigure your taxes using the excluded unemployment compensation amount and adjust your account accordingly. The IRS will send any refund amount directly to you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

When? When are they going to send the money they've owed me for months? I've waited for so long, being told by TurboTax that my return would be amended and it wasn't. Words cannot express how frustrated I am. You're literally expecting people to sit on their hands and not call the IRS and not chase after their money in these hard times? These automatic copy paste responses are disrespectful to the people that have been waiting for months. The IRS owes me $1,500 and you must be insane if you think I'm not going to hassle them about it. If I owe the IRS that money you better bet I would be getting harassed daily. NO MORE EXCUSES. NO MORE WAITING.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

Just to be sure I am crystal clear, my return was not adjusted. I did receive unemployment income, and I did file my taxes before the federal law was passed. My return was not adjusted for the difference in taxes paid for unemployment insurance. My refund should have been over $2,000 and they sent me $700. Now can I am in my return? Are they sending out multiple deposits for single returns?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

Did you read the link I included? This will tell you exactly what the IRS is doing with returns that have unemployment. Your original return was not and will not be adjusted. The adjustment is done separately by the IRS. The IRS has said not to amend that THEY will do the adjustments and will send the additional refund based on unemployment beginning in mid-May.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

Did you read my response? They sent me a refund but it's the wrong amount. So now what? Wait longer? What's the point of sending the wrong refund and then having to send something else again later?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s my federal refund?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

championkeith2012

New Member

HollyP

Employee Tax Expert

HollyP

Employee Tax Expert

soliveira125

New Member

dnotestone

Level 2