- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Where can I find the 8915 F form on the TurboTax app?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

Where did you see that information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

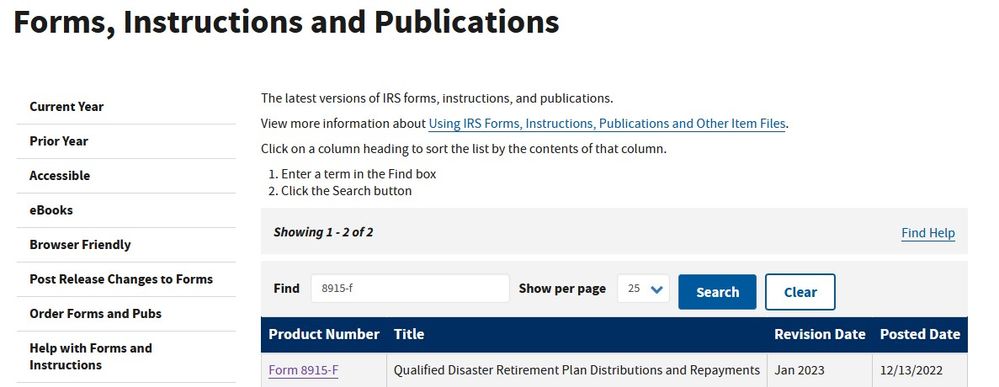

March 9, 2023 See here

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

It was released today.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

Yes. Form 8915-F is available on Mar. 9. See Federal Individual Form Availability.

Form 8915 is used to report a disaster-related retirement distribution, and any repayments of those funds. For tax years 2021 and 2022, Form 8915-F will replace Form 8915-E, which was the form used to report 2020 COVID-related qualified disaster distributions.

Learn more at How do I use Form 8915 to report my 2020 COVID-related retirement distributions?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

Did you even take the time to verify the form is available before you posted? Today is March 9th and the form is still not available.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

Of course I did, I don't state facts without checking them first. I suggest you reinstall TurboTax since it's not working properly for you. I filed this evening with the 8915-F.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

Actually the news is not so good. My Federal return was rejected because of an error in the 8915F data. In more than 25 years of filing I've never had a return rejected.

The code is

/Return/ReturnData/IRS8915F/FEMADisasterDeclarationNum - Data in the return is missing or invalid. Please double check your entries.

Isn't the return review supposed to check that this won't happen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

How long it took to find out it’s rejected? What happens if it is rejected, can you refile with Efile?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

I found out about 8 hours later and you can try to refile but given that this return went through a review both my me and my TurboTax I am not sure that it's ready to be refiled. It struck me thay maybe Intuit knows about this issue and pulled the form which would explain why some people are not able to see it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

More on this issue - and we should not have to be dealing with this - it should have been taken care of automatically by TurboTax. I will try to fix it and report back.

Review information that appears in Form 8915-F...

If there is a FEMA number listed on line C it must be a valid federally declared disaster number, and it must be formatted as XX-NNNN-ST where XX is either DR or EM, NNNN is a four digit number and ST is a valid state abbreviation

If box D is checked no FEMA number should be listed on line C

If corrections are needed do not attempt to make them on the 8915-F. Go to the 8915-E worksheet and make the changes in the smart worksheet at the top of the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

OK I figured it out.

TurboTax is entering "Coronavirus" in box C of 8915-F but since box D needs to be checked, box C should be blank. So the answer is to delete "Coronavirus" from the 8915-E worksheet.

I made this change and my return was accepted by the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

How did you make any changes to the 8915F? The system prefilled it in and listed the FEMA disaster code in the incorrect format and even checked the wrong year box for the year the disaster began. How can you make these changes digitally so youre able to refile electronically?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

You go to the 8915-E worksheet in "form" mode, delete the word "Coronavirus", exit form mode and refile.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where can I find the 8915 F form on the TurboTax app?

There is a workaround concerning checking the box If this was a Coronavirus-related distribution reported in 2020, check here at the screen Did you take a 2020 Qualified Disaster Distribution?

Please see @DataB27's explanation here.

Please follow these steps to fix the rejection issue:

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Uncheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and click continue

- On the "Which disaster affected you in 2020?" screen I selected the blank entry and click "back"

- Then recheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and continue.

Another option is to delete "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and then go back to the retirement section and reenter the information:

- Open or continue your return in TurboTax.

- In the left menu, select "Tax Tools" and then "Tools".

- In the pop-up window Tool Center, select "Delete a form".

- Select "Delete" next to "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and follow the instructions.

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and enter your information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rawalls18

New Member

william-b-clay

New Member

johntheretiree

Level 2

Hedavis1973

New Member

CWP2023

Level 1