- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Unemployment relief

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment relief

I looked for an answer and get confused. I recently, 15 minutes ago, read an article stating that if you made 10,200 or less on unemployment you get the relief.

Does that mean if you made over that you do not?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment relief

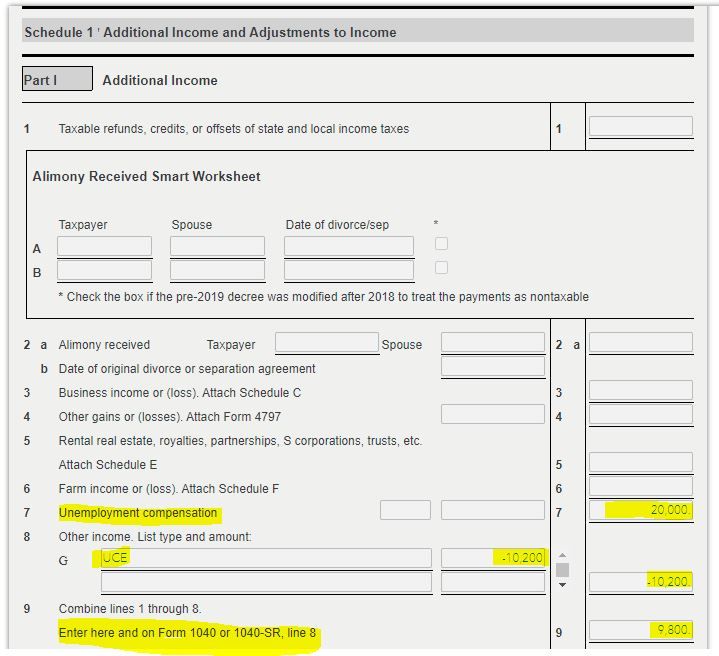

It means the first $10,200 is excluded from your income on the tax return. Any remaining UC is included on your tax return Form 1040 on Line 8

The exclusion is reported on Schedule 1 Line 8 as a negative number. The unemployment compensation received is on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment relief

I already filed my taxes. That's why I'm so confused lol

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment relief

When did you file? If you already filed and didn't get the 10,200 unemployment exclusion you do not need to amend. The IRS will be adjusting it for you. See new article May 14, 2021

Prior March 31, 2021 Info

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment relief

My returns were accepted mid Feb. I think I was just confused by the verbiage on that one article. I knew $10,200 was the magic number but the article I read today made it seem like if you made over that, you wouldn't qualify at all.

I just don't want to be worrying about or expecting something that I'm not entitled to.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sarahdawnallen712

New Member

chelseyjjimenez

New Member

Liseuses

Level 1

wkassin

Level 3

purloinedcow

New Member