- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Status still Pending

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

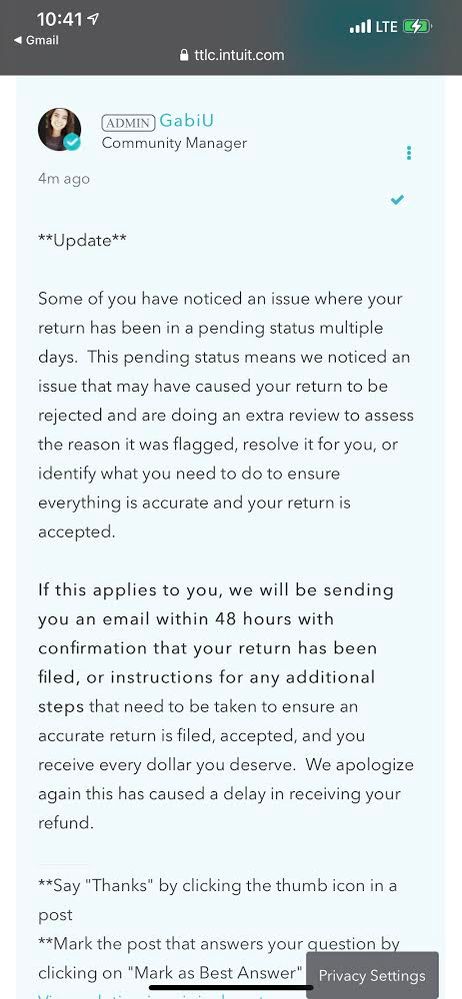

So what was the point of this post (shown in attached screenshot) ? No one received an email. And none of us received any further follow up. We all sat patiently until the deadline passed us only to see that no further communication from any specialist or TT support was to come. How is it that tax specialists can give information such as that in the screenshot if you guys truly don’t know what’s going on or how to fix things? What’s the latest status for us all stuck in pending? Plenty of people have filed with earned income or additional child credit etc with other tax services and were approved same day. I’m still pending ten days later. There has to be an explanation to this considering the IRS continues to say they do NOT have my return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

THERE’S SOME PEOPLE WHO HAVENT RECEIVED THEIR 2019 taxes!!!!!! sooooo basically wait! I mean **bleep** the irs just opened ,y’all acting like we aren’t in a crisis, I’m sure their working as fast as possible.It’s not even March yet and people complaining.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

@CeeRam

If this does not affect you then why even jump on this thread?

We are early filers.. not procrastinators or people trying to avoid filing or even filing at the last minute and hoping for a miracle. We literally tried to do the right thing and are being held up endlessly. 11 days in holding is unacceptable. It’s literally their one job: handle tax returns. They’ve known since last March that this day was coming.

Pretty rich of you to assume that all of us have not been thru that same crisis and for that very reason need our returns handled properly and refunds issued ASAP. Maybe slow down a bit until you can visualize the bigger picture. I speak for no one but myself but I feel certain you have no idea what the h*** I’ve been thru during this last year. Nor do I give a right s*** about your opinion. This is literally a forum about pending returns. If it doesn’t fit your circumstances then maybe you should step off and find a forum that does.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

Please explain me what you have to do or change before you did re-e-filing. Mine also got rejected same reason ie Form 1116/Foreign Tax Credit. I checked everything appeared correct, there is no showing red flag, and I am not sure what else I can do before re-e-filing. Please help me if you can. Thanks.

I want to request TT community also if they have any suggestions before re-e-filing Tax return rejected because of Foreign Tax Credit/Form 1116. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

My software glitch error was related to employee stock options, however I didn't have to do anything other than refile. The only thing I would do is make sure the TT software is up to date then refile. I was accepted within 30 min after I refiled and did nothing but select e-file to refile. Hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

Just re-enter the data and re-file. Nothing new

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

The issue has nothing to do with the IRS processing the tax return. The issue appears to be a software glitch of various kinds (employee stock options and Form 1116 - foreign taxes are two that I have seen mentioned) with TT software that are causing the IRS servers to keep them in pending status for days which is an unusual situation for those of us who like me in 20 years of e-filing have never had my return rejected much less in pending status for more than a few hours. The IRS has previously opened as late as the first week of February for processing returns and my return which was filed 2 weeks early was accepted on the same day.

You either don't understand or are completely mischaracterizing the issue here. Please be considerate of others when responding. Your response was not helpful to those who are wondering after over a week of the IRS accepting returns why theirs is still in limbo with few answers from Turbo Tax or the IRS. All they have to assist them are those of us who finally were able to get our returns rejected and refiled as I did mine after waiting 5 days with no answers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

As others are saying, it is a simple case of re-entering the data (should be already saved) on the areas where you are rejected. This points to errors in TurboTax that we have to fix with updated software. Then re-file. It is painless except the unknown wait for why is my return in "pending purgatory"? Once rejected, I fixed and resubmitted in 10 min and then got everything accepted within a day.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

Thanks a million. I just reentered everything, really nothing new, and resubmitted. Within 33 minutes I got an email informing that Federal Tax Return has been accepted by IRS.

Now I am waiting State to do the same thing as State had not accepted before because federal was not accepted, in spite everything was fine. Foreign Tax Credit does not apply to State anyway.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

@Taxlax Had you received a rejection notice or did you just go back and re-enter because you were stuck in pending?

**ignore this. I now see your previous comments explaining your situation better.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

My and MY Son's return are being held up for a K-1 form that we do not need.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

The pending status is now almost a month old. I need to file my and my son's returns now.

We do not need a K-1 Form. We filed schedule C forms to report the income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

You need the reject to be able to re-e-file. So if you are stuck in pending purgatory waiting for an accept or reject longer than 48 hours, contact Office of the President at Intuit. They have email addresses at their site and should be able to help you get unstuck. It appears TurboTax is slowly processing the pending backlog

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

I did get rejection email first. Then I refiled.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

So I filed with another company and the IRS accepted my returns immediately. TurboTax can enjoy my rejected returns. No one has time to play with them. I was told by a TurboTax representative that these returns that have been pending days have to go through a internal security check by TurboTax. They had no clue how long this process was going to take. So In short, My returns were NEVER transmitted to the IRS. Such liers

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

danielquinnell

New Member

john-oshaughnessy22

New Member

winegolfer

New Member

misty7798l

New Member

gjazze

New Member