- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Refund advance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

I was approved for a refund advance in the amount of $250 when I filed. I filled out the info for the card. I received a email today saying my taxes were accepted from turbo tax. But green dot sent a email saying advance was denied but my card is on the way?how do I check to see if I was approved or not?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

The email you got told you ... the ADVANCE was denied however the refund will still be put to the Debit Card once the IRS releases it.

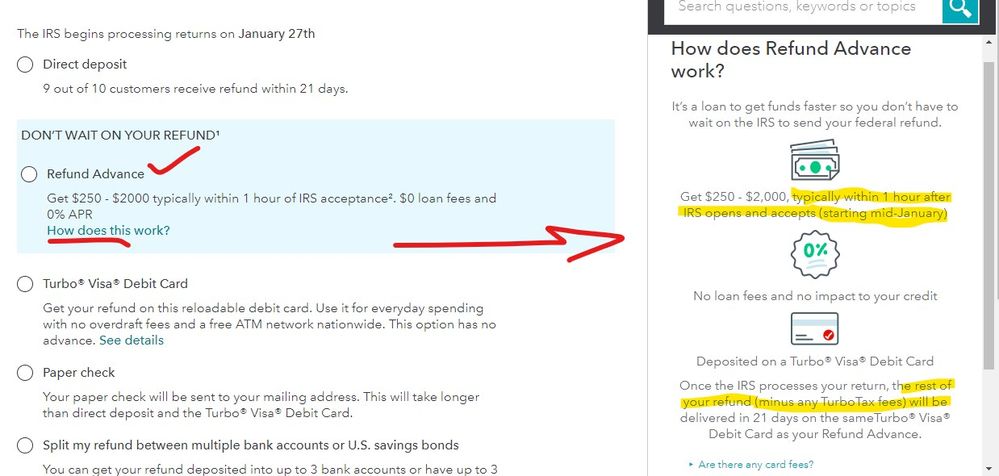

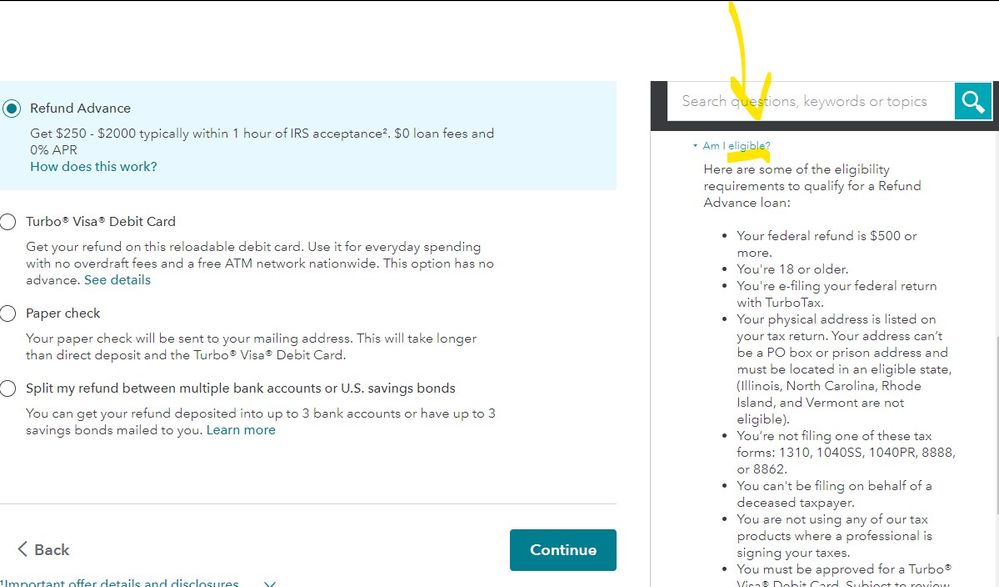

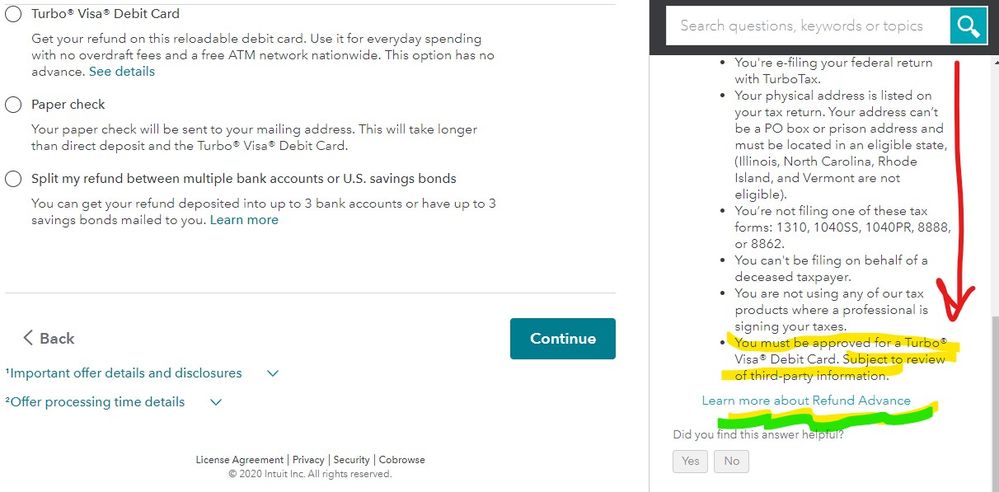

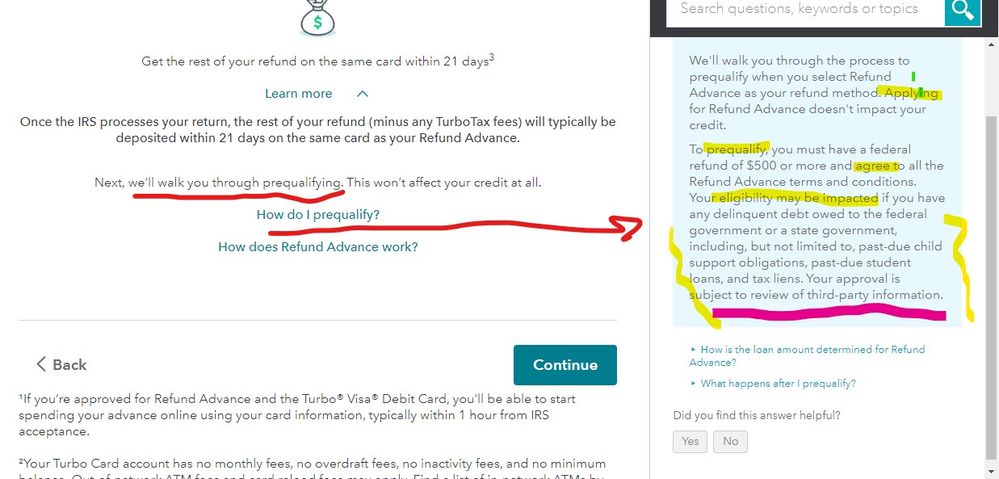

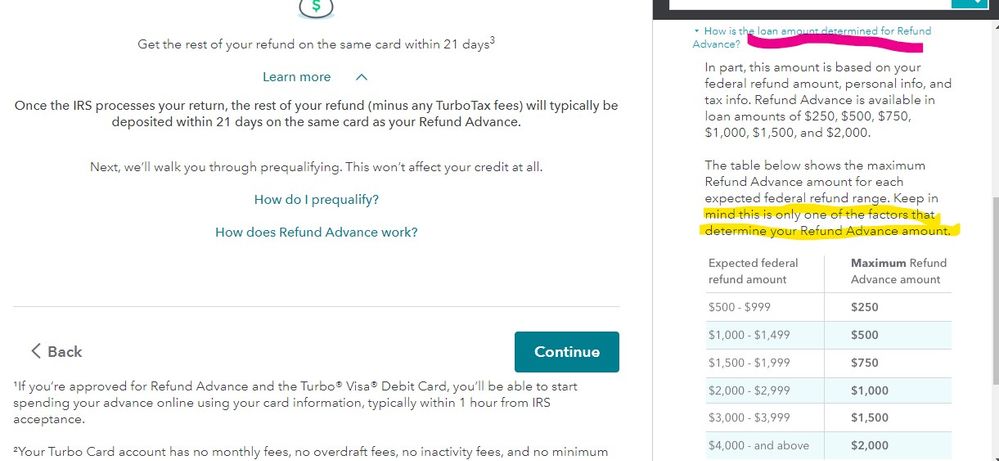

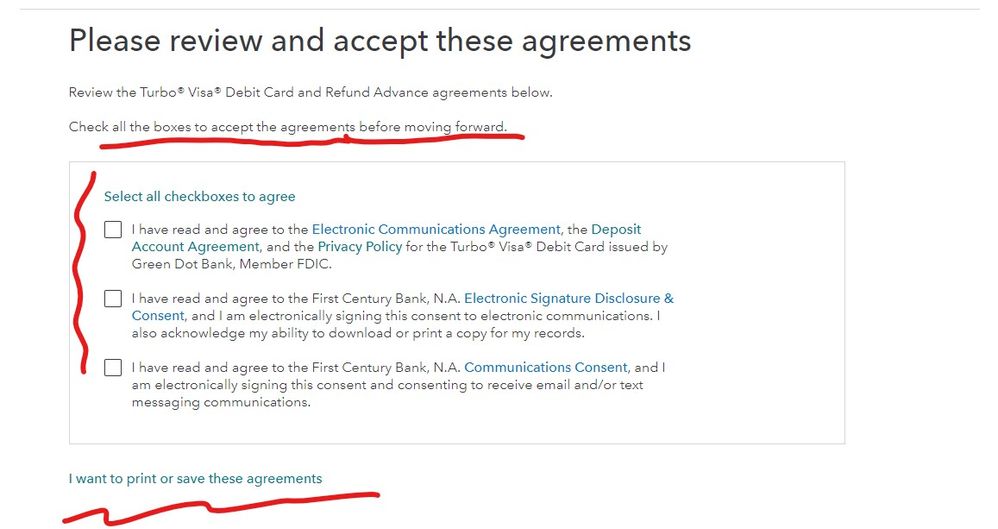

After you file AND once the IRS has accepted your return for processing your APPLICATION FOR A LOAN must also be approved by the processing bank AND the debit card company. If you do not get approved all the way down the line the advance will not happen ... this info was explained in the disclosure forms you HAD to click on AND agree to in order to continue to file. Watch your email for any notifications of approval or denial.

▾ What happens after I prequalify?

Once you prequalify, you'll still need to file your taxes to submit your application for Refund Advance and Turbo® Visa® Debit Card.

Final approval for Refund Advance is subject to the following:

- The IRS accepts your return before 12am PST on February 7, 2020.

- You have no outstanding delinquent government debt or tax offset, including, but not limited to, past-due child support obligations, past-due student loans, tax liens, and any other payments owed to a federal or state agency.

- You pass the lender's final evaluation.

- You didn't change any info you entered when you were prequalified.

- Possible review of third-party information.

If you change any info after prequalifying, you'll have to reapply for Refund Advance.

After you file your taxes, we’ll email you within 1 hour of IRS acceptance to let you know if you've been approved for Refund Advance.

This offer is available until February 7, 2020, or until available funds have been exhausted, whichever comes first. Availability subject to change without further notice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

my federal return was accepted today at 4:30 pm by the IRS. I have not received an email stating approved nor denied for the cash advance. Is there a way for me to check the status of the application?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

Check your spam folder.

I can’t access my Refund Advance temporary card

You should receive an email with instructions on how to create your online account. If you can’t find it, check your junk mail folder. The sender will be turboprepaidcard@email.turboprepaidcard.intuit.com. If you cannot locate it after checking your junk mail folder, or are having trouble creating an account, or logging into your Turbo Prepaid Card online account, call us toll-free at (888) 285-4169.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

I did. I've gotten nothing other than email verification for the debit card. that was yesterday

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

I also received the email to set up my turbo card account but have not gotten an email stating approved or denied.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

Pre qualifying then getting denied is rather irritating. Is it in their terms? Yea. Do I have a need for a "turbo card" if I'm not getting a refund advance? Absolutely not. I would have just had the refund go to my bank account.

They set you up for failure with this. There should be no "pre qualified" talk if they dont actually have you pre qualified

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

You can be prequalified for a home mortgage also but the loan is not guaranteed until the underwriter approves the final paperwork ... this loan is no different in that it must have a final approval. They cover their butts with lots of formal language and the use of precise terms. Anytime you see the word LOAN you need to read and comprehend all the terms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

I'm fully aware of the terms and conditions for the refund advance.

The issue is they do not tell you until AFTER THE IRS accepts your return whether you were approved or denied which makes it hen impossible to go elsewhere that may have approved you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

Did you get a notification that fc was approved?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

Sorry but these are the rules for this kind of loan and you were told all this before you filed ... if you did not want to take the chance then you could have stopped anytime and gone elsewhere.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

I've got the debit card account already open and active so i was approved for that. and I have zero debt I owe to any government agency and zero loans or tax withholdings or anything that would come out of my return.

Yet i was still denied literally as soon as the IRS accepted my return.

I've got no explanation of why it was denied. And nobody knows who I can contact to find out more information. The email just states "although you werent approved for a refund advance"

And it's a no reply email of course

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

Just like any denial for credit a letter of explanation or a separate email will be forthcoming ... make sure to check your spam folder.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

Thank you for that review of the documents we signed and the verbiage provided to us when we took the option of advance. However, from my situation (sounds similar to OP) I recied the email from green dot before my taxes are even accepted. Per your copy of the verbiage it says within 1 hour you'll be notified. So I think OP and myself are trying to figure out if the GreenDot email is our denial or if another email will follow?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

halldestiny2612

New Member

crybaby31031

New Member

luisberrios081

New Member

sjmondo61

New Member

camillecorporal13

New Member