- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Refund advance

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

same thing with me filed jan 21 2022 accepted irs jan 24 2022. keep geting the run around from all 3 compainies, bank says im pre approved they are waiting to here from tt rather or not the irs has accepted my taxes, cal tt they make no since what so ever! they said no your taxes have to approved from irs not accepted i said no mam if that was case then i wouldnt need a advance, then they said i never applied for loan i said i have the 3 pages here saying i applied and it has my signature and date, then the bank says send us a certified letter asking the compliance department to look into the matter i did that and they told me same thing from beginning weve recived your application regarding the loan we havent gotten the accepted from irs part from tt. i emaild tt ceo & ck ceo. because i feel someone should have better information then what im getting ive never in my tax filing life had to deal with this many issues.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

I filed a complaint with the BBB and just received a call from the Presidents office of Intuit. He assured me that they were looking into it and gave me contact information until he reaches out again in a couple days. I will post an update then.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

@Allygogo21 I am having the same problem. IRS accepted my refund on the 24th. I have talked to Turbo Tax, First Century Bank and Credit Karma. TT can't tell me why my application wasn't processed and says I didn't apply for the advance, but in my documents there is the Consent to disclose your information for the refund advance loan and for a checking account with Credit Karma Money. Every "expert" I have talked to just keeps giving me different numbers to call. FCB doesn't have any record of my application & CK tells me that they can't deposit money in my account until they receive a confirmation from FCB. I'm chasing my tail and really worried that none of my refund will get deposited anywhere!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

Just got this response from them and it's been almost two weeks....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

After almost two weeks I just finally got this from them..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

Ok everyone so after almost weeks of trying to figure this out I finally got this response..they are trying to straighten it out

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

I'm glad they at least responded, but in my opinion doesn't mean much. After the whole stimulus fiasco last year, they should have taken the time to make sure everything was ready this year. I'm pretty convinced at this point the whole refund advance was just a ploy to get people to sign up for Credit Karma money. What bothers me is that the whole time before my return was accepted by the IRS I was showing approved for the advance refund and the whole 24 to 48 hr message. As soon soon my status changed to accepted they also changed my refund advance to not approved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

hey everyone! i wanted to share an email address i got from the ceo of tt, i emailed it and explained my issues, lady called me from 1800# within an hour of sending it! she said she will be getting to bottom of it and hopefully have an answer end of day. i suggest you all email and see if they can also help!

In the meantime, you may reach us sooner by emailing us at [email address removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

Thank you ! I’m emailing as well

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

same exact thing happend to me! im past the refund advance stage now i just want to make sure when they deposit my actual refund i do not have the same issues. i put a email in the comments below that you can use if you wanted to figure out what was going on

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

@Bbcawdrey I really hope they have a resolution and not just saying it. I sent my email !

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

I sent an email, and just got off the phone with an intuit case manager from the presidents office. I informed him of everything going on and he said there are two separate issues happening currently.

1) Customers are being put into a loop after selecting the refund advance option and it is kicking it back and forth between Credit Karma the bank and TT. He doesn't know what yhe problem is just yet,, but he says they have techs working on it.

2) Lots of people, myself included are being approved when filing and then once the return is accepted by the IRS the bank essentially changes their mind after digging a little deeper. I think this is unacceptable, but he eas very courteous and said he would look into this. I informed him I was approved the whole time until right after my refund was accepted. We will see what happens. He is in contact with the bank who is suppose do be reaching out to those of us with this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

At this rate we’ll get our returns from the IRS before TurboTax gets their stuff together. At this point it’s too little too late. They knew 24 hours after the IRS opened that they were having a problem. They gave us the run around and told us to call everyone but Jesus. Then, when they’re threatened with customers calling lawyers and BBB claims NOW they want to get the company big wigs involved. I’ve been a faithful TurboTax customer for 10 years…. Never again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

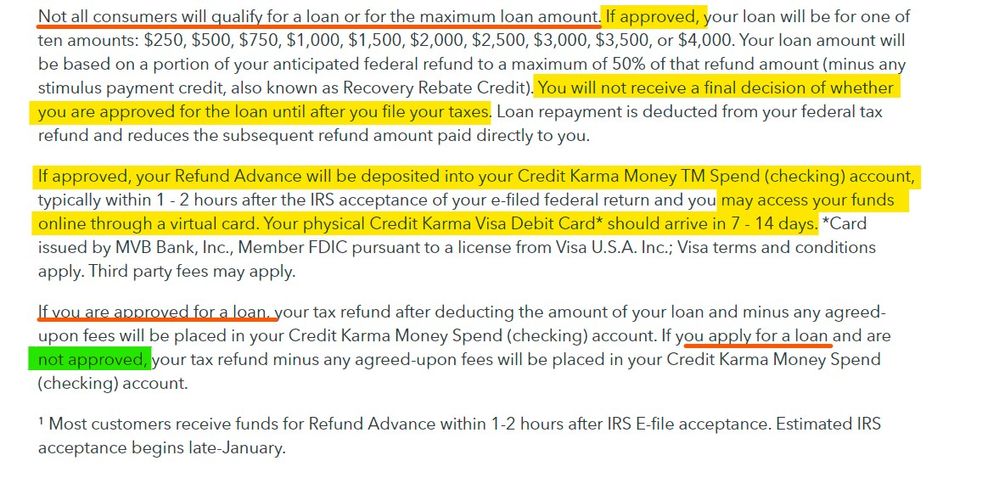

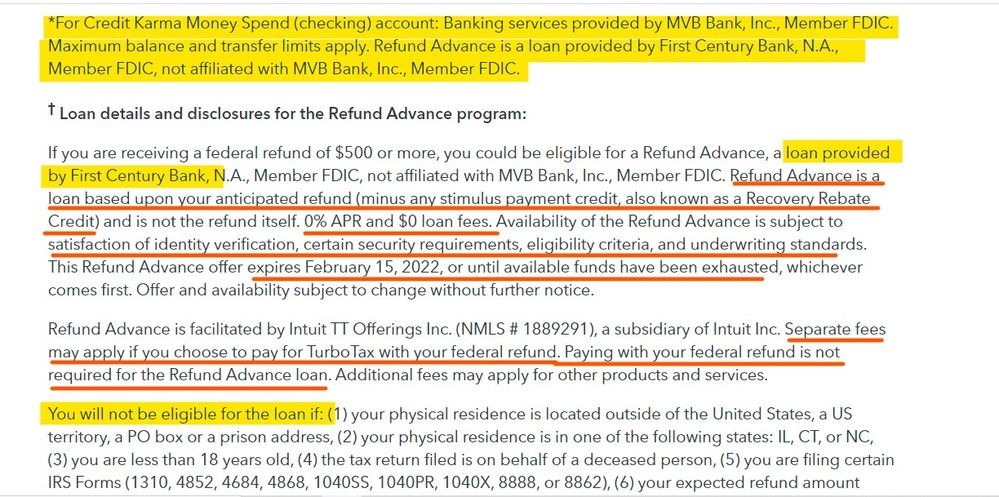

If you read the fine print of the agreement you signed (see below) ... the bank doesn't have to make the loan even if you are pre approved in the program. Final approval only happens once you file and the IRS accepts the return for processing. Only then is the application sent to the bank and they can use any means they choose to determine if you are a good risk.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund advance

Well obviously 🙄 they have the right to approve or deny majority of us talking about tt dropping the ball after the acceptance of the irs tt never sent the bank the acceptance from the irs

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jaktax

New Member

fabianalonso192

New Member

thumble1985

New Member

powellrobles

Level 2

powellrobles

Level 2