- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Received 2020 CA state refund but not 2020 federal refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 2020 CA state refund but not 2020 federal refund

Mailed my 2020 returns around April 2021 using certified mail.

Received my CA state tax refund in May 2021.

It is July and still have not received state tax.

I checked the "where's my refund" website and entered my SSN, filing status, and refund amount and it could not find anything. What can I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 2020 CA state refund but not 2020 federal refund

You wrote:

Received my CA state tax refund in May 2021.

It is July and still have not received state tax.

Do you really mean that you have not received your federal refund? Did you mail the federal and state returns in two separate envelops to separate addresses?

There are a LOT of delays for federal refunds---it can take months for the IRS to process a mailed return.

MAILED RETURNS

Per the IRS:

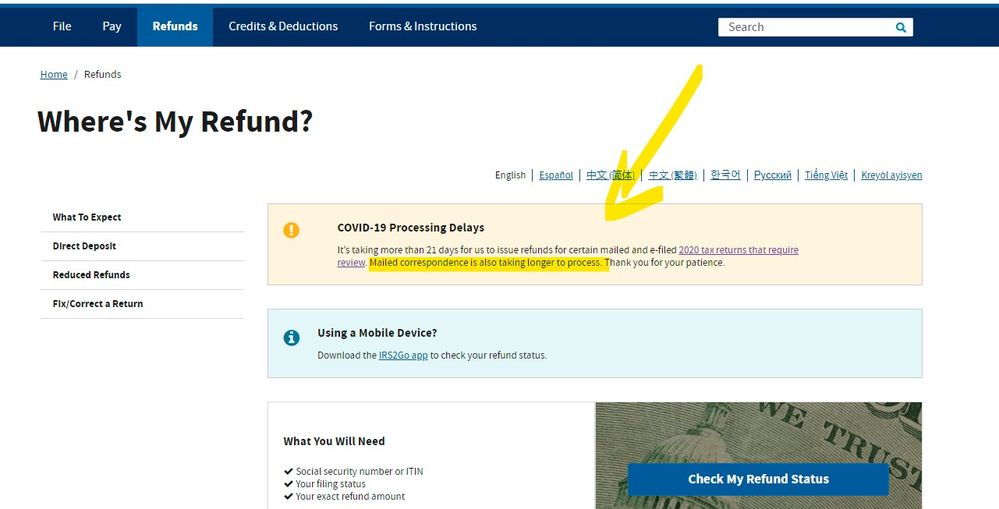

COVID-19 Mail Processing Delays

It’s taking us longer to process mailed documents including:

- Paper tax returns, and

- All tax return related correspondence.

We are processing all mail in the order we received it.

Do not file a second tax return or call the IRS.

It can take 3-4 weeks (or a LOT longer since the IRS is severely backlogged) for anything to show up on the IRS site when you mail a tax return. Expect at least 6-8 weeks for complete processing of a mailed return and probably MUCH MUCH longer.

If you mail a tax return (or a payment) to the IRS, it is a good idea to use a mailing service that will track it like UPS or certified mail so you will know it was received.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s.

TurboTax will not know anything about your mailed return, and will continue to show “Ready to Mail” on your account. TurboTax will not know that you put your tax return in an envelope and took it to a mailbox. TurboTax does not get updates on mailed (or e-filed) returns.

When the IRS opens its mail and begins to process mailed returns you can check the status on the IRS site. https://www.irs.gov/refunds

State returns have to be mailed to the state.

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

If you are wondering if you should send your return again——the IRS does not want you to file a second time. Putting two tax returns into the system at the same time can lead to confusion and even more delays. If you did not use tracking and do not know if the return was received—-you have to make your own judgement call and decide if you want to risk further delay by sending the return again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 2020 CA state refund but not 2020 federal refund

@xmasbaby0 yes I meant I did not received my federal refund yet but I received my CA refund in May 2021. I mailed the state return and the federal return separately. I remember mailing both around April 2021 timeframe. The state refund came in on May which was in a month or so, which is pretty fast but it’s 3 months since I’ve mailed the federal and nothing. The where is my refund website cannot find my federal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 2020 CA state refund but not 2020 federal refund

As already mentioned mailed in returns are taking much longer and until your return gets opened and entered into the system you will not see it on the IRS WMR? tool ... check back once a week until you see progress.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 2020 CA state refund but not 2020 federal refund

@Critter-3 How does that explain the state tax that was mailed in around April and I have received the refund in a month?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 2020 CA state refund but not 2020 federal refund

Fed & state returns are processed by totally separate taxing authorities and CA did it faster and they have millions of returns less to deal with. The feds this year have a lot more human reviews they have had to deal with which is putting them behind as they are still short staffed.

Go to this IRS website for operational status - https://www.irs.gov/newsroom/irs-operations-during-covid-19-mission-critical-functions-continue

As of June 23, 2021, we had 17.5 million unprocessed individual returns in the pipeline. Unprocessed returns include tax year 2020 returns such as those requiring correction to the Recovery Rebate Credit amount or validation of 2019 income used to figure the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC). This work does not require us to correspond with taxpayers but does require special handling by an IRS employee so, in these instances, it is taking the IRS more than 21 days to issue any related refund. If, as a result, a correction is made to any RRC, EITC or ACTC claimed on the return, the IRS will send taxpayers an explanation. Taxpayers are encouraged to continue to check Where’s My Refund? for their personalized refund status and can review Tax Season Refund Frequently Asked Questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 2020 CA state refund but not 2020 federal refund

@Critter-3 I also mailed in amended tax returns around April. I have not received either refunds for both state and federal. I got the state refund for 2020 but not the amended state for previous years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 2020 CA state refund but not 2020 federal refund

Ok... here is how it is ... no amended return can be processed until the original return has been processed and amended returns require a human to process it and if you have not heard the IRS is once again short on personnel so amended returns can take 6 months or more to process so all you can do is be patient.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 2020 CA state refund but not 2020 federal refund

@Critter-3 The 2018 and 2019 ORIGINAL return has already been filed and processed. I physically mailed the Amended returns for 2018 and 2019 in April 2021. I haven't received anything back yet. NORMAL?

I also physically mailed the 2020 federal and 2020 CA state returns in April 2021. I got the CA state return in May 2021, literally one month after I sent it in the mail. I have not received the federal return. It's 3 months but I get that federal is BEHIND.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bglass09

New Member

evalim4819

New Member

xavierterry692

New Member

gogwins

New Member

SCswede

Level 3