- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: prepaid federal tax is not computing on amended return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

prepaid federal tax is not computing on amended return

I neglected to include a 1099-INT on my 2023 tax return filing. The additional Fed & State tax I owe is $649 & $108 respectively. To meet the 4/15 deadline to avoid any penalties/interest, I paid IRS and State $700 & $120. After entering the 1099 info, I then entered in the 'Payments with Extension' section under 'Other Income Taxes' under 'Deduction & Credits', the amount of $700 in the 'Payment with 2023 federal extension' data field and the $120 in the 'Payment with 2023 state extension' data field. The State calculates correctly a refund of $12, however the Federal Tax is still showing tax due of $649. The Federal Tax I believe should show a refund of $700 - $649 = $51. Am I missing an entry somewhere?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

prepaid federal tax is not computing on amended return

Yes, it appears you did everything correctly. Here is a suggestion that may work.

- Delete your 4868 and the federal extension amount.

- Close out your program and then open it again

- Enter your 2023 extension payment again and then your 4868 and see if this makes a difference.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

prepaid federal tax is not computing on amended return

Thanks for the quick reply

I don't see the form 4868 in the sidebar of Fed forms. I can however, open it with Open Forms. Once displayed, not sure how to delete it since it still doesn't show up in sidebar.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

prepaid federal tax is not computing on amended return

I did locate how to remove the 4868. Following your instructions, I still get same results.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

prepaid federal tax is not computing on amended return

Hit Delete Form at the bottom of the page to remove the 4868. Check the 1040X - Refund or Amount you owe section (lines 18-23). The 1040X should only show the changes, the payment you made with the extension should be on Line 16 - it would not have been included on your original return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

prepaid federal tax is not computing on amended return

I'm using Desktop version and Menu "Forms" --> "Remove ..." is what I used to delete the form.

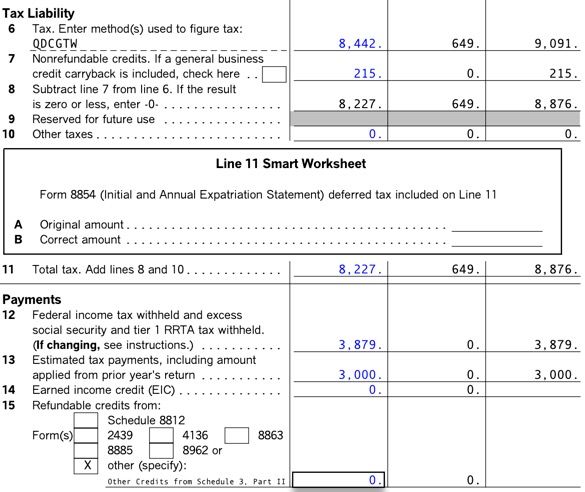

Here's a portion of my 1040X with the $700 entered for the paid 2023 extension.

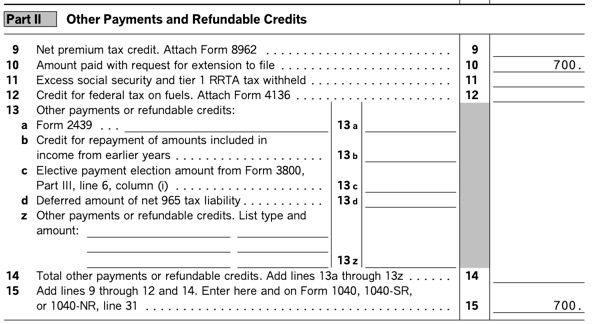

The $700 does not show up. However, here is Schedule 3 Part II which DOES show it:

Shouldn't Sch 3 line 15 be entered on 1040X line 15?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

prepaid federal tax is not computing on amended return

Yes, you can fix this issue by entering the amount paid with extension directly on the Original 2023 Returns Payments Smart Worksheet in Form mode. Here's how to do that:

- Open your TurboTax software and your return.

- Select the Forms icon toward the upper right corner.

- Highlight Form 1040X in the list on the left.

- You'll find the Original 2023 Returns Payments Smart Worksheet between box 15 and 16. Enter your extension payment on line A.

- The amount will be added to your line 16 amount.

This manual entry in Forms mode doesn't cause an override because it is on a smart worksheet, so there aren't any calculation issues with this entry.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

prepaid federal tax is not computing on amended return

Thank you. This works!

Since I paid the additional tax online after I submitted my original 2023 return, would option C "Additional tax paid after return was filed" be the better option to enter the $700 versus option A?

I am assuming option C is referring to the initial/original return and not the amended return, true?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

prepaid federal tax is not computing on amended return

Yes, if you paid it after you filed your return, then you would list it as C. Additional tax paid after return was filed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

darylwalker1

Level 3

blueworm9

New Member

deanfeiock

New Member

janetgates

New Member

Sunray

New Member