- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Over at irs.gov to file for an OPP & it has a drop-down so I can select which form I filed. 1...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

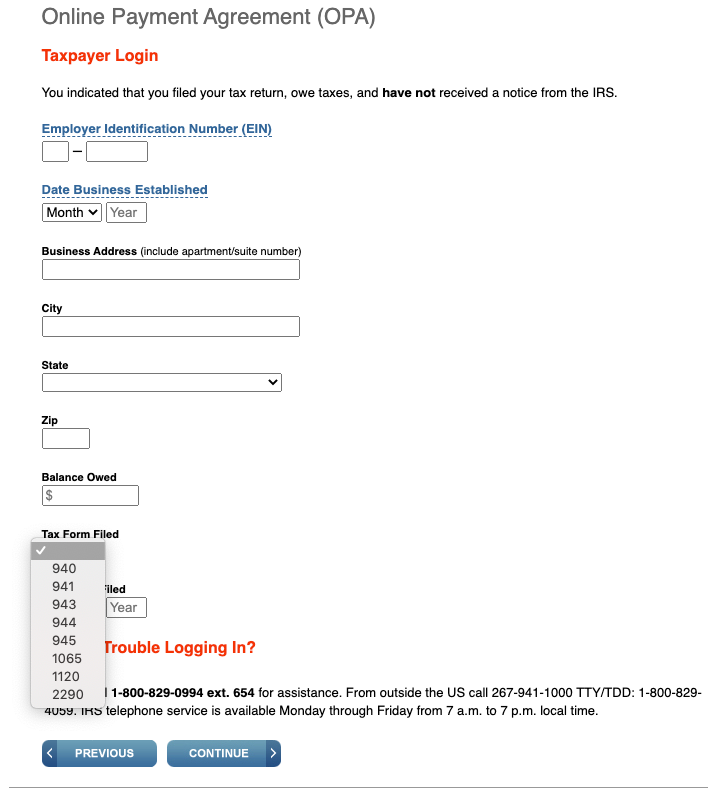

Over at irs.gov to file for an OPP & it has a drop-down so I can select which form I filed. 1040 is not there... these are the options. 940 941 9xx xxx xxx xxxx 1120 2290

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Over at irs.gov to file for an OPP & it has a drop-down so I can select which form I filed. 1040 is not there... these are the options. 940 941 9xx xxx xxx xxxx 1120 2290

Sorry, I did not realize that you were looking for a payment plan.

As I said, if you filed your business using Schedule C on a 1040, then you would apply under "Individual Payment Plan".

This is because your "business" is part of an individual return and not a separate business return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Over at irs.gov to file for an OPP & it has a drop-down so I can select which form I filed. 1040 is not there... these are the options. 940 941 9xx xxx xxx xxxx 1120 2290

What is an OPP? What are you trying to do?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Over at irs.gov to file for an OPP & it has a drop-down so I can select which form I filed. 1040 is not there... these are the options. 940 941 9xx xxx xxx xxxx 1120 2290

Online payment program. Trying to set up my account. It asked which form I filed, but 1040 is not listed in the dropdown menu. Could it be that even though I own a small business (llc) that I need to do the OPP as an individual instead of a business? Just didn't know which option to choose and it won't let me move beyond that screen without it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Over at irs.gov to file for an OPP & it has a drop-down so I can select which form I filed. 1040 is not there... these are the options. 940 941 9xx xxx xxx xxxx 1120 2290

Thanks.

Is this LLC a single member LLC that you filed using Schedule C on the 1040? Then this is OK to pay as for a 1040.

Go to Payments.

If you choose Bank Account (Direct Pay), then you can choose Make a Payment.

On the next screen the Reason for Payment is Tax Return or Notice or Extension (whichever), the Apply Payment to is 1040, 1040A, 1040EZ, and the Tax Period for Payment is 2019...assuming that meshes with what you want to do.

I assume that if you choose the Credit Card step several screens back, you will see a similar dialogue.

Does that work for you?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Over at irs.gov to file for an OPP & it has a drop-down so I can select which form I filed. 1040 is not there... these are the options. 940 941 9xx xxx xxx xxxx 1120 2290

This doesn't seem like it's a payment plan... just to make random payments. I am looking to pay back over time. Yes, single member LLC. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Over at irs.gov to file for an OPP & it has a drop-down so I can select which form I filed. 1040 is not there... these are the options. 940 941 9xx xxx xxx xxxx 1120 2290

This is where I was... https://www.irs.gov/payments/online-payment-agreement-application

I was trying to do it as a business... but now I am thinking I have to do it as an individual since 1040 was not an option on the drop down menu.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Over at irs.gov to file for an OPP & it has a drop-down so I can select which form I filed. 1040 is not there... these are the options. 940 941 9xx xxx xxx xxxx 1120 2290

Sorry, I did not realize that you were looking for a payment plan.

As I said, if you filed your business using Schedule C on a 1040, then you would apply under "Individual Payment Plan".

This is because your "business" is part of an individual return and not a separate business return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Over at irs.gov to file for an OPP & it has a drop-down so I can select which form I filed. 1040 is not there... these are the options. 940 941 9xx xxx xxx xxxx 1120 2290

thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Over at irs.gov to file for an OPP & it has a drop-down so I can select which form I filed. 1040 is not there... these are the options. 940 941 9xx xxx xxx xxxx 1120 2290

You are most welcome. Good luck with it!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Over at irs.gov to file for an OPP & it has a drop-down so I can select which form I filed. 1040 is not there... these are the options. 940 941 9xx xxx xxx xxxx 1120 2290

This is exactly the answer to my question. Now I don’t have to wait on hold for over an hour. Thank you so much!!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Rockpowwer

Level 4

SueWilkinson2

Returning Member

temoniaellie36

New Member

nadya0227

New Member

Danielle454

New Member