- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Never received notice about deferring SS taxes. in 2020. Now am being contacted by IRS for payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Never received notice about deferring SS taxes. in 2020. Now am being contacted by IRS for payment.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Never received notice about deferring SS taxes. in 2020. Now am being contacted by IRS for payment.

look at schedule 3 line 12e. 1/2 is due by 12/31/2021

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Never received notice about deferring SS taxes. in 2020. Now am being contacted by IRS for payment.

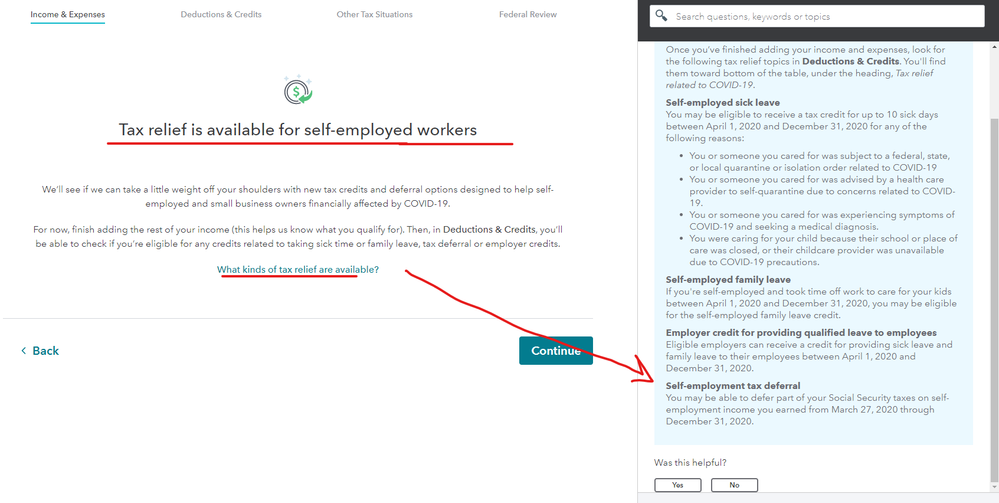

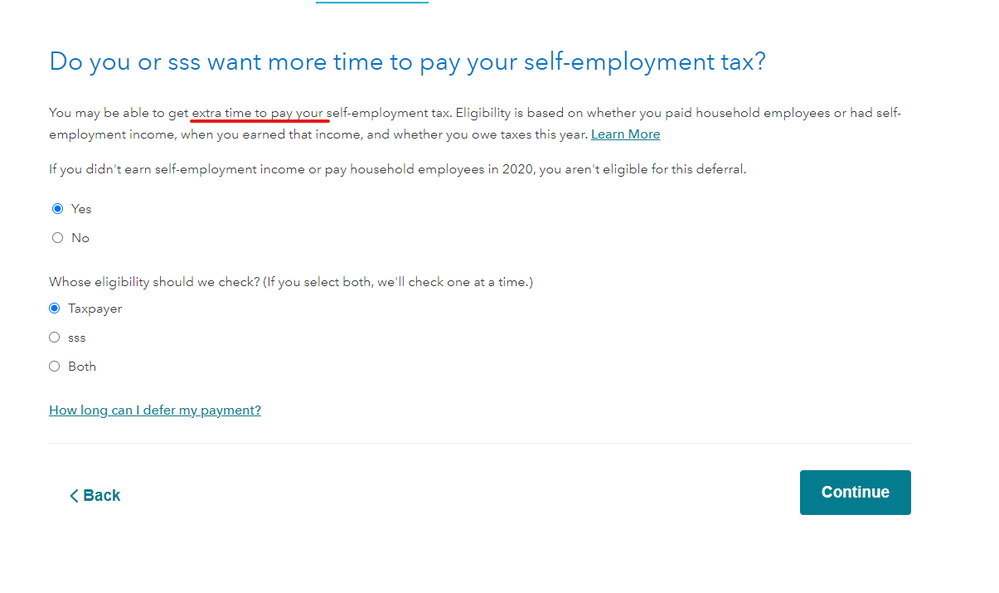

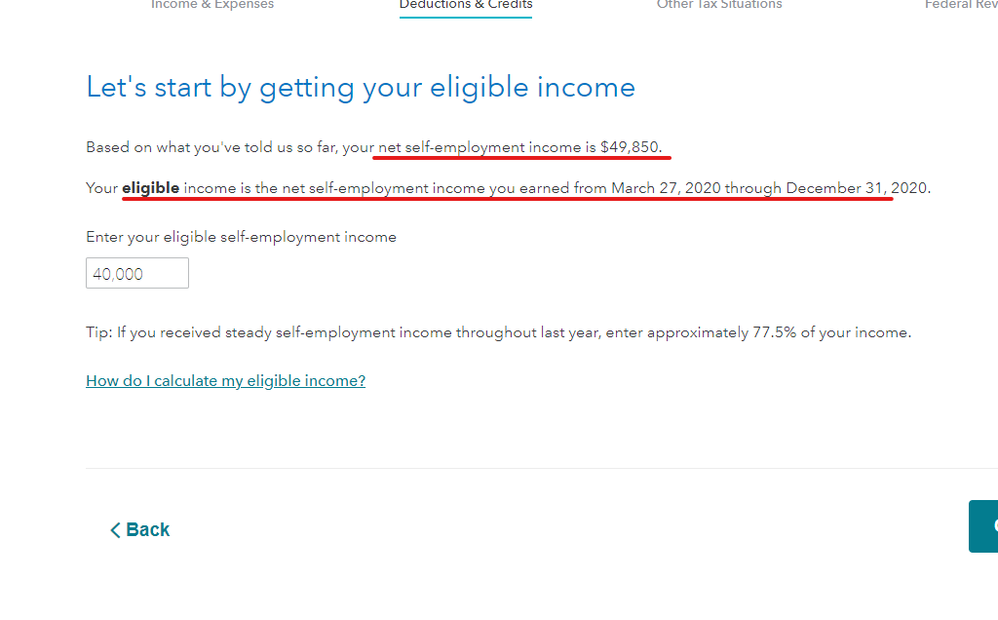

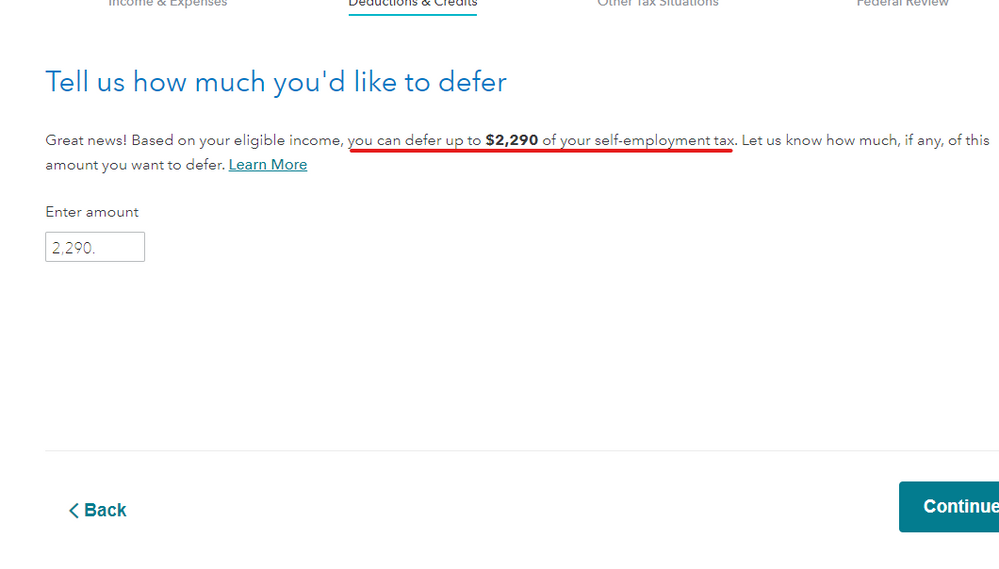

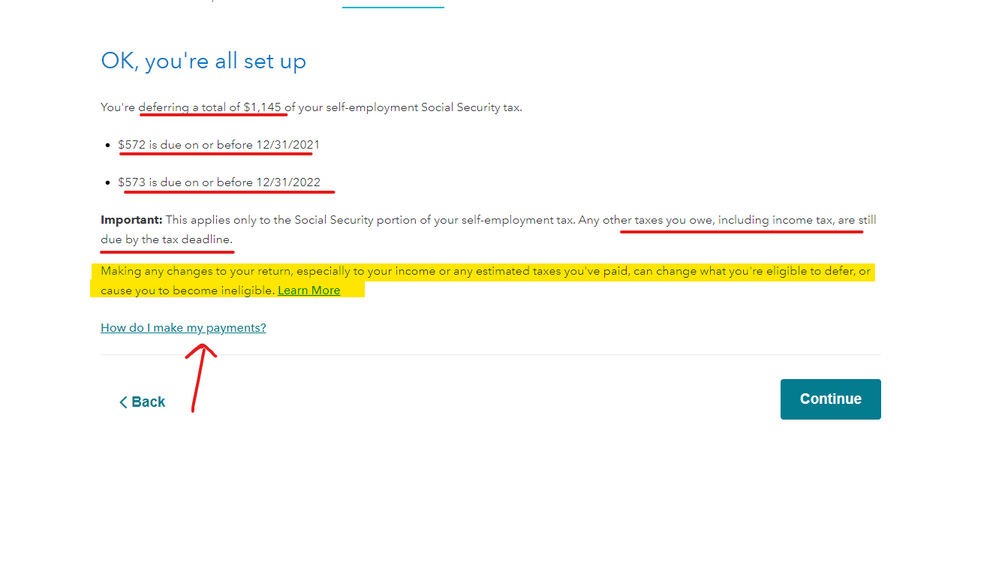

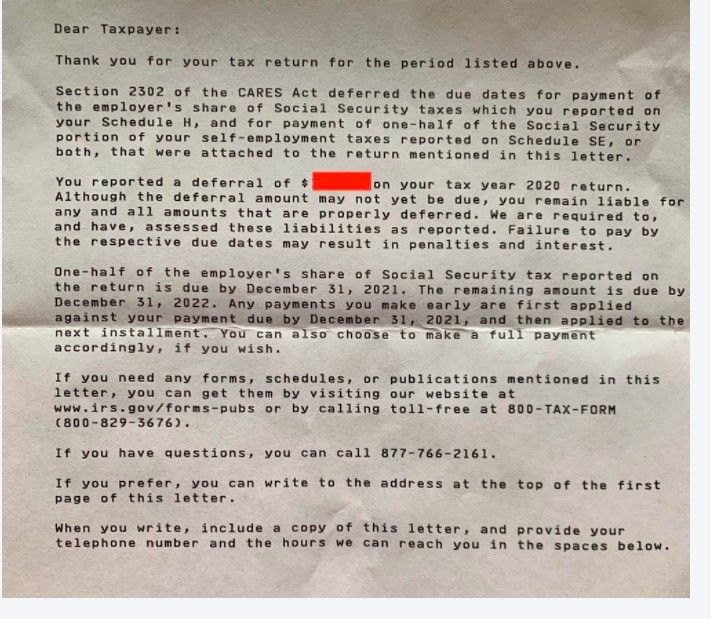

Yes it was ... there were 6 screens that dealt with this matter in the interview so I don't know how you could have missed all this ... the screens were interactive so you had to enter an amount to defer ... this was not done without your input. The last screenshot is of the IRS letter that was sent ... follow the instructions on it or here on the IRS web site...

The tax on Schedule 3 line 12e (for 2020) is only deferred. It is not canceled or eliminated. You have to pay half by December 31, 2021, and the remaining half by December 31, 2022. See the following IRS notice for instructions to pay the deferred tax.

How self-employed individuals and household employers repay deferred Social Security tax

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gprud910228

New Member

miguelneg44

New Member

lorrainearellano83

New Member

galaxy-bean-03

New Member

Kuehnertbridget

New Member