- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

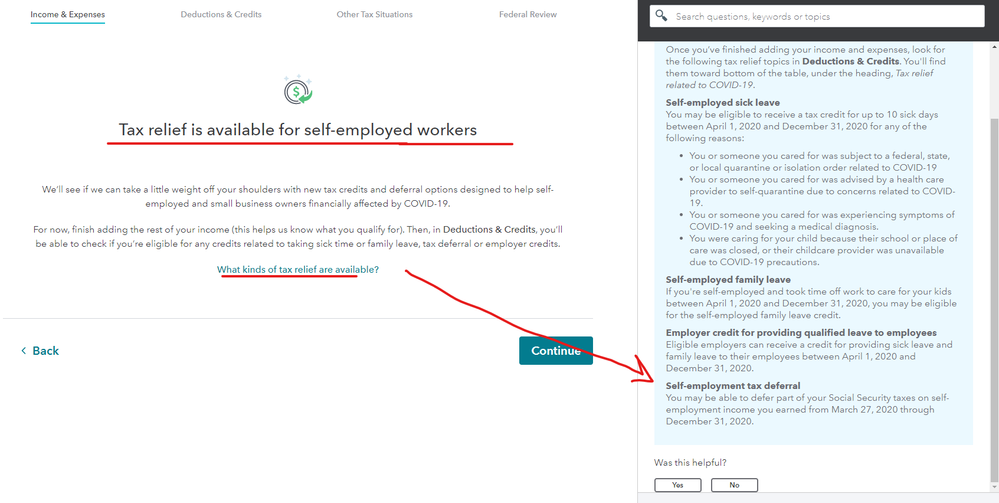

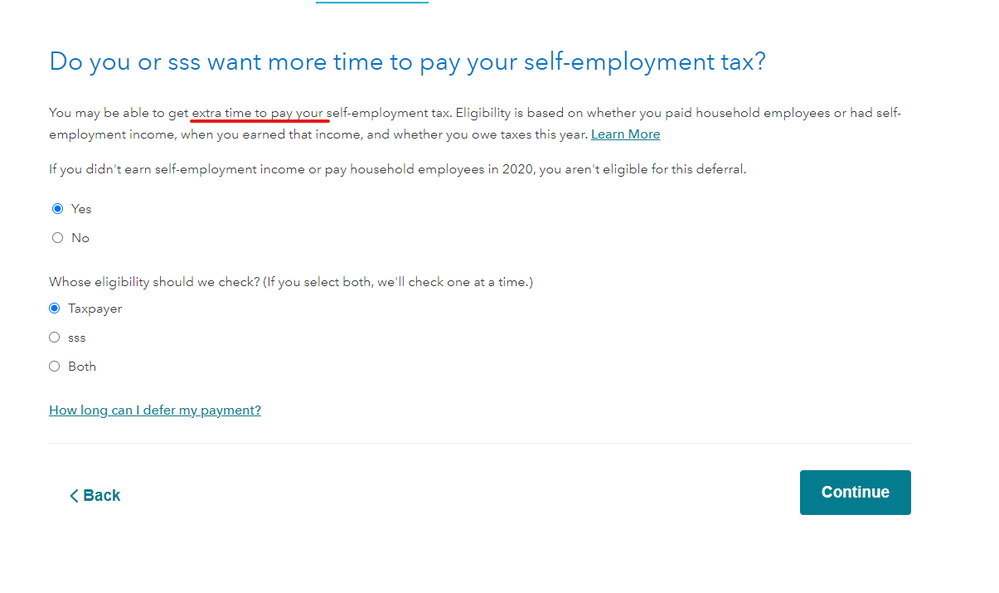

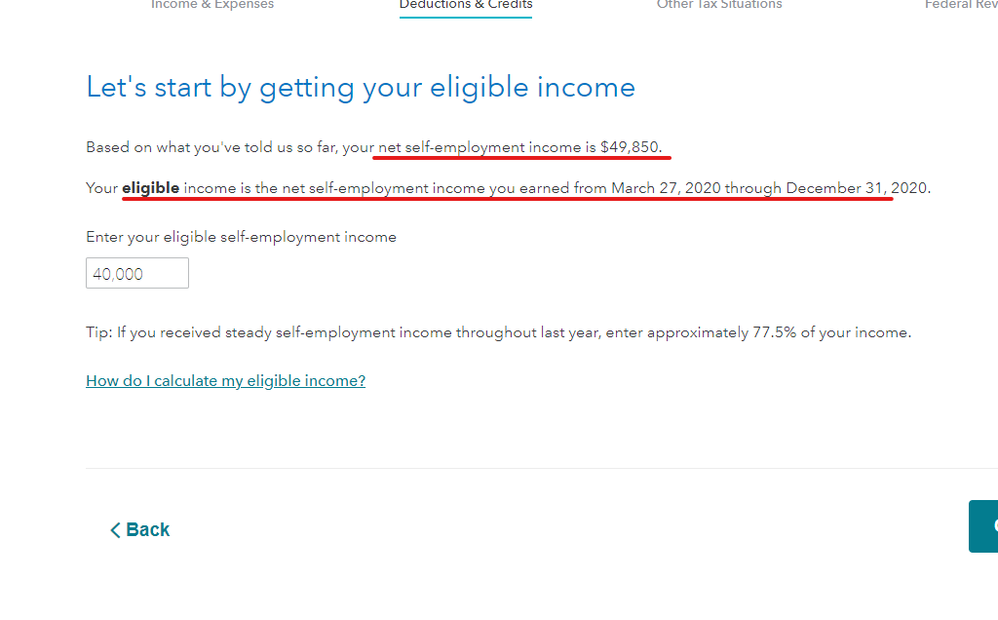

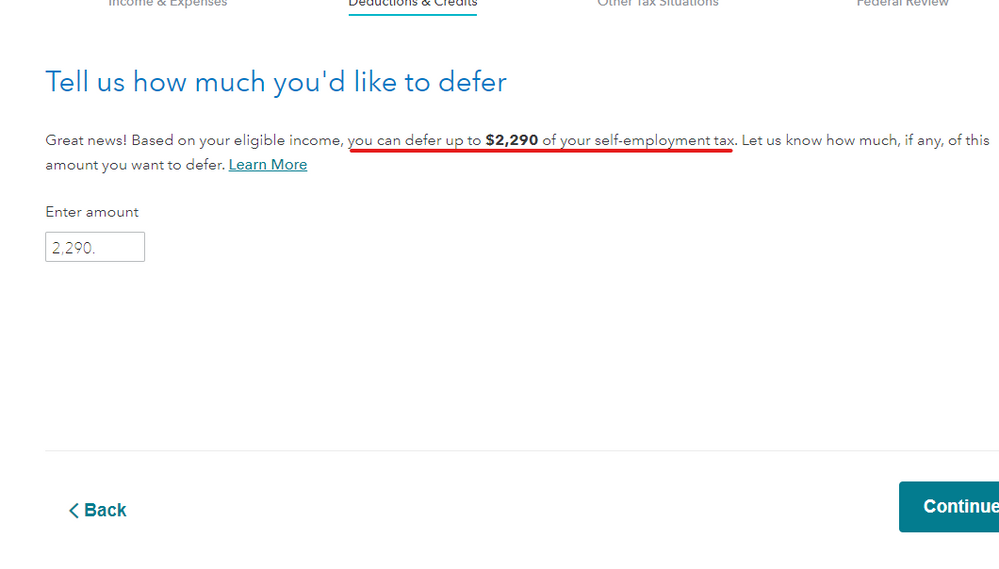

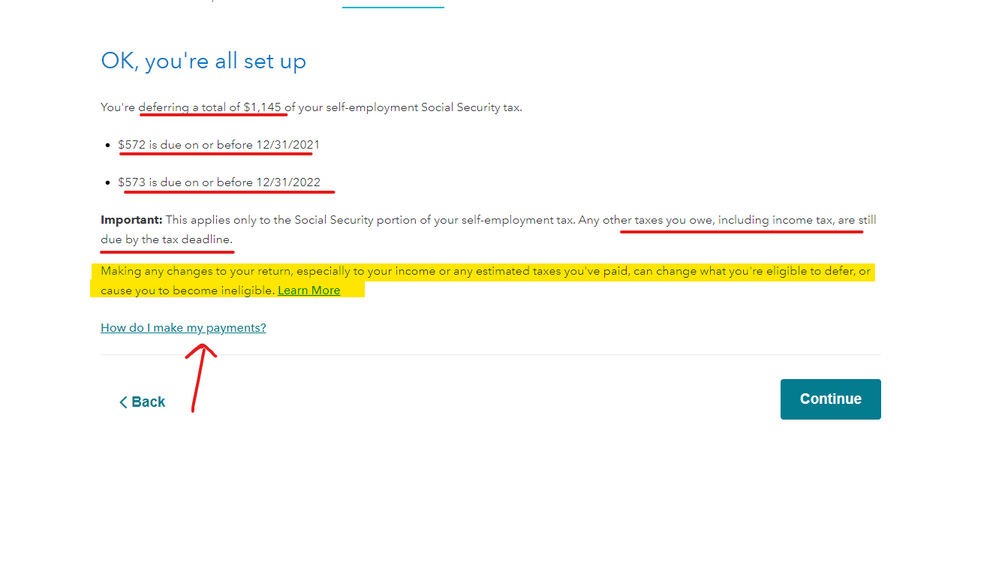

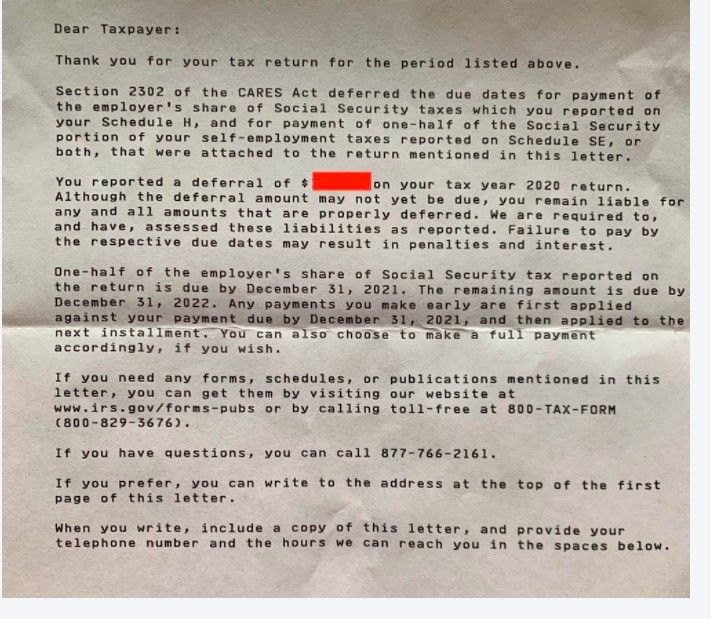

Yes it was ... there were 6 screens that dealt with this matter in the interview so I don't know how you could have missed all this ... the screens were interactive so you had to enter an amount to defer ... this was not done without your input. The last screenshot is of the IRS letter that was sent ... follow the instructions on it or here on the IRS web site...

The tax on Schedule 3 line 12e (for 2020) is only deferred. It is not canceled or eliminated. You have to pay half by December 31, 2021, and the remaining half by December 31, 2022. See the following IRS notice for instructions to pay the deferred tax.

How self-employed individuals and household employers repay deferred Social Security tax

December 1, 2021

3:44 AM

584 Views