- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: My tax return for 2020 has been processed, but I found I made a mistake and I'd like to do a modification and file a 1040X. When will 1040X for 2020 be available on IRS?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return for 2020 has been processed, but I found I made a mistake and I'd like to do a modification and file a 1040X. When will 1040X for 2020 be available on IRS?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return for 2020 has been processed, but I found I made a mistake and I'd like to do a modification and file a 1040X. When will 1040X for 2020 be available on IRS?

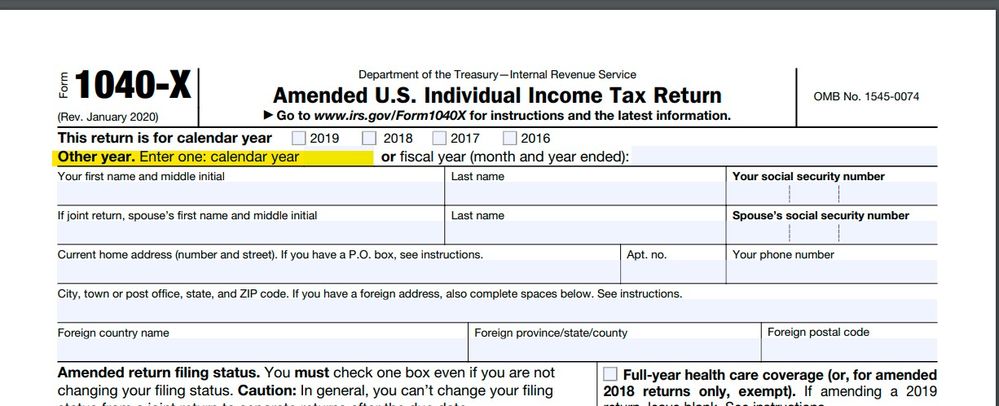

In the Form 1040-X PDF on the IRS web site, read the "New Information for Form 1040-X Filers" at the top of the cover sheet on the page before the actual form. It says the following.

"If the taxpayer is amending their 2020 calendar year return, they should manually enter "2020" in the entry box next to "calendar year" on the line below the calendar year checkboxes."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return for 2020 has been processed, but I found I made a mistake and I'd like to do a modification and file a 1040X. When will 1040X for 2020 be available on IRS?

The amendment process has been ready for months ... and if you have a balance due make sure to pay it when you send in the amendment to avoid any penalties or interest.

If you have already filled your taxes the first step is to wait and see if it is Accepted or Rejected.

- If it is Rejected you will be able to correct the rejection error and make the needed corrections and refile the return.

- If it is Accepted you will have to wait and file an amended tax return:

- If you're getting a refund wait until the refund comes in.

- If you owe money wait at least two weeks before filing the amended return. (This is so that the IRS has time to process the original return.)

To amend a return

Some quick ground rules:

- Be sure the original return was filed and accepted.

- DO NOT go back into the return or change anything before you start the amendment process.

- Gather everything you need before you start.

- Complete the entire amendment process before you log out.

- Starting with 2020 tax returns you can E-File a 1040-X amended tax return. All prior years must be printed and mailed.

You can correct a return that you've already filed and had accepted. Select the year that applies and use this guide to proceed.

Select your tax year for amending instructions:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return for 2020 has been processed, but I found I made a mistake and I'd like to do a modification and file a 1040X. When will 1040X for 2020 be available on IRS?

In the Form 1040-X PDF on the IRS web site, read the "New Information for Form 1040-X Filers" at the top of the cover sheet on the page before the actual form. It says the following.

"If the taxpayer is amending their 2020 calendar year return, they should manually enter "2020" in the entry box next to "calendar year" on the line below the calendar year checkboxes."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return for 2020 has been processed, but I found I made a mistake and I'd like to do a modification and file a 1040X. When will 1040X for 2020 be available on IRS?

If you use the program this should be done automatically ... review the 1040X prior to filing.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17615824249

New Member

FrantaeC

Level 1

4loganporter

New Member

joycanady

New Member

dkjk5657

New Member