- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Is the recovery rebate credit causing return delays?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the recovery rebate credit causing return delays?

I filed Feb 11th was accepted on turbotax on Feb 12th. where's my refund tool says it is still processing and a date will be provided. Today is march 17th and I still have no information. I filed for a recovery rebate for my daughter who was born in 2020 and I'm not sure if that is why.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the recovery rebate credit causing return delays?

Same thing for me. I called and after being on hold for nearly 3 hours they said mine was in further review because having a baby in 2020 didn’t qualify for it. TurboTax calculated that it qualified and literally everything else on the internet says a baby born in 2020 qualifies you for it. It’s so frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the recovery rebate credit causing return delays?

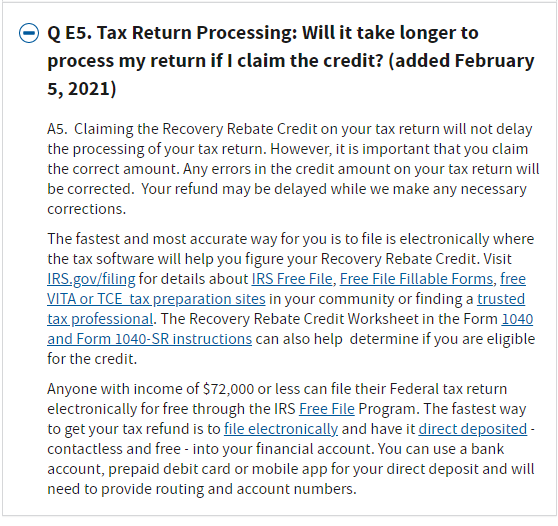

It depends, the IRS says that claiming the Recovery Rebate Credit will not delay your return unless the amount is incorrect. Babies born in 2020 are eligible to get the stimulus payment if they qualifying children. A qualifying child must meet the 2020 Child Tax Credit rules and have a valid social security number.

From the IRS, 2020 Publication 972 (2020) Child Tax Credit and Credit for Other Dependents

Qualifying Child for the CTC

A child qualifies you for the CTC if the child meets all of the following conditions.

-

The child is your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half brother, half sister, or a descendant of any of them (for example, your grandchild, niece, or nephew).

-

The child was under age 17 at the end of 2020.

-

The child did not provide over half of his or her own support for 2020.

-

The child lived with you for more than half of 2020 (see Exceptions to time lived with you , later).

-

The child is claimed as a dependent on your return. See Pub. 501 for more information about claiming someone as a dependent.

-

The child does not file a joint return for the year (or files it only to claim a refund of withheld income tax or estimated tax paid).

-

The child was a U.S. citizen, U.S. national, or U.S. resident alien. For more information, see Pub. 519, U.S. Tax Guide for Aliens. If the child was adopted, see Adopted child , later.

......In addition to being a qualifying child for the CTC (defined earlier), your child must have the required SSN.

See the screenshot below or go to this link for more information: Recovery Rebate Credit — Topic E: Receiving the Credit | Internal Revenue Service, question 5.

@Csmitt1210

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the recovery rebate credit causing return delays?

I dont usally file taxes but i did this year for the stimulus and was told i was approved and accepted for the recovery rebate credit and was supposed to get march 9th but its still processing why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the recovery rebate credit causing return delays?

I dont usally file taxes but i did this year for the stimulus and was told i was approved and accepted for the recovery rebate credit and was supposed to get march 9th but its still processing why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the recovery rebate credit causing return delays?

It's possible that the IRS is examining your return but it's hard to know if it's because of the stimulus or something else. When the IRS accepts a return, it means that their scanning didn't find any mismatches that it has to pass before the numbers and calculations are performed.

Here is a TurboTax article with the latest information about the third stimulus payment.

If you didn't receive your stimulus and it went to the form of a refund due to the Recovery Rebate Credit on your 2020 tax return, please check this link for more information.

If you never received the stimulus at all and did not declare it on your tax return, please check this link.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the recovery rebate credit causing return delays?

- Same thing with me I filed recovery rebate cause my stimulus went to closed account but I got my check 48 hrs after filing my tax now we are 38 days into me filing and it still says processing. I finally got a live person at the irs and she told me to call back may 5 but she didn't see anything wrong with my refund. If filing the recovery rebate is the hold up why even tell people to file it that way . So now the 3 rd stimulus payment was sent to the same closed account because the irs hasn't processed my updated tax return info yet . Fyi I don't file child tax credit just me and disabled dependent should have been a simple return has been for the last 8 years until this year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the recovery rebate credit causing return delays?

The IRS has actually issued the guidance in regards to the Recovery Rebate Credit. The instructions provided within TurboTax are actually provided to assist taxpayers comply with the tax laws.

The IRS has stated in the attached link why your return could possibly be delayed due to the credit. As long as your information matches what is in the IRS's system, the delay may be part of the normal processing time by the IRS at this point in time.

Correcting Recovery Rebate Credits on returns already filed

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the recovery rebate credit causing return delays?

I've spoken with three separate irs employees on the phone and they all said that the recovery rebate credit is causing delays

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the recovery rebate credit causing return delays?

Yes it was the recovery rebate I finally got mine and it was 600 less because the recovery rebate and something about they took 600 from my refund didn't really understand but still hadn't gotten my 3 stimmy suppose to be mailed on march 26 and noting

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the recovery rebate credit causing return delays?

@Marytweedharveydoodles You must have had 600 on 1040 line 30. That would have been for the second Stimulus payment if you didn't already get it. Did you get both the first and second rounds? Maybe the second one came after you filed? The IRS knows they already sent it to you. But you tried to claim it again on your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the recovery rebate credit causing return delays?

Yes I got a paper check 3 days after I filed I called and told the irs and ask if I should amend the return to keep from taking do long they said no they adjusted and it took from Feb 13 when it was accepted til March 22 before I got the return was frustrating cause the return had updated bank info and caused the 3 stimmy to be sent to wrong account just really needed my return and stimmy

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

a-willey8118

New Member

demitriosnc

New Member

sbhedman

New Member

danameginniss

Level 1

kathar_hane

New Member