- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

It depends, the IRS says that claiming the Recovery Rebate Credit will not delay your return unless the amount is incorrect. Babies born in 2020 are eligible to get the stimulus payment if they qualifying children. A qualifying child must meet the 2020 Child Tax Credit rules and have a valid social security number.

From the IRS, 2020 Publication 972 (2020) Child Tax Credit and Credit for Other Dependents

Qualifying Child for the CTC

A child qualifies you for the CTC if the child meets all of the following conditions.

-

The child is your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half brother, half sister, or a descendant of any of them (for example, your grandchild, niece, or nephew).

-

The child was under age 17 at the end of 2020.

-

The child did not provide over half of his or her own support for 2020.

-

The child lived with you for more than half of 2020 (see Exceptions to time lived with you , later).

-

The child is claimed as a dependent on your return. See Pub. 501 for more information about claiming someone as a dependent.

-

The child does not file a joint return for the year (or files it only to claim a refund of withheld income tax or estimated tax paid).

-

The child was a U.S. citizen, U.S. national, or U.S. resident alien. For more information, see Pub. 519, U.S. Tax Guide for Aliens. If the child was adopted, see Adopted child , later.

......In addition to being a qualifying child for the CTC (defined earlier), your child must have the required SSN.

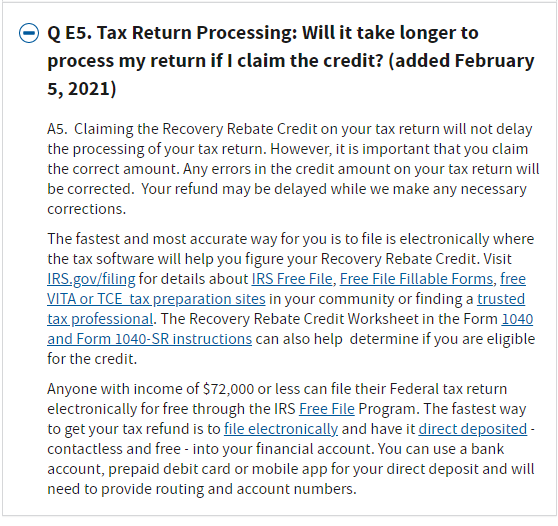

See the screenshot below or go to this link for more information: Recovery Rebate Credit — Topic E: Receiving the Credit | Internal Revenue Service, question 5.

@Csmitt1210