- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: I still did not understand how to report a interest on investments earned in another country ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I still did not understand how to report a interest on investments earned in another country and get the FTC. have already discussed with an agent CASE #xxxxxxxxx.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I still did not understand how to report a interest on investments earned in another country and get the FTC. have already discussed with an agent CASE #xxxxxxxxx.

To claim the foreign tax credit, here are the steps:

In TurboTax online,

- Open up your TurboTax account and select Pick up where you left off

- At the right upper corner, in the search box, type in "foreign tax credit" and Enter

- Select Jump to foreign tax credit

- Follow prompts

- Choose the Income Type, select "Passive Income"

- On screen, "Country Summary", add a country to continue

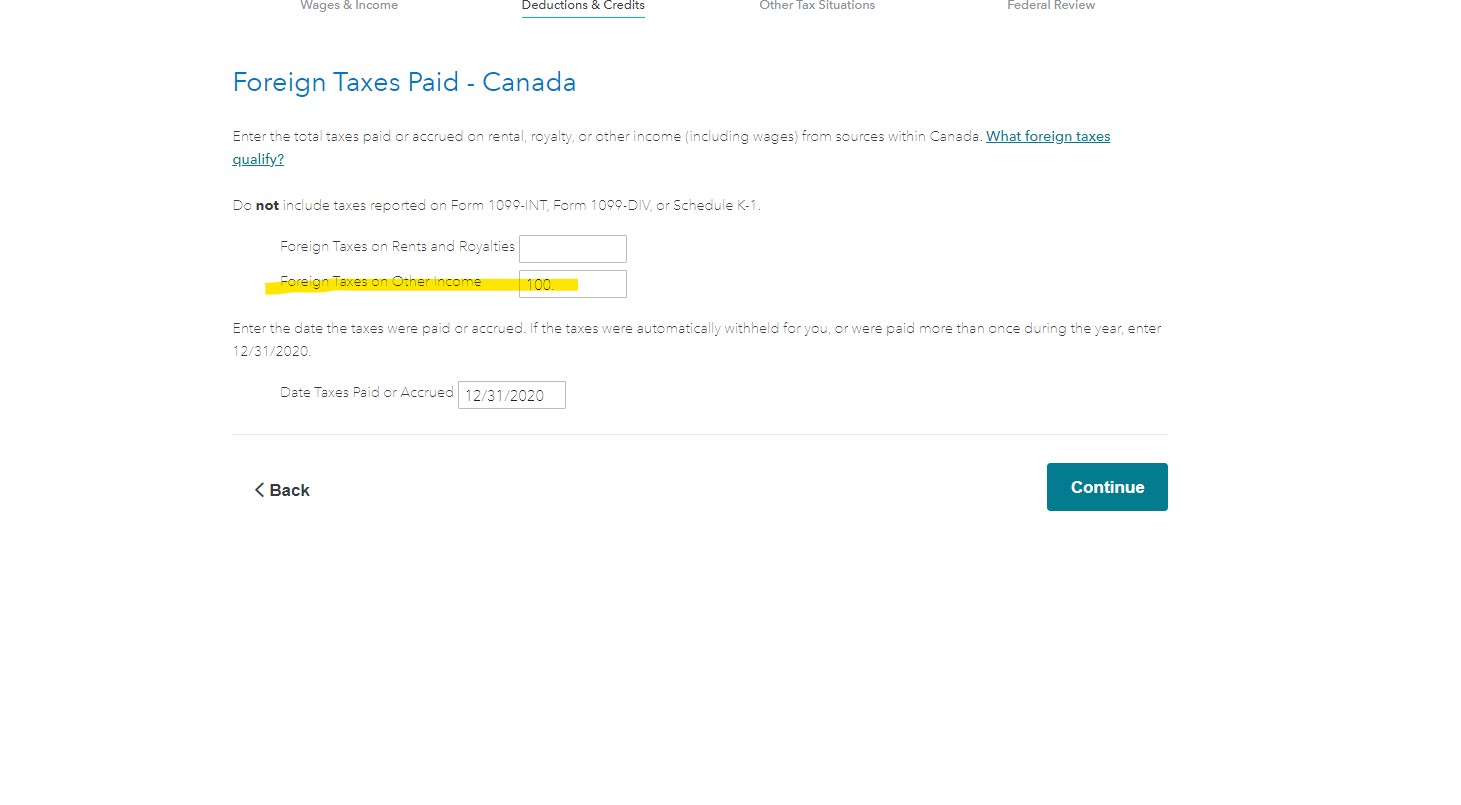

- On screen, "Foreign Taxes Paid", under foreign taxes on Other Income, enter the amount

- Follow prompts to enter foreign taxes if you did not enter it on 1099-DIV

- See image below.

If you pay taxes on dividends to both foreign and US government, you may claim a foreign tax credit on your taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I still did not understand how to report a interest on investments earned in another country and get the FTC. have already discussed with an agent CASE #xxxxxxxxx.

Thanks My income type is "Certain income re-sourced by treaty" for the interest income but the FTC is being ignored. TT seems to only accept the FTC on 1099-DIV.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I still did not understand how to report a interest on investments earned in another country and get the FTC. have already discussed with an agent CASE #xxxxxxxxx.

It depends. How much was the FTC. If $300 or under, it doesn't require a 1116. the reporting on the 1099-DIV is sufficient.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sam992116

Level 4

user17558084446

New Member

catdelta

Level 2

johnsmccary

New Member

RicN

Level 2