in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: I'm trying to amend my taxes because I claimed the American Opportunity Credit when I should ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to amend my taxes because I claimed the American Opportunity Credit when I should have claimed the Lifetime Learning credit. How do I change that?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to amend my taxes because I claimed the American Opportunity Credit when I should have claimed the Lifetime Learning credit. How do I change that?

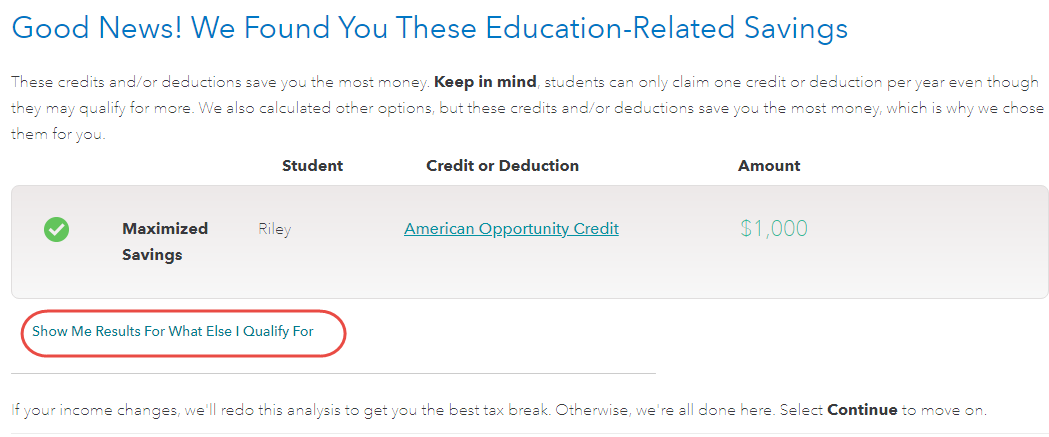

Are you sure you need to amend your return? TurboTax calculates the deduction or credit that benefits you the most.

For instructions on amending your 2020 return, please see this TurboTax Help Article: How do I amend my 2020 return?

On the screen, Good News! We Found You These Education-Related Savings. TurboTax tells you the most beneficial credit/deduction. [See Screenshot #1, below.] If you click on the link Show me results... TurboTax will list your other options. [Screenshot #2]

Screenshot #1

Screenshot #2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to amend my taxes because I claimed the American Opportunity Credit when I should have claimed the Lifetime Learning credit. How do I change that?

Yes, I do need to amend. I answered the prequalifying questions wrong (I've been in school more than 4 years) which disqualifies me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to amend my taxes because I claimed the American Opportunity Credit when I should have claimed the Lifetime Learning credit. How do I change that?

I'm not sure how to navigate to that screen from the homepage. I been through all the options in the education section and it doesn't show me anything about education credits.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to amend my taxes because I claimed the American Opportunity Credit when I should have claimed the Lifetime Learning credit. How do I change that?

WAIT!!

If you are using TurboTax Online you can't amend your 2020 return right now! We are awaiting guidance from the IRS on how to handle certain situations!

Meanwhile, DO NOT go in and start changing anything on your return in the system, or you will make a mess for yourself.

The best way to get back to the education questions is once you've started the 1040X (after it's been added to the program) first delete the 1098-T and then go back to the Education section in the Deductions & Credits screen. This will cause the questions to appear again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to amend my taxes because I claimed the American Opportunity Credit when I should have claimed the Lifetime Learning credit. How do I change that?

Ah, really? Yes I'm using Turbotax Online Deluxe. I thought it opened today to be able to amend 2020 tax returns. When will I be able to do it then?

I was able to get to the screen that you showed in your screenshot... but the system automatically chooses the "best" tax credit for you. When I can, I'll delete and redo the 1098T so I can answer the prequalifying questions again. Do you know if they'll take back the difference or the whole amount? ($2,500 to $2,000)? It would be upsetting because of how long it takes the IRS to process these.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to amend my taxes because I claimed the American Opportunity Credit when I should have claimed the Lifetime Learning credit. How do I change that?

You will get the credit you had on your original return when it is processed, so when you file the amended return you will have to pay back the difference, as the Lifetime Learning Credit will probably be less.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to amend my taxes because I claimed the American Opportunity Credit when I should have claimed the Lifetime Learning credit. How do I change that?

I've gone through the steps mentioned above. I wasn't given either of the screenshots. Instead, it just said that I did not qualify.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

QRFMTOA

Level 5

Taxes_Are_Fun

Level 2

DarrinK

Level 1

skylee_hall

New Member

in Education

Zimers

Level 1