- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can I amend to fix ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can I amend to fix ?

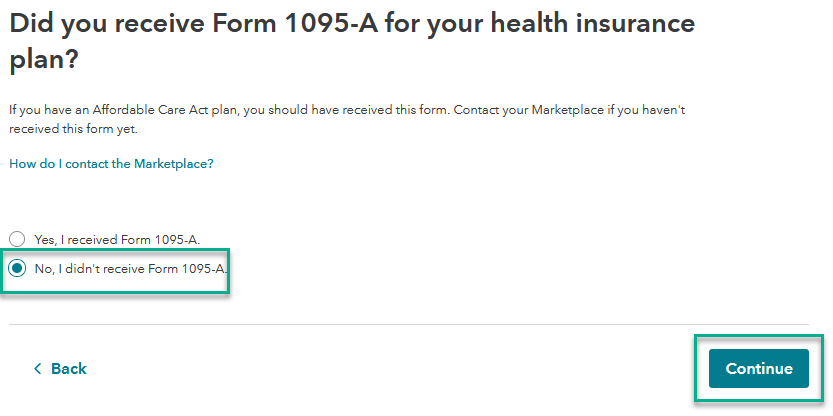

You should have said NO when it asked if you have 1095A. You are not supposed to enter a 1095C at all. Go back to that question you answered incorrectly and change it. Then try again to e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can I amend to fix ?

So was your return ever accepted? If your return was always rejected, you don't need to amend your return, but just correct the input.

To delete the reference to the 1095-A, please do the following:

1. Do a Search (upper) for 1095-a (lower case). Ignore all the suggest search terms and just hit enter.

2. Mac users will have to find 1095-A in the Topics List.

3. When you see the jump-to link, click on it.

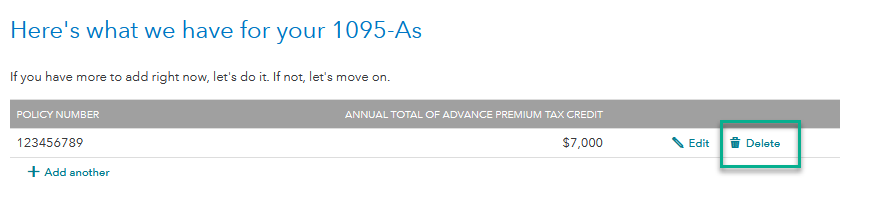

4. You should see a table of 1095-As. Click the Delete button on the right.

Does this work for you? Did you enter the 1095-C data in the 1095-A screen?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can I amend to fix ?

do not file an amended return. those are only after the original is accepted. instead, you need to correct the original.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can I amend to fix ?

A Form 1095-C is not reported on your tax return. Possibly you need to delete the Form 1095-A and associated forms.

You'll need to delete this form 1095-A and Form 8962.

- If you're using TurboTax Online software and need to delete a form, click here.

- If you're using TurboTax CD\Download software and need to delete a form, click here

Amending a return is free, but it seems that is not what you need to do. Please update to clarify if necessary.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can I amend to fix ?

Thanks.. non of those forms (1095-A or 8962) are listed on my return nor is there a 1095-C listed

should I clear and start over?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can I amend to fix ?

It asks if I received 1095-a I think the first time I misread thinking it was asking for the 1095-c that I did have so I said yes.

I fixed that to "no" the second time and it was rejected again

maybe I should clear and start over? (If possible)

thnx

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can I amend to fix ?

Clear and Start Over is an alternative.

These are other options.

First confirm that you, or any others listed on your return were not covered by a Marketplace policy. You may be able to find a 1095-A form by signing in to your healthcare.gov account and downloading it.

Once your confident that you did not get a 1095-A, you can try to delete the form.

To delete a Form in the Online version:

- On the menu bar on the left that shows.

- My Info

- Federal

- State

- Review

- File

- Select Tax Tools

- On the drop-down select Tools

- On the Pop-Up menu select Delete a Form

- This will give you all of the forms in your return.

- Scroll down to Form 1095-A

- Select the Form

- Click on Delete.

- Always use extreme caution when deleting information from your tax return. There could be unintended consequences.

If this didn’t work, go into your return and make sure that you checked that you didn’t get a 1095-A.

- Start with Federal Taxes

- Click on Deductions and Credits

- Click on I'll choose what I work on (if shown)

- Scroll down to Medical.

- On Affordable Care Act (Form 1095-A), click the start or update button.

- Indicate that you did not get a 1095-A

Finally

You can try to enter $1 for 1095. This will not affect anything on your return, but having the form there may get the IRS to accept your return. To do this take the following steps:

- Use the same steps above, but indicate that you did get a 1095-A

- Post $1 for January

This will not change your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can I amend to fix ?

I have followed all of the listed steps to clear the 1095-a and when I transmit it is still coming back rejected for the same error. I had the same problem in 2022 for my 2021 taxes and it kept changing the 1095-A answer to yes and I followed instructions for creating a fake 1095-a and got a letter from IRS rejecting the claim as it was not the same as they had on file. No one in my household have ever had health insurance thru the market place and now I'm not sure of what to do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can I amend to fix ?

Based on what you just said, it sounds like the IRS does have something on file, "IRS rejecting the claim as it was not the same as they had on file.". You or a person you claim as a dependent may have opened something in the past. Please confirm that you, or any others listed on your return were not covered by a Marketplace policy. You may be able to find a 1095-A form by signing in to your healthcare.gov account and downloading it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can I amend to fix ?

This happened for the 2021 tax year and I made the correction to fake the numbers and the return showed accepted but I still received a letter from IRS stating it was not correct. I in turn called the Market Place and verified that we had never had any insurance thru them. After sitting on hold with IRS they verified that they had no record of any market place insurance. My 2022 return is now changing my answer to yes on the Form and I have pulled up the form and deleted it and I am still getting rejected. Should I delete this return and go back to 2021 federal forms and delete the 8962 to carry over to a new return for my self?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can I amend to fix ?

When you enter that section, it automatically defaults the answer to "Yes", so if we change the answer to "No" and Continue until we are back at the main Deductions and Credits screen, it will stay checked as "No".

First, be sure there is no Form 1095-A information in the ACA section. Use the trashcan icon to delete.

Then, go back and answer "No" to the question Did you receive Form 1095-A and Continue until you are back at the main screen.

It will be saved with the "No" answer for you to resubmit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can I amend to fix ?

I have a situation kind of near this one, I got the 1095-a deleted, then when I got to file it's just a white screen so I go back n do it again same thing..I did it on my phone n on my lap top, same result

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a 1095-C TT asked about a 1095-A and I can't change my return .. rejected 2x. How can I amend to fix ?

To find and fix the error relating to Form 1095-A, you should revisit the questions in TurboTax. If this does not fix the issue try and delete the Form following the steps below. Once deleted, clear your Cache before signing on to your TurboTax again.

- Sign in to TurboTax and select Fix my return

- On the Let's fix your returns and then refile screen, select Fix it now

- Select Continue on the Let's take a look at your return screen

- You’ll get taken back to the Keep going to refile your returns screen. From here, select Federal from the left menu

- Select Deductions & Credits from the top menu and scroll down to Medical. Select Show more

- Select Start or Revisit next to Affordable Care Act (Form 1095-A)

- Answer the questions and continue through to enter the details from your Form 1095-A

- When you’re done, select File from the left menu and continue through to refile your return

The other option is to delete Form 1095-A and reenter the Form:

- Select Tax Tools from the left menu, then

- Tools, then Delete a form.

- You shouldn’t see Form 8962 or Form 1095-A in the forms list.

- If you do see these forms, select Delete next to the name of the form to remove it from your return

Click on the link below to clear your Cache:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rebecca-williams

New Member

davemoser22

New Member

welp-stephen

New Member

Watsonbabygirl143

New Member

shansmw

Level 2