- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: How to deal with adjustment made by IRS and 1040X that was filed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

Just to follow-up.. The IRS issued the refund for her.. It is in today's mail.. The amount of the refund check is not fully what we were expecting from the 1040X, not sure why. The refund is for the EIC credit plus interest. When I did the amended return, the EIC also made her eligible for the additional child tax credit - and for whatever reason, the IRS did not issue that as well.

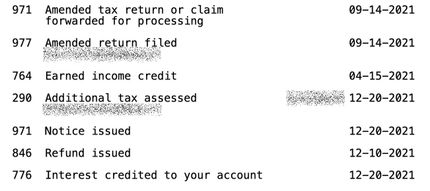

Here is what the dates/activity sections of her transcript looks like if you're interested

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

Thank you for the updates; truly appreciate it!

I just checked and no further updates for me. Just curious - when was the original Amended return filed? I filed on 07/06/2021.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

The thing is IRS changed its policy and recently said they would calculate EIC for you.

BUT

There are other credits you might become eligible for.

You have to file 1040-X to get those credits.

You will eventually get a letter specific to your 1040-X, not to your UE 10,200 exemption which is handled separately.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

Finally we got our additional check in mail two days back! So finally that's done!

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lorettavanheel4

New Member

lorettavanheel4

New Member

pinguino

Level 2

statusquo

Level 3

lorettavanheel4

New Member