- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

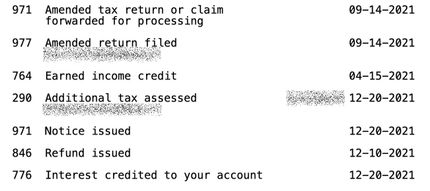

Just to follow-up.. The IRS issued the refund for her.. It is in today's mail.. The amount of the refund check is not fully what we were expecting from the 1040X, not sure why. The refund is for the EIC credit plus interest. When I did the amended return, the EIC also made her eligible for the additional child tax credit - and for whatever reason, the IRS did not issue that as well.

Here is what the dates/activity sections of her transcript looks like if you're interested

December 14, 2021

4:36 AM