- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: How do I enter the amount of my 2020 federal refund that I applied to 2021 federal taxes so t...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of my 2020 federal refund that I applied to 2021 federal taxes so that Turbo Tax counts that amount as part of taxes paid for 2021?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of my 2020 federal refund that I applied to 2021 federal taxes so that Turbo Tax counts that amount as part of taxes paid for 2021?

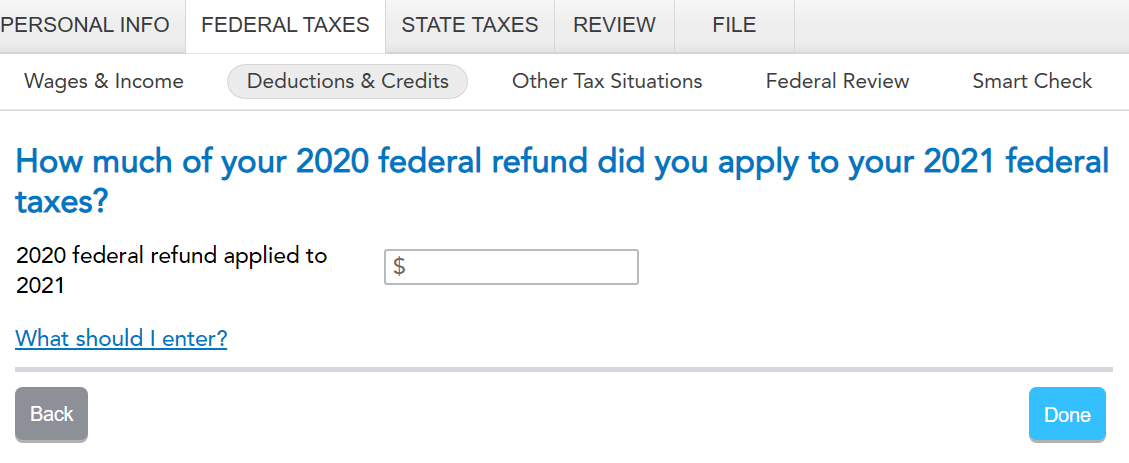

Check your entries to make sure the amount of your 2020 Federal refund applied to 2021 taxes have been entered correctly.

- Login to your account.

- Select Federal from the left menu.

- Go to Deductions and Credits.

- Scroll down to Estimates and Other Taxes Paid.

- Select Strat next to Other Income Taxes.

- Scroll down and select Start next to 2020 Refund applied to 2021 Federal Taxes

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of my 2020 federal refund that I applied to 2021 federal taxes so that Turbo Tax counts that amount as part of taxes paid for 2021?

MayaD says to scroll down and select Start next to 2020 Refund applied to 2021 Federal Taxes, but my version of Turbotax (Premier) doesn't have a menu item for that.

Turbotax says "we transferred the 2020 federal extension payment you made in 2021. Make any necessary corrections to this amount" but the box doesn't allow anything to be inserted into it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the amount of my 2020 federal refund that I applied to 2021 federal taxes so that Turbo Tax counts that amount as part of taxes paid for 2021?

In TurboTax Premier, please follow the instruction below:

- Open your return.

- Click on Federal Taxes.

- Click on Deductions & Credits.

- Scroll down to Estimates and Other Taxes Paid.

- Click Start next to Other Income Taxes.

- Click Start next to 2020 refund applied to 2021 federal taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kat2015-

New Member

Kh52

Level 1

catoddenino

New Member

borenbears

New Member

FroMan

New Member